How Blockchain Can Supercharge B2B Payments

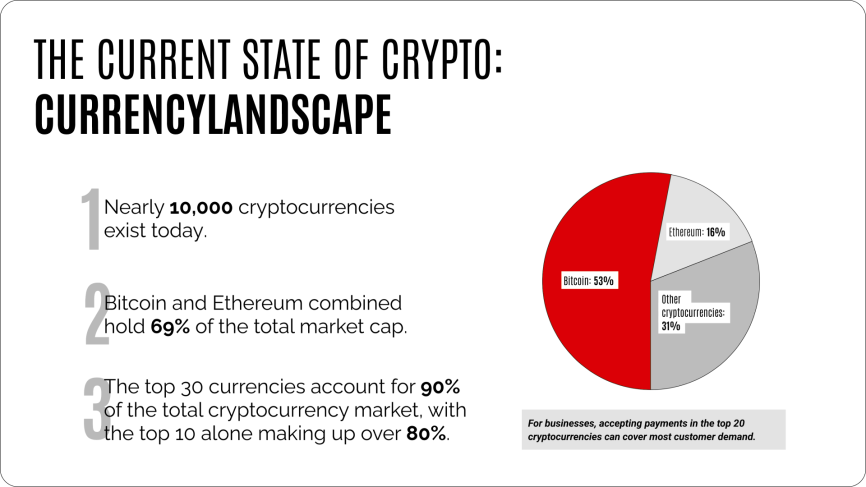

Most people have heard about cryptocurrencies and the endless talk of blockchain payment options. Yet, when asked, 75% of Americans who know about cryptocurrencies aren’t confident in their safety and reliability. Making it even more confusing, there are nearly 10,000 currencies on the market, and it’s easy to get overwhelmed.

To make sense of it all, let’s start from the top and survey the market:

Understanding Crypto & Smart Contracts

A large part of the confusion is that Blockchain, Bitcoin, and cryptocurrency are often used interchangeably. Let’s break this down – Blockchain is the technology responsible for cryptocurrencies, of which Bitcoin is the first and most successful one.

The Blockchain is a distributed ledger that simply records data and has a mechanism for deciding how to govern it. In other words, nobody can tamper with the database due to cryptography. This made Blockchain a great baseline for virtual assets – making internet payments fast, secure, and reliable.

Bitcoin was the first cryptocurrency, designed to safely exchange funds with strangers online without the need to involve banks. From this, we get the idea of smart contracts – agreements made on the Blockchain that are enforced automatically without the need for third parties and intermediaries. Ethereum is currently the dominant solution for this.

Here’s a handy article if you want to dive deeper into the technology behind crypto.

The Blockchain Technology Explosion

Developing better and more efficient Blockchains led to a steady growth of this new market. Entrepreneurs started creating their own applications that reduce the need for intermediaries and overhead in their niches. This is especially relevant for the financial sector, where using the blockchain for payment processing disrupts entire industries.

Stablecoins became another milestone in the payment revolution by pegging the worth of cryptocurrencies to more common stores of value, such as the US dollar, gold, silver, or other assets. They provided much-needed stability to the market to help propel it even further.

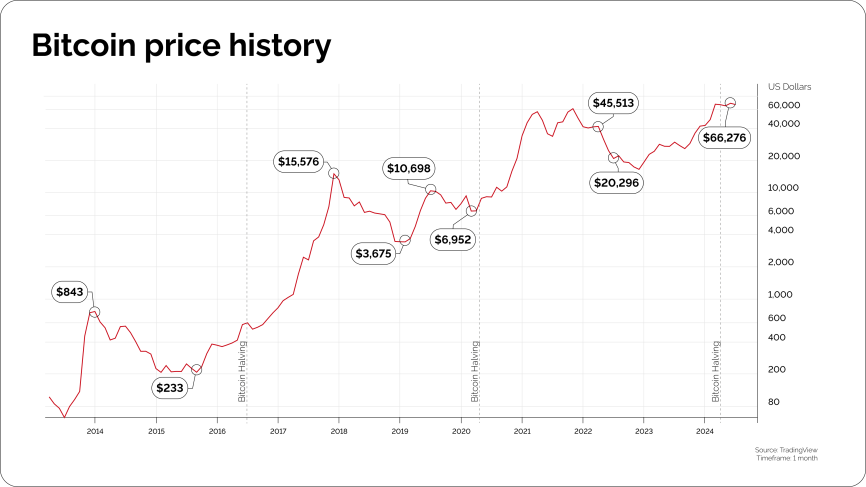

Bitcoin itself went from a value of $0.0009 in 2009 to above $65,000 in May 2024 and paved the way for thousands of cryptocurrencies – most just trying to copy its success, some attempting innovative projects in their industries, others just making memes.

