Can Crypto Become the Next Go-To Forex Payment Gateway?

Forex seems like a perfect match for crypto payments. Think about it. Cryptocurrencies operate almost without geographical or temporal borders, boast near-instant settlements and, as a nice bonus, incur processing fees a fraction of those charged by traditional institutions. Isn’t that better than your standard Forex payment gateway?

Yet crypto payments may still be looked upon with suspicion. This could be due to the perceived volatility of this new asset class. A lack of knowledge about cryptocurrency also plays a role.

We believe it’s time to dismantle these misconceptions and explore the potential crypto holds for Forex brokers. Spoiler alert: it’s significant.

Should Forex Brokers Consider Crypto Payments?

The short answer is: yes. But there’s a lot to unpack here. Let’s start with a dive into the current state of crypto.

The crypto market is booming, and Forex can capitalise on it.

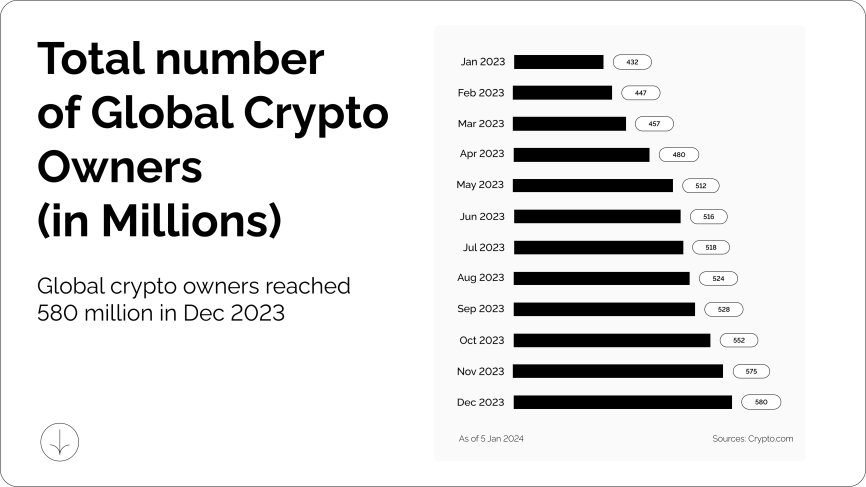

After a period of uncertainty and rehabilitation, the crypto market is on the rise in 2024. Institutional investors are pouring money into new Bitcoin ETFs just in time for the halving. Regular folks are no strangers to crypto either. As many of our readers know, the number of people holding crypto assets reached 580 million at the end of 2023. That’s roughly 1 in every 13 people and an attractive market for Forex businesses to tap into.

The data above reveals a 34% surge in crypto users. While it’s tempting to connect such a quick influx of investors to short-term factors like a bullish market or media hype surrounding the halving, evidence suggests the newcomers are to stay.

- Chainanalysis’ 2022 Global Cryptocurrency Report shows that many of those who invested in crypto during the 2021 boom are sticking around.

- Similarly, a study conducted in Germany found that nearly a half (46%) of crypto investors are long-term holders. This aligns perfectly with the needs of the Forex market, which thrives on stable, long-term participants.

Overlap in geography and demographics of crypto and Forex

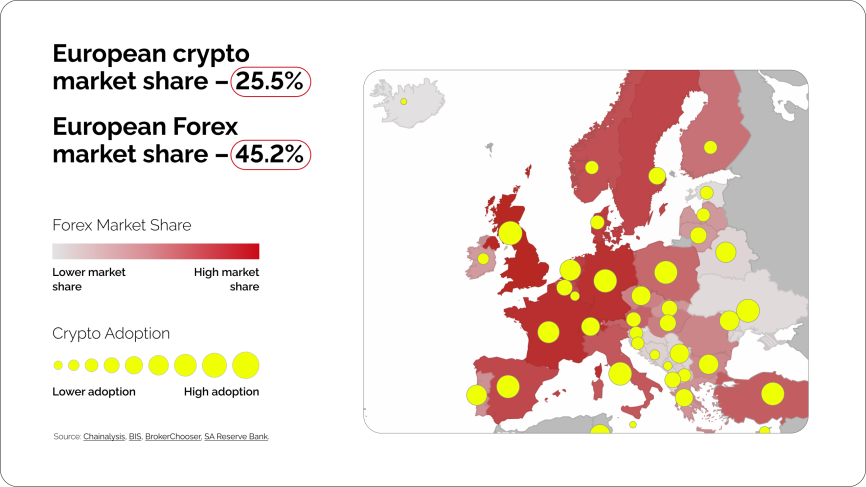

When it comes to the landscape of crypto adoption, several countries and regions ranked high in 2023, including the US, UK, Hong Kong and Japan. Interestingly, the same countries also boast a large number of Forex traders.

