HOW TO IMPROVE A PAYMENT EXPERIENCE FOR YOUR CUSTOMERS

An efficient and user-friendly payment experience is like a well-oiled machine in a busy city: it ensures that traffic flows smoothly without any issues, allowing travelers to reach their destinations quickly and without stress.

Now think of how this relates to your product. The smoother the customer payment experience, the more profitable your business can become.

In this post, we will outline the best ways to improve your customer payment journey in 2024.

Key Takeaways

- Learn the key components of an efficient payment process.

- Discover the best strategies to improve your customer payment experience.

- Learn how to use technology to further enhance customer satisfaction.

Understanding Your Current Payment Experience

The first step in improving the customer payment journey begins with a deep dive into the current state of your payment process.

This initial step is crucial for identifying both the strengths and weaknesses of your existing system.

Here’s how you can approach this:

Assessing the Current State of Your Payment Process

Start by mapping out the entire payment journey from the customer’s perspective.

Look for any obstacles or delays that customers face, which could range from cumbersome form fields to clearer payment instructions.

Identifying these friction points is the first step towards creating a smoother payment experience.

Next, you’ll want to evaluate the variety of payment methods you offer, as a limited selection can alienate customers who prefer alternative payment options.

Assessing this aspect helps ensure your payment process is inclusive and caters to a broader audience.

TOOLS AND METRICS FOR EVALUATING PAYMENT PROCESS EFFICIENCY

Tools like Google Analytics can track the customer’s journey through the payment process, providing data on dropout rates, time spent on the payment page, and successful transaction rates.

Heatmap tools can show where customers click, move, and scroll on your payment page, helping identify what attracts attention and what causes confusion.

Establish key performance indicators (KPIs) such as transaction success rates, average processing time, and customer satisfaction scores. These benchmarks allow you to measure the impact of any changes you make.

Main Features of a Great Payment Experience

Now that you have identified the weaknesses on your site, here are the essential elements that you should be aiming for that contribute to a smooth, hassle-free payment process:

SPEED AND EASE OF TRANSACTION

“A study by McKinsey & Company highlighted that reducing transaction times at checkout by just one minute could increase a retailer’s revenue by 5%.”

Customers expect rapid transaction processing. Delays or lengthy processes can lead to frustration and cart abandonment.

A streamlined checkout process with minimal steps and the option for guest checkout can significantly enhance the user experience.

Bitcoin transactions typically take around 10 minutes to be confirmed, but as blockchain technology advances, newer cryptocurrencies like Ripple (XRP) or Solana offer significantly faster transaction times, with transactions settled in seconds.

Here’s a few speed comparisons to take a look at in order to give you a better idea:

- USDT: 50,000 transactions per second

- Solana: 24,000 transactions per second

- Ripple: 1,500 transactions per second

- Cardano: 1,000 transactions per second

- Bitcoin: 7 transactions per second

MULTIPLE PAYMENT OPTIONS

“According to a report by Worldpay, 42% of global e-commerce transactions are made using alternative payment methods such as digital wallets, bank transfers, and local payment solutions.”

Offering a variety of payment options, including credit/debit cards, digital wallets (like PayPal, Apple Pay, and Google Wallet), local payment methods, and even cryptocurrencies should be offered to limit friction for your customers.

MAKE SECURITY EVIDENT TO YOUR CUSTOMERS

Make sure that you’ve implemented strong security protocols such as SSL encryption, two-factor authentication, and compliance with PCI DSS standards to reassures customers that their financial information is safe.

It is also a good idea to display security badges and certifications prominently to help build trust and reassure customers about the safety of their transactions.

CLEAR COMMUNICATION AND TRANSPARENCY

Customers love to know exactly what they’re signing up for or purchasing, and the more clear you make things for them, the more likely they are to convert.

Display all costs, including taxes and shipping fees, before the customer initiates the payment process to prevent surprises and build trust. You should also focus on payment confirmation and access to support.

