Solana vs Ethereum – Deep Dive Analysis

The Solana vs Ethereum debate rages on as both platforms gain traction. While Ethereum remains the second most popular Blockchain next to Bitcoin, Solana reached the top 5 and conquered a significant chunk of the smart contract market in less than four years. Will SOL catch up or even overtake ETH? Is it just a flash in the pan? Let’s find out!

Key Takeaways

- Ethereum is already established on the market and has a significant first-mover advantage due to years of iteration and improvement.

- Solana came to the market strong, practically launching its way into various top 5 crypto lists in a fraction of time it took Ethereum to grow.

- Both are Layer 1 solutions that enable developers to create decentralized applications and launch Smart Contracts.

- The Ethereum ecosystem is much larger, with over 45,000 dApps; however, Solana boasts higher transaction speeds and almost 10x lower fees.

- While a Solana overtake of Ethereum is still in question, both Blockchains show significant growth heading into the summer of 2024.

Key Difference: Ethereum has more value stored in its Blockchain and dApps (TVL), but Solana is several times faster and cheaper. Ethereum’s maturity makes it more stable and secure, while Solana’s ecosystem is rapidly catching up as the platform gains momentum.

Gain new customers, expand your reach, reduce

fees & eliminate chargebacks.

What is Ethereum?

Ethereum is a decentralized open-source platform conceived in 2013 by Vitalik Buterin, funded in 2014, and officially launched in July 2015. The Ethereum network’s primary value is enabling developers to create applications that work with smart contracts and a programming language called Solidity.

Smart contracts are one of the earliest innovations in the Blockchain space, essentially allowing two or more parties to make agreements without having to rely on anyone for guarantees and mediation. This is going to be important for our Solana vs Ethereum comparison going forward.

Here is a helpful graphic to explain the concept:

Quick Overview

The decentralized Ethereum Virtual Machine was the first turing-complete solution implemented at that scale. In short, smart contracts on the Ethereum network allow for a wide range of business conditions and complex computations. In contrast to the Bitcoin Script, Ethereum was designed from the ground up to support a wide range of algorithms, making it more powerful, but also more vulnerable to attacks.

As one illustration, in 2016, the DAO project was hacked, draining over $60 million worth of Ether, which amounted to roughly 5% of all ETH tokens in existence at the time. This event led to a major split in the community, and the Ethereum Foundation intervened and permanently altered the Blockchain to erase this theft. The older, original version continues to operate to this day as Ethereum Classic.

Where is Ethereum Now?

After years of testing and development, Solidity was supplemented by Vyper, a Pythonic language that addresses network security issues. In 2022, Ethereum changed its consensus mechanism from a Proof-of-Work to a Proof-of-Stake algorithm. We won’t focus on The Merge in this article. However, CoinsPaid wrote an in-depth analysis of the change if you’re interested.

As of June 2024, there are over 4,500 decentralized applications on the Ethereum Network, with 55 million+ smart contracts and over 270 million unique wallet addresses. The United States SEC recently approved Ethereum Spot ETFs, showing institutional interest in this Blockchain and its clear leadership role in the market.

Ethereum Cliff Notes

- Ethereum was launched in 2015 and has been in active development for over 10 years.

- The network’s primary goal is to enable developers to create decentralized applications.

- Due to its focus on smart contracts, Ethereum had to focus on security and robustness first.

- After several challenges and forks, Ethereum remains the leading solution for Blockchain dApps.

What is Solana?

Solana is also a decentralized open-source Blockchain designed to help developers deploy applications. It was conceived in 2017 by Anatoly Yakovenko, and officially released to the public in 2020. Due to arriving on the market later, Solana had the benefit of understanding the scaling and network congestion challenges of other solutions – explicitly setting out to address them.

Quick Overview

The project was laser-focused on solving Ethereum’s scalability challenges, so the Solana vs Ethereum comparisons started all the way back in development. Solana was less interested in decentralization in development, sacrificing some of it in favor of speed and security. So, it uses proof-of-history and delegated proof-of-stake protocols to speed up the process.

