CeFi vs DeFi vs TradFi

You’ve probably heard of the arguments surrounding CeFi vs DeFi, or even TradFi vs DeFi. Indeed, these three ‘umbrella terms’ have emerged as significant buzzwords, each representing different financial systems and ideologies. As the finance world becomes increasingly digital, understanding these terms becomes paramount.

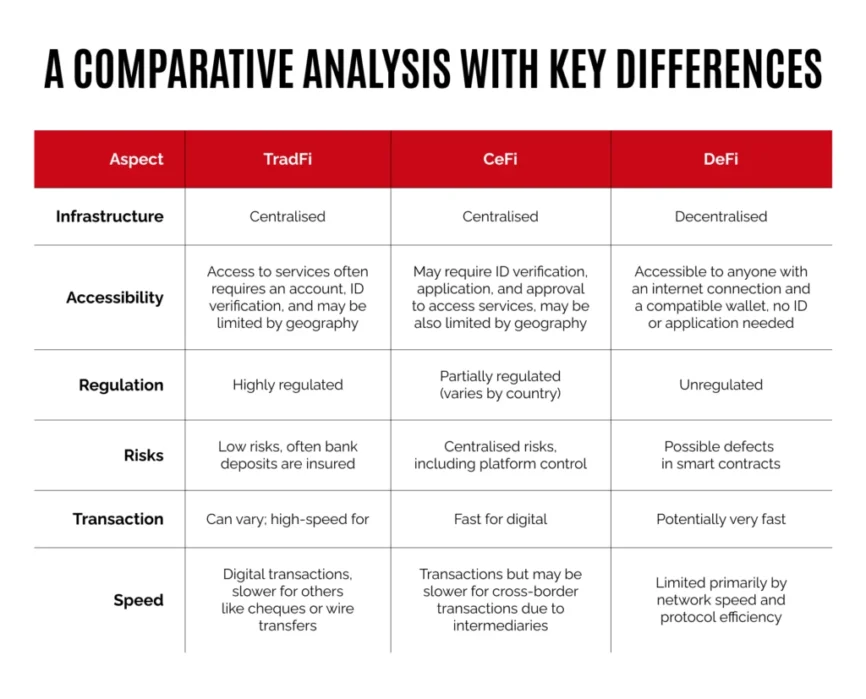

In this article, we delve deep into the distinctions between CeFi, DeFi, and TradFi, providing clarity on their functionalities and highlighting their key differences. To kick things off, let’s look at some general definitions and characteristics of each.

Centralised Finance (CeFi)

Centralised Finance (CeFi) is a financial system where transactions occur through centralised platforms, often acting as intermediaries. These platforms can be thought of as bridges connecting traditional finance and decentralised systems.

CeFi platforms, like popular cryptocurrency exchanges or lending applications, require users to give up custody of their assets to the platform. In return, they offer a more user-friendly interface, faster transactions, and often, regulated environments.

A prime example would be CryptoProcessing.com, which acts as an intermediary in the crypto space, providing a centralised platform for various financial transactions. However, as evidenced by the bankruptcy of platforms like Celsius in 2022, relying too much on human-operated systems can sometimes lead to financial disruptions.

Decentralised Finance (DeFi)

Decentralised Finance (DeFi) is a radical new system built on blockchain technology, allowing financial transactions without the need for intermediaries. It relies heavily on smart contracts to automate and ensure the integrity of transactions.

DeFi platforms operate through dApps (decentralised applications) which are developed using smart contracts on blockchain networks like Ethereum. These dApps offer services ranging from lending and borrowing to decentralised exchanges. While DeFi offers greater control to users and often higher returns, it also presents unique risks, like the infamous ‘rug pull’ scams. Yet, with established dApps like Aave and Uniswap, users have reliable platforms to navigate the DeFi ecosystem.

Traditional Finance (TradFi)

Traditional Finance (TradFi) is the long-standing financial system, encompassing banks, stock exchanges, and other non-blockchain financial institutions.

TradFi operates through centralised institutions that serve as intermediaries for financial transactions. These institutions are regulated by governments and financial authorities, ensuring a level of trust and security. While they may not offer the same level of flexibility and potential returns as blockchain-based systems, they provide stability and have stood the test of time.