Here’s a quick breakdown:

Powering Cross Border Payments

Cryptocurrencies have a unique strength of being global and near-instant. In other words, where a SWIFT international bank transaction would take up to 5 business days, as well as the intermediary and beneficiary bank fees, a blockchain payment takes around a minute and costs a fraction of that. That’s the primary reason why crypto is so popular in countries where banking is particularly difficult or restrictive.

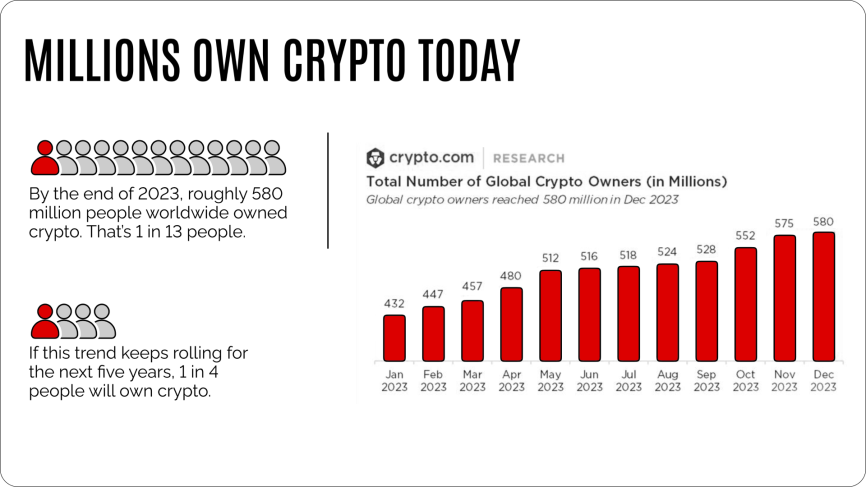

Over 580 million people owned cryptocurrencies by the end of last year, and this trend shows no signs of slowing. Research also shows that over 50% of crypto users are under the age of 34, which means we are dealing with a younger growing market.

Source: Crypto.com

However, the various Blockchain payment options can be tough to navigate without knowing which coins do what. As we’ve discussed, there are over 10,000 cryptocurrencies out there, and most hardly, if ever, get used. So, what’s the best route?

Which Coins to Accept

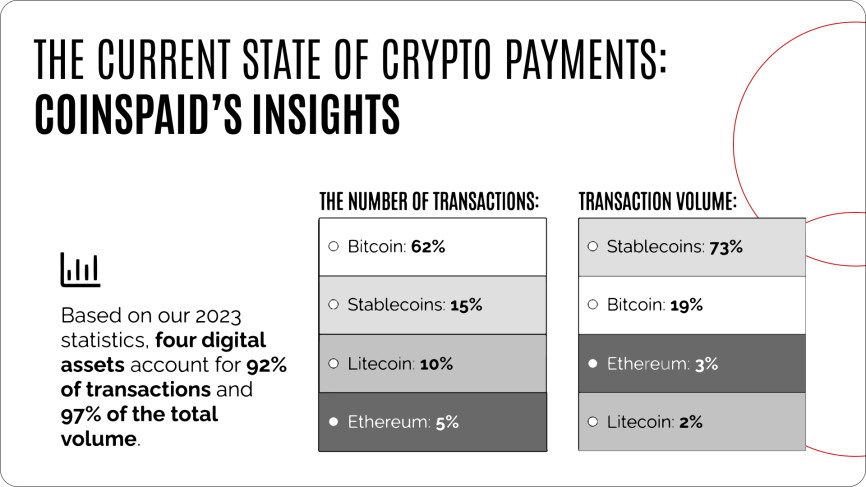

Once implementing crypto payments businesses usually start with the most popular cryptocurrencies out there – Bitcoin, Litecoin, Ethereum, and Stablecoins:

Today, merchants have no reason not to accept these top currencies as they are quick to both receive and convert into each other or fiat currency. Stablecoins account for a lion’s share of the transaction volume. The most popular stablecoin is USDT, with a market capitalization of $111 billion (May 16, 2024), each token representing $1 US.