The network became particularly popular for its NFT marketplace. Its first break came in 2021, following the launch of Degenerate Ape Academy. In just a few weeks, Solana more than doubled its value, putting the project on the map.

Where is Solana Now?

One of Solana’s major draws is the fact that developers can write applications with the help of the Rust programming language. This means that it can draw on existing talent for creating smart contracts and integrations, rather than imposing its own language like other solutions.

There are over 700 Projects listed in the Solana ecosystem. However, not all are decentralized; that number is around 300. While Solana has only a fraction of the smart contracts created on Ethereum, it’s routinely outperformed its competitor in raw transactions since 2022. Solana processes roughly 40 million transactions daily, compared to Ethereum’s 1 million. So, this Blockchain makes up for what it lacks in established projects with the help of raw speed and scaling.

Solana Cliff Notes

- Solana was launched in 2020 following a 2017 whitepaper draft and 2018-2019 private funding.

- The network’s goal is to power decentralized applications in a fast and scalable way.

- Solana boasts high performance but was historically vulnerable to network outages.

- Innovative architecture and the ability to code in Rust/C/C++ make Solana attractive for developers.

Solana vs Ethereum – the Blockchain Comparison

Layer 1 Blockchains are base solutions that usually serve as foundations for secondary networks and decentralized applications. If you want to help developers create new solutions, smart contract capabilities are the most important part. Both Ethereum and Solana are viable for creating Web3 applications. Both projects successfully ended up in leadership positions on the market because of their technical strengths.

Here is a quick Solana vs Ethereum Blockchain comparison for reference:

| Ethereum | Solana | |

|---|---|---|

| Launch | 2015 | 2020 |

| Native Token | ETH | SOL |

| Consensus Mechanism | Proof-of-Stake | Proof-of-History + Delegated Proof-of-Stake |

| Transactions per Second (TPS) | 13,63 current / 119 theoretical maximum | 669 current / 65,000 theoretical maximum |

| Programming Language | Solidity, Vyper | Rust, C, C++ |

| № of Projects | 45,000+ | 700+ |

| Decentralization | High | Moderate |

| Transaction Fees | between $1.5 and $9 | between $0.003 and $0.030 |

Sources: Chainspect, dAppradar, CoinCodex, TradingView

Ethereum’s consensus algorithm implemented in 2022 may seem similar to Solana’s combination of proof-of-history and delegated proof-of-stake. However, the key difference lies in implementation. Solana uses validators on the blockchain to vote on the timestamps of blocks, which provides greater speed at a fraction of the cost. However, Ethereum’s post-Merge infrastructure is more robust and less vulnerable to outages.

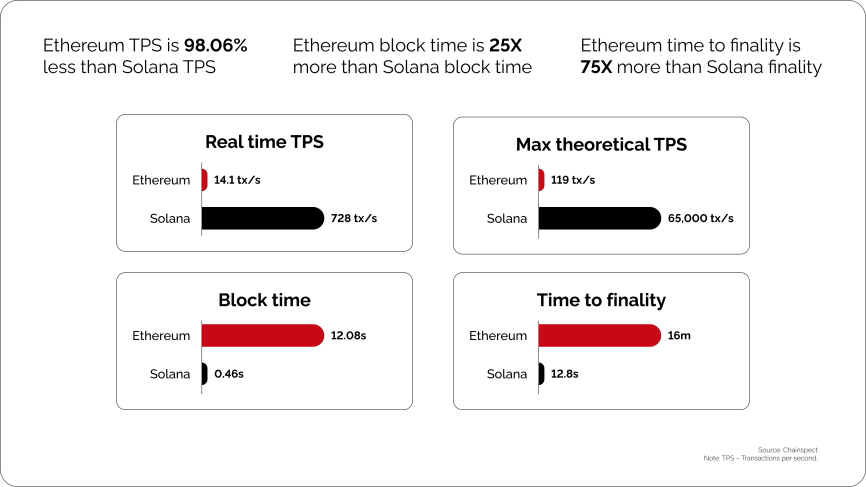

Transactions per Second (TPS)

The issue of scalability is the cornerstone of the Solana vs Ethereum conversation. Due to its innovative infrastructure, Solana currently handles 669 transactions per second, with the highest theoretical speed somewhere in the 65,000 transactions per second territory. In contrast, Ethereum only offers a fraction of that, with roughly 13.63 transactions per second, with the theoretical maximum somewhere at 119, assuming only the smallest possible gas-consuming transactions.