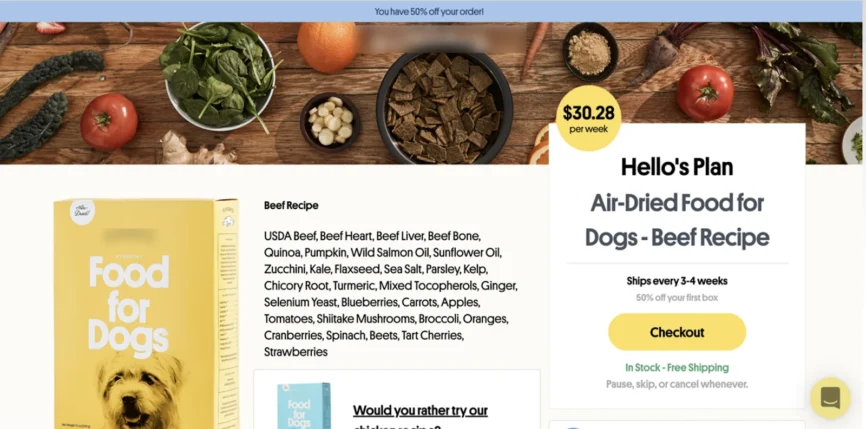

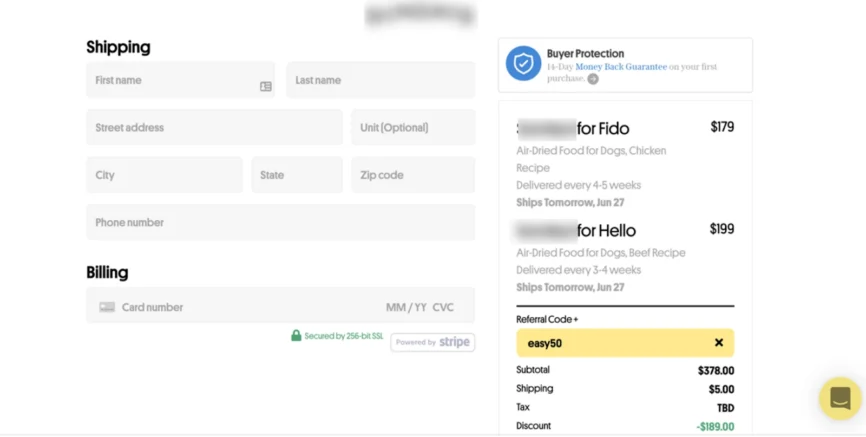

If we take a look at the screenshots above we can see a clear misunderstanding when it comes to price.

The user is drawn to the large, bold text that shows $30.28, but likely glosses over the small text that reads “per week”, which leads them to get confused when they see a large price total of $378 on the final checkout page.

This confusion deters many customers from completing this purchase and any future purchases from this company, because they feel that this company isn’t being transparent.

Sending immediate confirmation messages or emails after a transaction reassures customers that their payment has been successfully processed.

Providing easy access to customer support in case of issues or questions during the payment process is essential for a positive experience.

Strategies to Improve Payment Experience

Although you likely already have a good idea of what major changes need to be made, keep the following strategies in mind when tweaking your payment experience.

Simplify Your Payment Process

Minimize the number of steps required to complete a purchase. Each additional step in the checkout process presents an opportunity for the customer to abandon their cart.

Utilize autofill for returning customers and allow them to store their payment information securely. This reduces the time and effort needed for future transactions, making the process faster and more convenient.

Provide More Payment Options

Cater to a wide range of customer preferences by integrating multiple payment options, including credit cards, debit cards, digital wallets, crypto wallets and even bank transfers.

You should have Apple Pay, Google Wallet, Samsung Pay, and cryptocurrency payments enabled for mobile purchases.