Stablecoins are a good bet if you just want to accept currencies and treat them the same way as fiat money. Bitcoin is a good bet due to its additional appeal as a store of value and an asset. Litecoin tends to be popular for its speed and ease of handling lots of transactions, and most of Ethereum’s value is in its vast smart contract ecosystem.

Of course, you can expand your scope to dozens of other cryptocurrencies, some of which may be more appealing to your business. However, even if you do, you’ll likely encounter these top 4 options among the customers who will be paying for your goods or services.

The Blockchain Payment Opportunity for Businesses

While the market is still relatively new, its explosive growth presents an opportunity for forward-facing businesses. There are several ways to leverage crypto payments in ways that will benefit your bottom line:

Companies Choose Crypto to Attract Customers

Institutional investors have been interested in digital assets for a long time and continue to add digital asset funds to their portfolios. The World Trade Organization, along with giants like IBM have been exploring the implementation of Blockchain since 2018 and earlier. Large brands, from Ferrari to AT&T and Starbucks accept crypto. Many motivations are customer-focused:

Source: Deloitt

Industries that benefit the most from crypto, along with some brands that embraced it:

Crypto B2B Payments Reduce Costs

With Crypto processors, you pay around 1% or less commissions and don’t have to worry about chargebacks. This is especially important for online businesses that are labeled by credit card processors and financial service providers as ‘high-risk,’ which often comes with increased fees and a mandatory rolling reserve imposed on accounts.

Even for more traditional businesses, crypto payments are simply more efficient because of lower fees and higher speed. Coming back to the example of cross-border transactions – what normally takes several days is possible with crypto in just a few minutes. You’re saving both time and the cost of a SWIFT transfer that can run up to several hundred dollars.

Digital Assets Serve as a Hedge

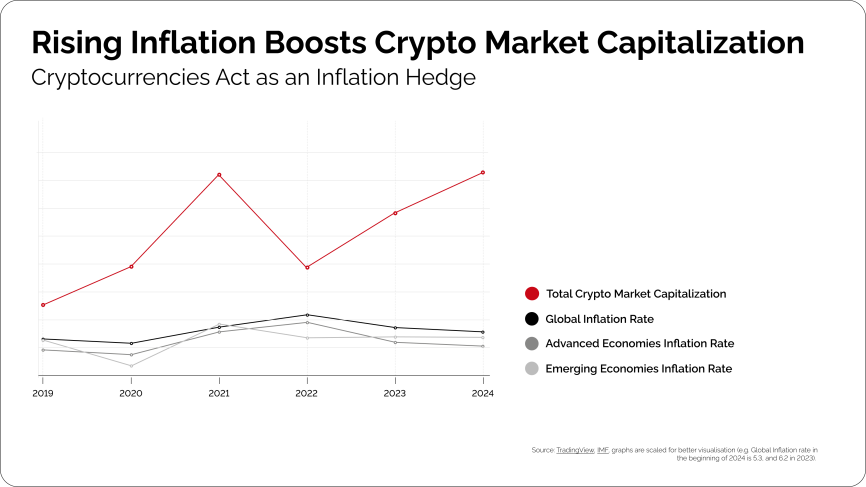

Certain cryptocurrencies, such as Bitcoin, hold a value of their own due to their utility as “digital gold,” in the words of a Deutsche Bank researcher. Many players on the market use cryptocurrencies as a way to combat inflation:

Source: TradingView, IMF, graphs are scaled for better visualization (e.g. Global Inflation rate at the beginning of 2024 is 5.3, and 6.2 in 2023).

In other words, you can keep a portion of crypto as an asset because its value goes beyond just payments. Some go as far as using crypto payments as part of building a digital portfolio to hedge against financial uncertainty.