In Europe, Switzerland, France and Germany are leading in terms of average daily turnover of OTC Forex transactions. These counties also rank high in terms of cryptocurrency value received.

This suggests that there’s a certain overlap in the demographics of crypto and Forex enthusiasts.

Sources: Crypto Market – Chainalysis 2023 Geography of Cryptocurrency Report, the index was inverted to 151-1 scale, a higher number indicates higher crypto adoption, where 151 is the highest adoption; Forex Market – first 52 countries were ranked from 151-100 based on BIS data, other countries were attributed with the base rank of 80 and ranked based on trading taxes, SA Reserve Bank.

Overall, Europe shows a favourable sentiment towards cryptocurrencies. One reason that feeds in this sentiment is a lack of a single payment solution that works across the union. Sure, there’s euro cash. But it is quickly going out of fashion. In response, the European Central Bank is pushing for a digital euro. That might be one of the first examples of institutional propagation of digital assets.

Down the individual level, the demographic overlap is also apparent. The average crypto holder is male, educated and financially secure. So is the average Forex trader.

Crypto payments in Forex: not the question of “if” anymore — but rather of “when”.

Lastly, some Forex businesses are already pioneering the crypto edge. A number of major brokers now let customers fund trading accounts with popular crypto assets like Bitcoin and Ethereum. And while some brokers embrace crypto as a Forex payment gateway, some took a step further and allowed crypto CFDs and trading pairs.

| Crypto service | What it means | Offered by |

|---|---|---|

| Crypto CFDs | Allows investors to speculate on cryptocurrency price movements without directly owning them | FXTM, FOREX.com, Capital.com, AvaTrade, Interactive Brokers, eToro. Oanda |

| Cryptocurrency trading | Allows investors to trade cryptocurrency pairs, for example, BTC/USD or BTC/USDT | AvaTrade, Interactive Brokers, eToro |

| Cryptocurrency payment gateways | Simplify the movement of funds between Forex accounts and crypto exchanges via API integration | SimpleFX, Gerchik & Co, XBTFX, Fxview, AdroFx, Sage FX, and 80+ other platforms* |

| Blockchain settlements | Using blockchain technology to settle Forex trades | HSBC, Wells Fargo, Oanda |

*spotted by Earnforex

With crypto adoption on the rise, we expect more and more Forex businesses to jump on the crypto bandwagon.

Confused about crypto’s place in the financial landscape? Curious how it stacks up against Forex?

Dive into our in-depth report to understand the latest trends, market conditions, and key differences between cryptocurrency and Forex trading.

Fill out the form below or connect with our chatbot to get your free report!

Why are Forex businesses adopting crypto payments?

Now, we’ve spotted the key drivers behind crypto adoption in Forex. But the question remains: what specifically makes crypto attractive as a Forex payment gateway? We’ve touched upon a few advantages in the introduction — its almost borderless nature, 24/7 accessibility and potentially lower fees. But there’s more.

TradFi | Crypto | |

|---|---|---|

| Fees | 1-3.5% for bank transfers | <1-1.5% |

| Speed | can take several days to complete | settled almost instantly |

| Transparency | More regulated yet prone to corruption | Under-regulated but open data and blockchain immutability enhance security and transparency |

| Access | An estimated 1.4 billion people globally are unbanked (as of 2023) | Anyone with an Internet connection can own crypto |

| Adoption | Widespread, used and accepted in all countries | Constantly growing, attracting new markets and audiences |

To increase revenue

The surge in crypto adoption creates a vast pool of potential new customers for Forex businesses to tap in. These customers are likely open to the idea of trading too, since the demographics of crypto holders and Forex traders overlap. Both groups tend to be tech-savvy and comfortable with taking calculated risks. By offering these folks a chance to pay with (or even trade) the assets they already own, Forex businesses can easily attract new investors.

Beyond attracting new customers, onboarding crypto may help Forex businesses retain the existing ones. A recent study revealed a disturbing fact: more than half of retail investors would consider switching brokers if they lack a digital asset trading offering. Introducing an appropriate crypto offering may help minimise customer churn, too.

To reduce costs

Forex is a global market. But its scale is a double-edged sword for investors. Together with unparalleled access comes the burden of fees. These may include:

- Credit or debit card transaction fees that usually range between 1.5% and 3.5% of the transaction amount.

- International processing fees that can reach as high as 3% and cover costs of moving funds across borders.

