Layer 1 in Blockchain (L1)

Layer 1 in blockchain refers to the foundational framework that powers a blockchain network. Layer-1 protocols include Bitcoin, Ethereum, and other major blockchain systems.

These protocols serve as the core infrastructure upon which additional layers and applications are developed, providing security and efficiency for complex transactions.

What is Layer-1 in Blockchain?

Layer-1 blockchain forms the primary architecture of a decentralized network, acting as its base protocol. It serves as a base for network activity and provides consensus mechanisms, transaction validations, and smart contract capabilities.

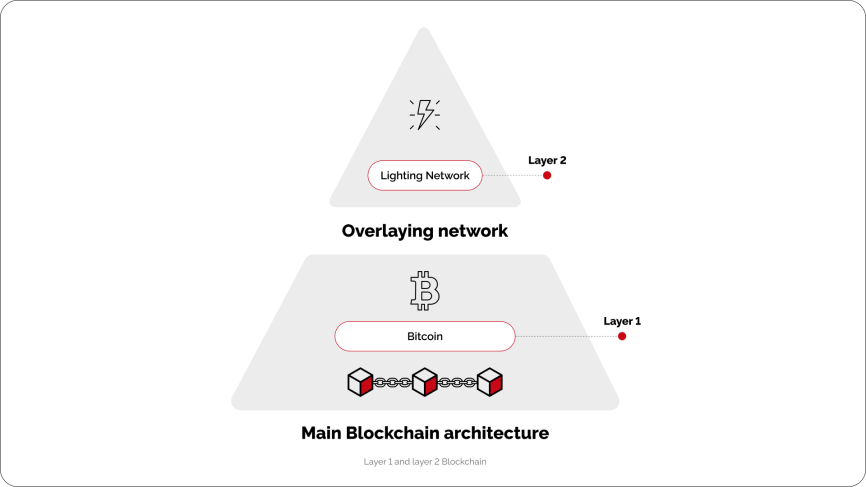

Moreover, the robustness of the layer-1 architecture ensures resilience and stability, laying the path for layer-2 solutions. In this logic, you get the main Blockchain infrastructure and other solutions built on top of it.

Bitcoin and Lightning Network are good examples of this. Bitcoin is the very first Blockchain, providing layer-1 to the Lightning Network, which is a payment protocol intended to speed up transaction processing:

Combined, these layers contribute to blockchain ecosystems’ overall scalability and functionality.

Layer-1 scaling

Layer-1 scaling involves enhancing the fundamental blockchain architecture itself, creating new avenues for increased transaction throughput. At a very simple level, it’s all about effectively handling more transactions per second.

Normally, you can increase throughput by changing block size or reducing block time.

- Increasing the block size means you can include more transactions in each block, increasing overall transaction capacity.

- Reducing block time means optimizing block creation speed, which allows for more transactions to be processed in a given period.

For example, Bitcoin’s Segregated Witness (SegWit) update is one such proposal on the Bitcoin network. Incidentally, conflict over block size was also the main reason for the Bitcoin Cash fork.