Personalize the Payment Experience

Recognize returning customers and personalize their payment page based on their previous preferences and purchases. This should include displaying their preferred payment method or even suggesting related products.

Integrate loyalty programs and discounts directly into the payment process. Rewarding customers for their loyalty at the point of sale will encourage repeat business and enhance the overall shopping experience.

Leveraging New Technology to Enhance Payment Experience

Technological advancements not only streamline transactions but also bolster security and provide personalized experiences.

Here’s how some of these new technologies can play a big role:

PAYMENT GATEWAYS AND APIS

Payment gateways act as intermediaries between e-commerce sites and payment processors, facilitating secure and efficient transactions.

Modern payment gateways offer seamless integration, support multiple payment methods, and ensure transactions are encrypted and secure.

APIs allow for the customization and integration of various payment systems into e-commerce platforms.

They enable businesses to offer a more tailored payment experience, support diverse payment methods, and streamline the checkout process.

Let’s even take this a step further and look at how crypto payment gateways are changing the game.

Crypto Payment Gateways

Crypto payment gateways work in similar ways to traditional payment gateways but are specialized platforms that facilitate the acceptance of cryptocurrency as a form of payment.

These crypto gateways offer a much-needed bridge between digital currencies and traditional e-commerce platforms, allowing businesses to tap into the growing market of crypto users.

Here are a couple key features and benefits of using crypto payment gateways:

Global Reach

Cryptocurrencies are not bound by national borders, making them an ideal payment method for international transactions.

Crypto payment gateways enable businesses to accept payments from almost anywhere in the world, without worrying about exchange rates or international transaction fees.

Notably, this global reach can significantly expand a business’s customer base.

Lower Transaction Fees

One of the most attractive features of crypto payment gateways, however, is the lower transaction fees compared to traditional payment methods.

Since transactions occur directly between the buyer and seller without intermediaries, the costs associated with these transactions are significantly reduced.

MOBILE APPS

Mobile apps provide customers with the convenience of making purchases and payments on the go.

Integrating payment functionalities into mobile apps can significantly improve the customer experience by offering a fast, secure, and user-friendly payment process.

Incorporating mobile wallets into apps allows for one-tap payments, reducing friction and enhancing the speed of transactions.

ARTIFICIAL INTELLIGENCE AND MACHINE LEARNING

AI and machine learning algorithms can analyze vast amounts of real-time transaction data to identify patterns and detect fraudulent activities.

By learning from historical transaction data, these technologies can predict and prevent fraud more effectively, enhancing security.

AI can also be used to personalize the payment experience for customers.

By analyzing customer behavior and preferences, businesses can offer personalized payment options, recommendations, and rewards, making the payment process more engaging and efficient.

BLOCKCHAIN TECHNOLOGY

Blockchain technology offers a secure and transparent way to conduct transactions without the need for intermediaries. This can reduce transaction fees and enhance security.

Smart Contracts are self-executing contracts with the terms of the agreement directly written into code. They can automate and secure the payment process, ensuring that transactions are completed only when predefined conditions are met.

Continuous Improvement and Adaptation

To ensure your payment process remains competitive and meets the evolving needs of your customers, it’s essential to stay informed about the latest payment trends and shifts in customer expectations.

Regular monitoring and analysis of your payment system are crucial for identifying opportunities for enhancement.

Being agile and ready to adapt your payment process in response to new technologies, customer feedback, and market developments is key to providing a consistently superior customer payment experience.

This approach of continuous improvement and adaptation will help maintain the relevance and efficiency of your payment solutions.

Conclusion

And there it is. Now you have all the knowledge needed to avoid missing out on valuable conversions and take your payment experience to the next level.

If throughout this article you noticed a need for your business to have the ability to accept cryptocurrency payments, then you came to the right place.

By partnering with us at CryptoProcessing.com we can have your business accepting crypto payments and increasing sales in record time.

To get started, simply fill out the form below. We look forward to hearing from you!