This puts Solana in competition with large centralized solutions like Visa or Mastercard, currently operating at a larger scale than any Blockchain. Ethereum isn’t expected to reach anywhere near that scale, having to rely on Layer 2 solutions for scalability. So, accepting Solana payments is a more attractive proposition for raw speed.

Decentralization

When it comes to Blockchain development, decentralization is one of the most important aspects of an infrastructure. While it’s not as black-and-white as ‘more decentralized = better,’ many people on the market have come to see it that way. Different structures enable different kinds of applications in Traditional, Centralized, and Decentralized finance.

Ethereum creator Vitalik Buterin has highlighted this from the very beginning, talking about the ‘Blockchain trilemma’ of scalability, security, and decentralization. Solana, however, focuses on security and scalability, which makes its Blockchain faster and fundamentally more vulnerable to issues like network outages.

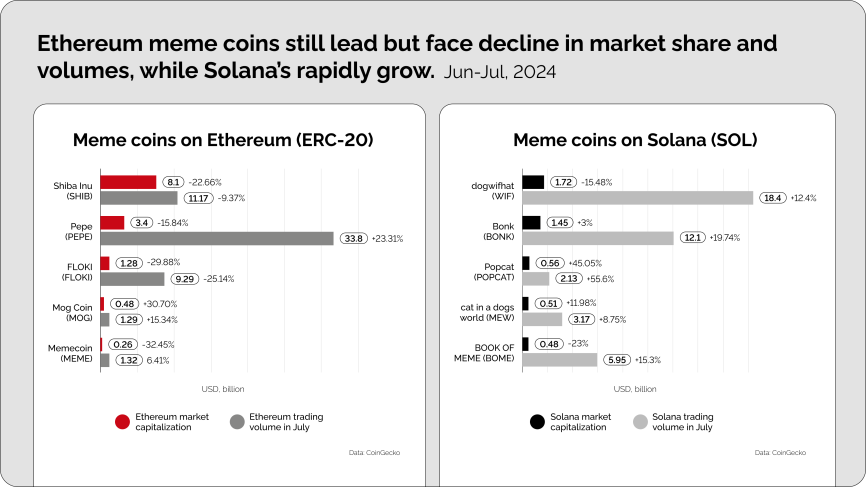

This is far from an academic difference. The development philosophy of these platforms may be why dApp developers keep choosing Ethereum, while NFT and memecoin project creators opt for Solana. Of course, both projects will have a fair number of both kinds of projects since their offer is similar in many ways.

Here is a quick rundown of Solana vs Ethereum for node distribution:

| № | Solana | Ethereum |

|---|---|---|

| Total nodes | 5269 | 12560 |

| Participant distribution | 49 countries | 88 countries |

Source: Solana compass, Nodewarch as of June 2024

SOL vs ETH – Token Comparison

Both Blockchains use tokens to power their ecosystems, and both reward staking tokens – depositing a certain amount to assist the networks with processing transactions. Users who stake tokens become validators, helping the networks grow by participating in transaction settlement.

Further adding to the similarities, the value of both networks is primarily determined by the size of the ecosystem – the number of projects and applications that use the architecture to power their Web3 solutions. So, how do they compare financially?