On top of these, there are conversion fees that are changed when investors are depositing an amount in a currency different from their base account currency. These fees make up to 1%.

Crypto transactions offer an alternative, averaging around 1%. Services like CryptoProcessing can further reduce these fees through flexible commission structures. We don’t incur onboarding or monthly fees either. So, lower transaction fees come with no trade-offs.

To minimise risks

A whirlwheel of a market, Forex thrives on movement. But excessive volatility may pose a major risk for traders. While it may seem counterintuitive, cryptocurrencies can actually be a valuable tool to minimise these risks.

Research shows that crypto assets can act as a hedge against volatility. The study has found that Forex portfolios balanced with crypto outperformed those unsupported by digital assets during economic turmoil triggered by COVID-19.

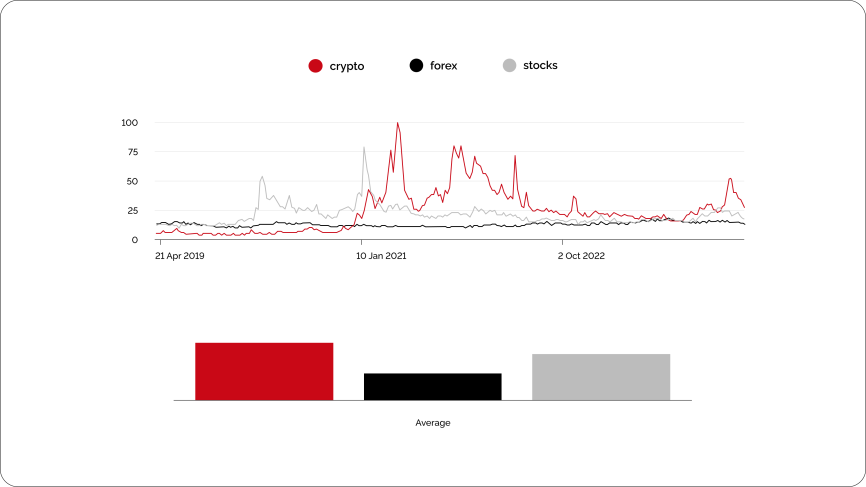

Indeed, people resort to crypto when the global economy gets flaky, as witnessed by the Google Trends data below. People’s interest in cryptocurrencies peaks during the stock market crash caused by the pandemic, then slowly levels, though still catching slightly more attention than the financial market.

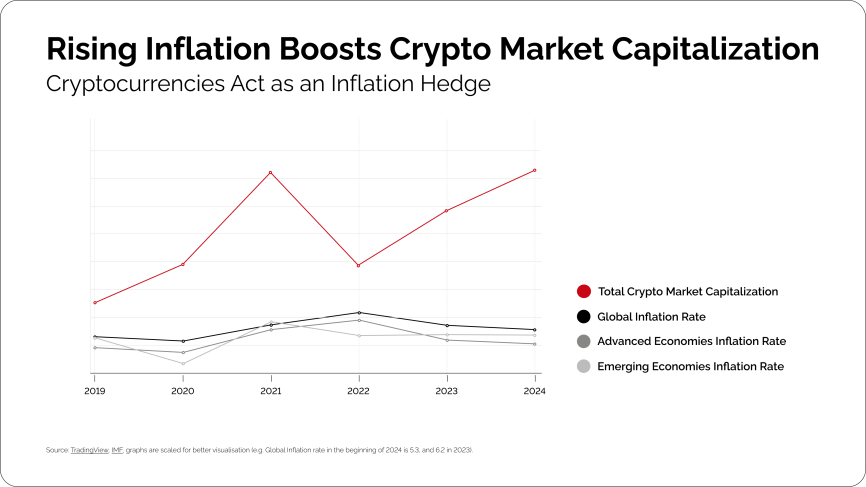

Beyond volatility, crypto acts also as an inflation hedge. In the figure, the crypto market cap rises alongside increasing inflation. This may suggest that investors view cryptocurrencies as a potential counterbalance to inflation, sort of like “digital gold”.

Source: TradingView, IMF, graphs are scaled for better visualisation (e.g. Global Inflation rate in the beginning of 2024 is 5.3, and 6.2 in 2023).

That said, with major events that can stir up the global economy (think stubborn inflation, the US elections and geopolitical turmoil) looming, Forex brokers may face a challenge of retaining customers who might be tempted to turn to dedicated crypto trading platforms. Offering crypto as a portfolio diversification tool may be a solution against potential churn.

With trusted services like CryptoProcessing, Forex platforms can hit two goals in one fell swoop. Alongside a payment processor, we offer a dedicated Business Wallet for storing crypto. It can be easily accessed to rebalance Forex accounts when investors do need a hedge.