CEFI vs DEFI

Centralised Finance (CeFi) operates by combining the power of digital assets with the structure of traditional intermediaries. These intermediaries, such as cryptocurrency exchanges, play a pivotal role in facilitating transactions, much like banks in the conventional financial sector. However, this centralised control results in users sacrificing full autonomy over their assets. The advantages include a user-friendly interface, faster transactions, and greater regulatory oversight, making it more appealing to those new to the crypto world or those who prioritise ease of use.

Decentralised Finance (DeFi), conversely, is the manifestation of blockchain’s original philosophy: a truly decentralised, open, and censorship-resistant system. Operating through smart contracts on platforms like Ethereum, DeFi applications allow users to lend, borrow, trade, and earn interest on their assets without intermediaries. This means users have full control and responsibility over their assets, giving them the potential for higher returns. However, this comes with a steep learning curve, and the decentralised nature can sometimes be a double-edged sword, leading to vulnerabilities like scams and hacks.

In essence, while CeFi offers a blend of the old and new, providing ease with a touch of centralization, DeFi embodies the revolutionary potential of blockchain, demanding more of its users but offering greater rewards.

DEFI vs TRADFI

Traditional Finance (TradFi) is the bedrock of the world’s financial systems. Banks, credit unions, and financial institutions operating under the regulatory oversight provide services such as lending, borrowing, and trading. The main advantage of TradFi is its stability and security, built on centuries of trust, regulations, and established protocols. However, it’s often criticised for being slow, exclusive, and sometimes inefficient.

Decentralised Finance (DeFi), as previously discussed, operates on the polar opposite end of the spectrum. It thrives on decentralisation, giving individuals the power to transact without intermediaries. While it offers flexibility, higher potential yields, and open accessibility, it’s also seen as the economic “Wild West” due to its unregulated nature, making it prone to risks and volatility.

The contrast is evident: TradFi offers a regulated and secure environment built on trust and stability, while DeFi champions flexibility, higher yields, and full control, albeit with associated risks.

CEFI vs TRADFI

Centralised Finance (CeFi) stands at the crossroads between DeFi and TradFi. It borrows the digital prowess of DeFi platforms, offering digital assets and blockchain-backed services. However, unlike DeFi, it doesn’t entirely do away with intermediaries. By maintaining centralised control reminiscent of TradFi, CeFi platforms aim to provide the reliability and trustworthiness of traditional institutions while offering the innovations of the crypto world.

CeFi platforms, such as centralised cryptocurrency exchanges, manage user assets, offering ease of transactions. They often come with a more straightforward user interface, making them more accessible to the general public. However, as they combine elements from both worlds, they also inherit challenges from both. The centralization can sometimes be a vulnerability, as seen with platform hacks, while they may also not offer the same potential returns or full control as DeFi platforms.

Indeed, CeFi attempts to merge the best of both DeFi and TradFi, creating a hybrid system that caters to a broader audience. However, the blend also means it faces unique challenges that neither fully decentralised nor traditional platforms encounter.

Summing up – The Future of Finance

CeFi, DeFi, and TradFi represent distinct paradigms, each with its inherent advantages and limitations. The meteoric rise of DeFi showcases the world’s appetite for decentralisation, while TradFi’s enduring presence underlines its tried-and-tested reliability. Both indicate not an either-or scenario but a likely synergy where they coexist, feeding into the strengths of one another.

Centralised Finance, or CeFi, finds its niche right at this confluence, acting as the transitional bridge for many. It offers the familiarity of centralised systems while introducing the world of digital assets, paving the way for a smoother passage from traditional structures to decentralised platforms.

As the financial landscape shifts and moulds itself in response to technological advancements and user demands, it’s plausible that boundaries between these systems may become more porous. Yet, the foundational philosophies — whether it be the autonomy of DeFi, the structure of TradFi, or the hybrid nature of CeFi — will undeniably influence their trajectories.

In this era of rapid financial transformation, arming oneself with knowledge about these distinct systems becomes paramount. As we journey into this uncharted territory, recognizing the nuances and intricacies of CeFi, DeFi, and TradFi will be the compass for those seeking to navigate the complexities of the evolving financial ecosystem.