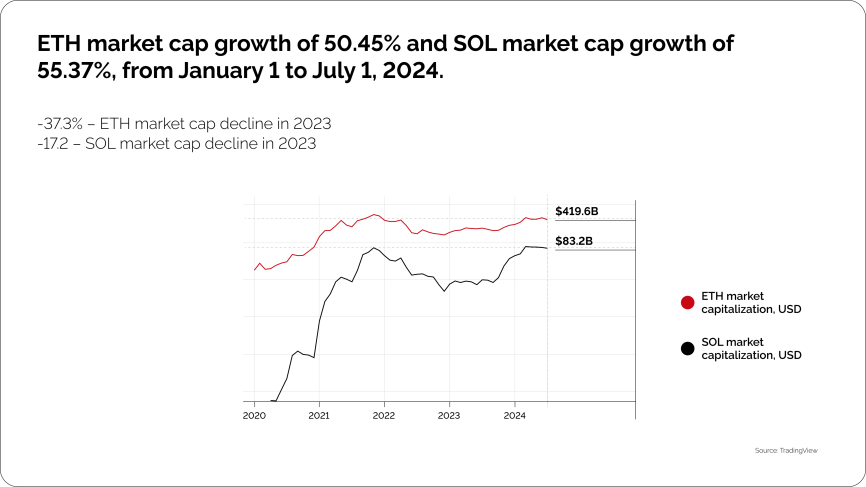

Capitalization & Price Comparison

Ethereum had a 5-year market headstart on its competitor, and it shows. Ethereum’s market capitalization has been through peaks and valleys but hovers around $420 billion as of June 2024, with the current price just above $3,500 for each ETH token. In contrast, Solana’s market cap is at around $65 billion, with each SOL token just above $140.

While this may appear to be an insurmountable chasm, we need to put it into perspective. SOL launched at just $0.9511 in April 2020 and became the fifth most-traded token in the world in just four years. Solana was the fastest growing chain at the end of 2022 and was on a steady upward trajectory throughout most of 2023, with the recent memecoin frenzy launching it back on the map.

So, Solana is growing at an incredible rate while Ethereum continues to dominate the market in both market cap and token price.

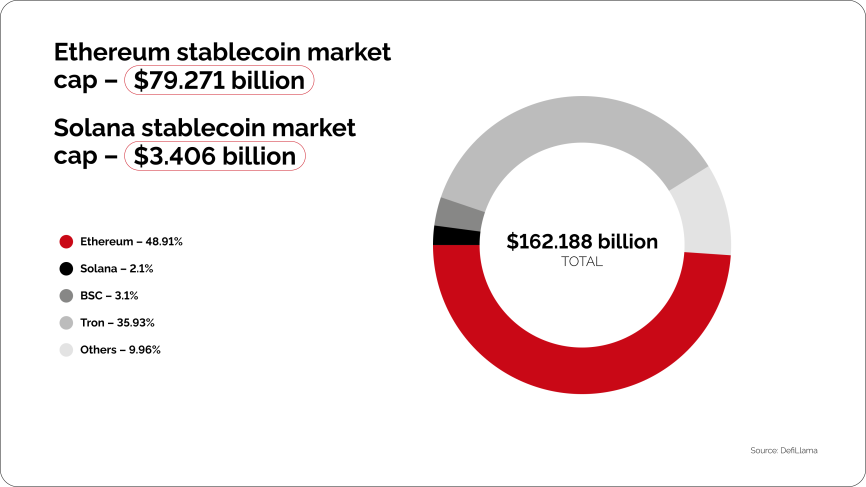

This Ethereum vs Solana difference is also well-illustrated in inflation and especially in stablecoins:

Source: Defilama

48% of the total stablecoins market cap is attributed to the Ethereum blockchain, while the Solana blockchain accounts for 1.8% of stablecoin capitalization. If you accept Ethereum payments, you’re probably doing it due to the sheer size and stability of the network, which has a lot to do with the vast amount of stablecoins that rely on it. On that note, there’s another important metric to compare:

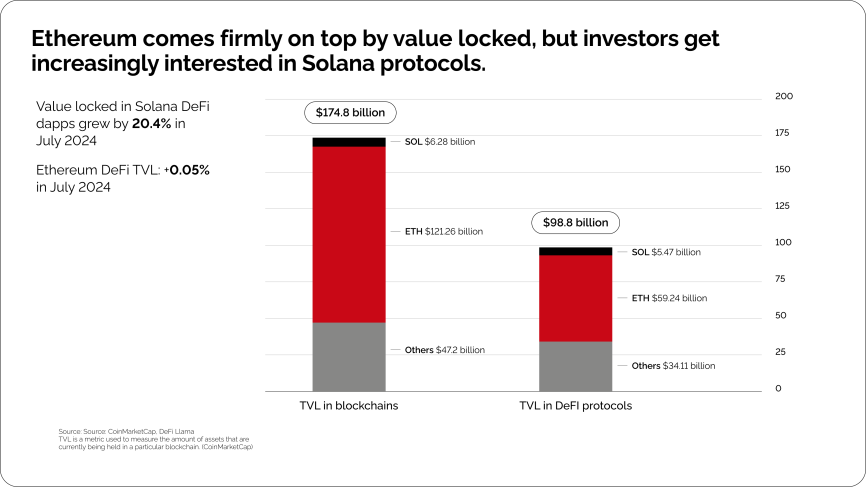

Total Value Locked (TVL)

Both Blockchains encourage users to ‘lock’ value on them – put simply, making a certain number of digital assets unavailable for trading in order to support the network. This is especially common for Decentralized Finance (DeFi), where staking or locking tokens on Smart Contracts powers entire business models.

Here, Ethereum comes firmly on top:

The majority of Solana TVL is in DeFi protocols, and even there, it’s significantly lower than that of Ethereum-based solutions. Ethereum’s dominance is mostly associated with first mover advantage. This only seems to accelerate as ETH gains institutional recognition and becomes an industry standard for smart contracts. However, Solana’s trend is still positive – it took a significant portion of TVL in a fraction of the time.

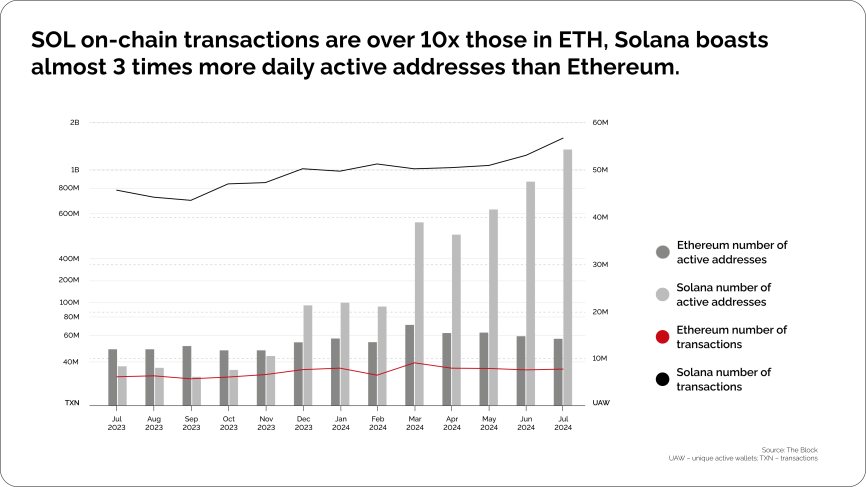

Daily Transactions & Active Wallets

Interestingly, in terms of active addresses Solana not only caught up with Ethereum, but even took over. Due to the aforementioned speed and scalability, SOL on-chain transactions are over 10x those in ETH, while Solana boasts almost 3 times more daily active addresses than Ethereum. Solana had a notably bumpier ride than Ethereum when it comes to user base growth, however, it’s still ahead as of June 2024.

Source: The Block (Solana, Ethereum)

Solana has already broken TPS records with a staggering performance of over 91 million transactions in a single day. Simply put, Ethereum is a preferred solution for business transactions and a store of value for retail investors, while casual users have an easier time with Solana. Those casual users and traders appear to be primarily responsible for the ecosystem’s rapid growth.

What about memecoins, anyway?

Historically, Ethereum has been the haven for ICOs, NFTs, and, of course, memecoins. Yet ever since Solana’s launch in 2020, it’s steadily been encroaching on the NFT and memecoin markets due to its fast transaction speeds, easy setup, and low fees. As mentioned earlier, the memecoin bull run propelled Solana to be the fastest-growing crypto ecosystem at several points in 2024.