To improve operational efficiency

Unlike traditional payment systems, Forex runs around the clock. Cryptocurrencies might be a better fit for a Forex payment gateway, given the always-on nature of this market.

- A recent survey revealed that 35% of traders are active in the first hour of the morning, with another 30% trading in the evening.

- Another study found that 35.3% of individual trades take place outside standard hours.

Indeed, there’s growing demand for payment options that aren’t constrained by traditional banking hours. This is where cryptocurrencies step in, offering the flexibility that today’s investors require.

Beyond accessibility, there’s the question of speed. Standard settlement periods for most currencies is 2 business days, with some exceptions such as CAD/USD settling the next business day. For most popular cryptocurrencies, settlement times are in the range of minutes or even seconds.

Onboarding crypto payments may already boost operations. But partnering with a trusted vendor like CryptoProcessing may take efficiency a step further. Our users particularly like the speed of Mass Payouts, a feature we’ve recently introduced, which can be up to 10 times faster than manual payments. On top of that, we offer a diverse range of payment options, from invoices to payment links, allowing traders to choose the solution that best suits their needs.

To create an appealing brand image

The Forex market is increasingly fragmented, and the competition for trading firms is high. Accepting cryptocurrencies may create an image of a tech-savvy business that keeps pace with technological advancements.

Moreover, accepting crypto may help create an image of a brand that values transparency. Blockchain, the technology behind cryptocurrencies, is notable for being transparent, with every operation recorded and tamper-proof. This aligns with the desires of new, younger traders.

Indeed, there’s a change in trader preferences recorded in data. More and more are opting for exchange-traded derivatives instead of over-the-counter trades. This is evident in the Forex futures and options market, which now boasts an average daily volume of $85 billion, compared to $76 billion in 2021. With younger traders flocking, the demand for transparency will likely continue to rise.

What are the challenges associated with crypto in Forex?

As a relatively new asset class, cryptocurrency comes with a few concerns that we must mention to paint a full picture.

Crypto volatility

The first one is the volatility of crypto assets. Cryptocurrencies can experience significant price swings in a short period, which can wreak havoc on Forex traders. While there’s a chance to profit from price fluctuations when buying a currency pair with, say, Bitcoin, there’s an equal chance of suffering financial losses.

Uncertain regulatory landscape

Regulatory uncertainty is another barrier for the adoption of crypto as a Forex payment gateway. And though a comprehensive global framework is still under development, there are some positive signs. The introduction of MiCA in Europe and the approval of Bitcoin ETFs in the US signal a shift towards a more regulated crypto environment.

Meanwhile, a trusted crypto processor can mitigate these risks

First, reliable processors like CryptoProcessing offer instant conversion of cryptocurrencies into fiat currencies like USD or EUR. This allows traders to lock in profits after a trade is completed and lowers the risk associated with crypto volatility.

Moreover, some processors, including us, “freeze” the exchange rate at the time a trade is initiated. This protects traders from any price fluctuations that might occur during the transaction.

Partnering with a processor that supports stablecoins, digital currencies pegged to the value of real-world assets, is another hedge against volatility.

When it comes to the regulatory landscape, choosing a legal crypto processor is crucial to navigate the uncertainty. At CryptoProcessing, we operate under a relevant virtual currency services provider licence in Estonia, known for its high standards and strict rules for crypto businesses.

Moreover, we adhere to the highest regulatory standards and provide clear and detailed accounting and legal documentation. Finally, we actively work with regulators to keep our merchants updated about the latest regulatory changes.

So, will crypto become the go-to Forex payment gateway?

While it’s hard to predict yet, the potential of cryptocurrencies in the Forex market is undeniable.

As both crypto and Forex markets evolve, the lines between the two may gradually blur. After all, both attract a similar audience: tech-savvy, risk-tolerant individuals seeking to make a profit. As a Forex business, why not tap in the pool that is likely open to the idea of trading?

Public interest in crypto is strong too, and we expect it to grow further. Ignoring this ever-expanding group of crypto enthusiasts could be a missed opportunity.

Finally, crypto’s inherent characteristics offer a solution to common Forex traders’ pain points. Slow settlements, limited availability and high transaction and conversion fees — all these challenges can be addressed with crypto.

There are concerns, of course. Volatility and legislation the primary. While comprehensive market-wide solutions are still under development, you don’t have to wait to benefit from the potential of crypto. Partnering with a trusted crypto processor can help you navigate these challenges now.

The choice is yours but we strongly encourage you to consider crypto.

of crypto payments

for Forex?