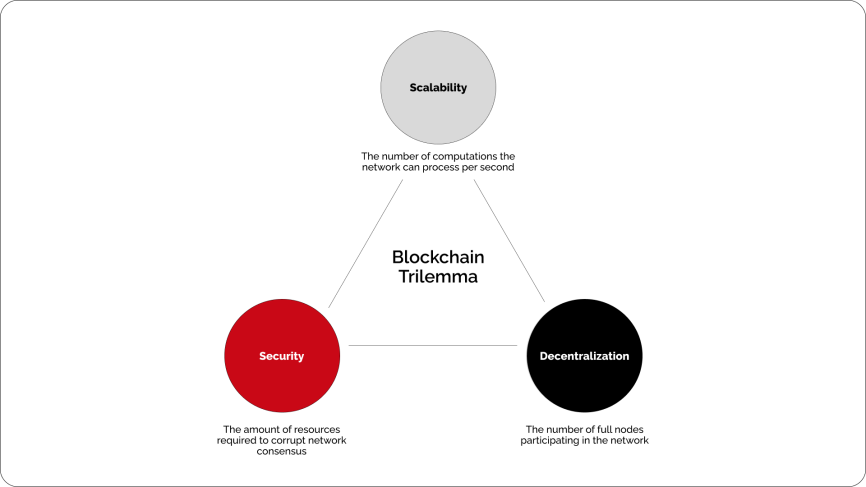

Vitalik Buterin, the founder of Ethereum, famously defined the problem of the Blockchain Trilemma. In short, there are three important aspects of every blockchain – decentralization, scalability, and security:

The three sides of the trilemma create a delicate balance. Decentralization helps ensure no single entity has control over the network, scalability makes it possible to handle a large number of operations, and security represents the overall network integrity.

Ethereum’s transition from Proof of Work (PoW) to Proof of Stake (PoS) with Ethereum 2.0 aimed to significantly enhance scalability and efficiency while maintaining decentralization. However, its effectiveness is still up for debate.

The goal of layer-1 scaling is to provide a solid foundation for the future applications and services built on top of the network.

What is Layer-1 Sharding?

Sharding is the process of dividing a blockchain network into smaller, more manageable segments called shards. It allows parallel processing to improve the blockchain’s scalability.

Each shard handles a portion of the network’s data and transactions independently. This is done for:

- Parallel Processing. Shards operate concurrently, processing transactions in parallel. This significantly increases the overall transaction speed and throughput of the network.

- Distribution of Data. Data related to consensus and the ledger state is distributed across the shards. So, each shard is responsible for validating a subset of transactions independently, preventing losses.

- Alleviation of Bottlenecks. Concurrent transaction processing helps avoid nodes getting ‘jammed’ with too many transactions that would otherwise have to be processed in sequence.

- Transaction Speed. By decentralizing processing tasks across shards, the network can handle more transactions at the same time.

That’s how Layer-1 sharding transforms the scalability landscape of blockchain technology, enabling it to support a wide range of applications and a larger user base efficiently.

Layer 1 Blockchain Examples

Bitcoin

Bitcoin is the first example of a Layer-1 blockchain, proposed by Satoshi Nakamoto in a whitepaper all the way back in 2008. Its primary innovation is the ability to facilitate secure peer-to-peer transactions without intermediaries.

Bitcoin uses a proof-of-work (PoW) consensus mechanism, which involves miners solving complex mathematical problems to validate and record transactions on the blockchain.

Ethereum

Ethereum takes the concept of blockchain technology introduced by Bitcoin and extends it by enabling decentralized applications (dApps) through the use of smart contracts.

Smart contracts are self-executing contracts where the terms are directly written into code. Ethereum’s blockchain can support a wide range of decentralized applications beyond simple transactions, making it a versatile platform for developers.

The network now operates on a proof-of-stake (PoS) consensus mechanism known as Ethereum 2.0, which involves randomly assigned validators that put value into the network.

Solana

Solana is a relative newcomer, launched in 2020 to achieve high throughput capabilities. Today, it processes thousands of transactions per second, which significantly outpaces many other blockchains.

This performance is achieved through its unique proof-of-history (PoH) consensus mechanism, which timestamps transactions before they are included in the ledger.

PoH works in conjunction with proof-of-stake (PoS) to maintain the security and integrity of the network.

Cardano

Cardano was founded by one of Ethereum’s co-founders, Charles Hoskinson, and is built on a layered architecture to enhance security and scalability.

Cardano employs a proof-of-stake (PoS) consensus mechanism called Ouroboros, which is designed to be energy efficient and extra secure.

Each of these Layer-1 blockchains: Bitcoin, Ethereum, Solana, and Cardano, demonstrates unique innovations and capabilities, reinforcing the robust infrastructure necessary for future technological advancements in the decentralized ecosystem.