Solana vs Ethereum – the Verdict

Combining the higher number of active wallets and a staggering number of transactions, SOL is definitely a worthy challenger to ETH’s market dominance! At least, as far as average users are concerned. Developers, DeFi enthusiasts, and business owners seem to still prefer Ethereum for its established position on the market and value already generated on the Blockchain.

To summarize:

- Ethereum and Solana offer solutions for a similar need; however, they inadvertently occupy different niches on the market.

- Ethereum has established trust and is known for security and stability, leading it in terms of TVL, DeFI applications, and stablecoin implementation.

- Solana is an impressive challenger. It boasts better performance and lower fees, which makes it attractive for NFT marketplaces, memecoins, and similar markets.

- Both platforms have a lot to offer users and investors. However, their value will ultimately depend on what developers can build with these ecosystems.

- Businesses can benefit from SOL and ETH, as these tokens already have value, and both have a place in the growing Web3 ecosystem in different verticals.

It doesn’t have to be a race! With CryptoProcessing, you can prompt your users to pay in whatever currency they prefer, and easily transfer it into 20+ other crypto coins and tokens, or even directly into fiat. Reach out to learn more!

have to choose

payments with CryptoProcessing!

Solana vs Ethereum FAQ

Is Solana faster than Ethereum?

Yes, Solana is significantly faster than Ethereum due to its innovative consensus architecture. It currently handles over 600 transactions per second, with a theoretical maximum of 65,000. This contrasts Ethereum’s current figure of slightly over 13 transactions and a theoretical maximum of 119 under the best possible conditions.

Will Solana ever overtake Ethereum?

Solana was designed from the beginning to be an ‘Ethereum killer.’ However, whether this comes to pass remains to be seen. Ethereum is more widely accepted among institutions, with the recent Spot ETF approval solidifying its role as the market leader. Solana would need to catch up regarding institutional adoption to overtake it.

Could Solana’s price go above $1,000?

While we cannot speculate about the exact values, Solana’s value is directly related to the size of its ecosystem. If many popular and valuable projects start using its infrastructure and growing, the price of SOL is likely to go up. In addition, institutional recognition would also play a significant role – Stripe’s recent decision to accept crypto payments and offer SOL certainly helped. However, it’s currently unknown whether the token will be able to break the three-figure mark in the coming years.

Is Solana cheaper than Ethereum?

Yes, Solana has some of the lowest transaction costs on the market, with fees as low as 0.000005 SOL or $0.002 equivalent, sometimes going up to $0.03, depending on congestion. However, that’s still a fraction of Ethereum’s prices that tend to start at 8-10 Gwei, or above the $1 equivalent as of June 2024. With that said, Ethereum’s prices used to be 10-20 times their current value before the chain transitioned to PoS.

Is Solana more secure than Ethereum?

Solana is overall slightly less stable because its Blockchain is smaller than Ethereum’s, with fewer nodes making it more prone to outages. However, when it comes to transaction security, both Blockchains boast solid performance – vulnerabilities are more likely to be found in individual smart contracts and dApps than on the main infrastructures themselves.

Why does Ethereum have a higher Total Value Locked (TVL) than Solana?

The Solana ecosystem isn’t nearly as mature as Ethereum’s. ETH’s TVL dwarfs that of other Blockchains because most popular dApps were built with its infrastructure. However, these numbers are often inflated by adding the total value of Layer 2 solutions to Ethereum’s TVL. In addition, Solana has been steadily catching up this year.

Is SOL or ETH better for business?

SOL is faster and cheaper to use than ETH, better for high-volume transactions, and can power all sorts of solutions for marketplaces, exchanges, NFTs, etc. However, ETH is currently better as a store of value and has more utility when it comes to powering a range of solutions on its Blockchain, including stablecoins.

Overall, your choice will depend on your business model and priorities. With CryptoProcessing, you can easily accept both from your customers and even automatically convert them into 20+ other cryptocurrencies or 40+ fiat options!