Comparison: Blockchain Layer 1 vs. Layer 2

When comparing Layer 1 blockchains with Layer 2 blockchains, here’s a handy table for reference:

| Layer 1 | Layer 2 | |

|---|---|---|

| Purpose | Foundational layer of the network | Built on top of layer-1 to enhance performance |

| Goal | Provides security and integrity for operation | Lowers transaction fees and enhances scalability |

| Transaction Speed | Slower, potentially prone to bottlenecks | Significantly faster compared to layer 1 |

| Interoperability | Usually limited to the network | Able to transact with different chains |

| Resource Use | Typically higher, depends on protocol | Built for better performance |

| Usage | General network functionality, transactions | Advanced, more efficient transactions and records |

| Examples | Bitcoin, Ethereum | Lightning Network, Polygon |

Both layers play crucial roles in the future of Blockchain, with Layer-1 providing a robust foundation and Layer-2 driving innovation and scalability.

Benefits of Layer 1 Blockchains

Layer-1 blockchains offer security and decentralization, forming the bedrock of the blockchain ecosystem. They provide:

- Decentralized Governance: Layer 1 creates the foundation for a more democratic and transparent decision-making process.

- Data Integrity: Layer-1 ensures that data is accurate and consistent across the network, preventing tampering and fraud.

- Infrastructure: It’s best to think of layer-1 solutions as foundations for other solutions that use them to innovate more effectively.

- Widespread Adoption: Blockchains like Bitcoin and Ethereum are commonly used, providing a trusted platform for other uses.

Challenges and Limitations of Layer 1

Layer-1 technology, while foundational, faces intrinsic challenges that shape its evolution and implementation. In the past, blockchain networks, like Bitcoin and Ethereum, encountered scalability issues, revealing the inherent limitations within layer-1 architecture.

As transaction volumes surged, this scalability problem became more pronounced, demanding innovative solutions.

For example, before the release of Ethereum 2.0, transactions in ETH could reach sums of upwards of $200 equivalent in 2022. This shows how Layer-1’s inherent complexity often clashes with the need for seamless user experience and high transaction throughput.

In contrast, today the average ETH transaction fees are at around $3 equivalent. Advanced technological adaptations, such as new consensus algorithms introduced by the Foundation, are essential but challenging. With concerted efforts from the global blockchain research community, these challenges present opportunities for profound advancements that could help blockchains scale, but for now layer-2 solutions present a viable alternative.

Get Started With Layer-1 Blockchains

By focusing on layer-1, developers and enthusiasts alike can harness the inherent strength, security, and versatility of blockchain technology. Most valuable assets, such as BTC, ETH, SOL, ADA, and others, are often used for payments by users all over the world.

They’re paramount in building robust applications that can process cryptocurrency transactions in high volumes.

As 2025 unfolds, those well-versed in layer-1 protocols will be at the forefront of pioneering advancements, driving impactful changes across industries.

FAQ

What is a Layer 1 blockchain?

A Layer 1 blockchain refers to the base layer or main network in a blockchain ecosystem that handles all fundamental operations such as transactions and security protocols.

How does a Layer 1 blockchain differ from a Layer 2 solution?

Layer 1 blockchain operates as the primary network handling core functions, while Layer 2 solutions are built on top of Layer 1 to enhance scalability and transaction speeds by offloading some processes.

What are the examples of popular Layer 1 blockchains?

- Bitcoin, which uses Proof of Work

- Ethereum, which recently transitioned to Proof of Stake.

- Solana, which uses a Proof of History, somewhat based on PoS.

- Cardano, which uses Ouroboros, a modified Proof of Stake.

What are the main challenges faced by Layer 1 blockchains?

The main challenges include scalability issues, high energy consumption, and slower transaction speeds compared to Layer 2 solutions.

enhanced security, lower fees,

and global accessibility