To summarize, there are several ways to use blockchain payments to your advantage:

- Reduce overhead on international payments and domestic transactions.

- Remove the rolling reserve or chargebacks as a financial risk.

- Use digital assets as a hedge for inflation or financial instability.

- Appeal to a primarily younger audience of cryptocurrency users.

- Create a tech-savvy image among your customers.

How to Integrate Blockchain Payment Solutions

A blockchain payment system can easily slot into your existing website in the same way regular integrations would. However, unlike traditional payment processors, crypto payment gateways don’t get between you and your customer – this means no banks, no chargebacks, and no rolling reserves.

It also means you should carefully consider who you partner with for processing your crypto transactions because unregulated service providers can quite literally run away with your money. It’s more like having a courier for your physical cash than using a credit card with a large bank – fewer intermediaries and overheads, but more due diligence required.

To help address this, we’ve created our own Payment Gateway at CryptoProcessing:

- Accessible international invoicing, channels, and payment links.

- 20+ of the most popular crypto options on the market

- Conversions to 40+ traditional currencies with bank account withdrawals.

- Up to 80% savings on processing fees with around 1% or less in commissions.

- Licensed in Estonia and audited by independent cybersecurity experts.

We’re internationally recognized for excellence:

What Keeps Merchants from Integrating Crypto Payments?

Since we just addressed the due diligence required in choosing your service provider, the biggest barrier in the way of crypto is still down to uncertainty. Even if cryptocurrencies are the next frontier of payments, there are still unknowns, and technology is developing rapidly.

That said, we’re also no longer in the BBS era of crypto – wallets and payments are user-friendly and fast, providing the kind of experience we’ve come to expect from software.

Let’s take a look at the three most common concerns and how to address them:

1. Crypto Volatility

Problem: We’ve all seen Bitcoin jump by massive percentages over weeks or even days – trading near $48,000 in March 2022, only to fall to $29,000 by May. It opened in 2023 at $16,530 and at the time of writing (May 16, 2024) is at $66,259. And Bitcoin is just one illustration – other cryptocurrencies are arguably even more volatile, sometimes going from dollars to cents in days.

Source: TradingView

Solution: Stablecoins help merchants account for volatility. USDT and USDC are the most common options trading 1:1 with the US dollar. You can easily accept crypto without having to worry about the current market price. Simply take whatever coins your customer pays in and immediately exchange them into stablecoins to stay on the safe side. You can even go further and exchange all of it into fiat and receive payouts directly to your bank account.

CryptoProcessing even goes a step further and helps you do this automatically to set up a payment flow convenient for your business. We freeze the exchange rate at the moment of purchase to make sure your payment is safe from market fluctuations, and offer stablecoins and fiat options to help find the best solution for your needs.

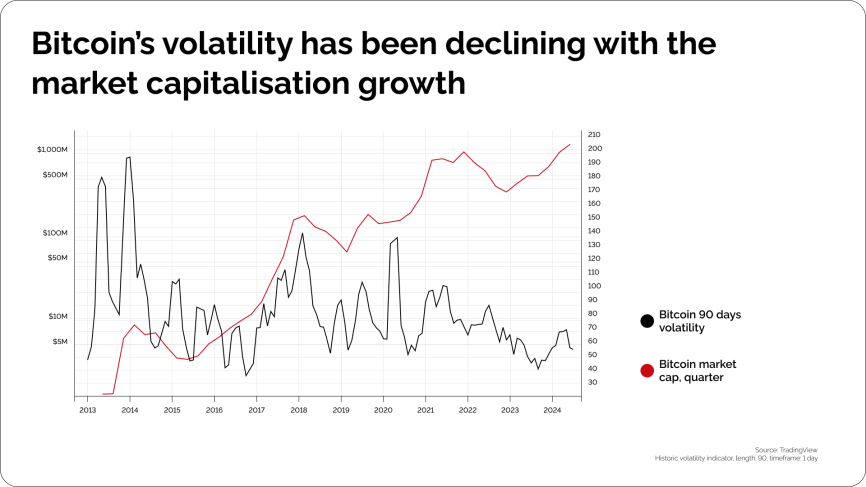

On an interesting note, Bitcoin’s volatility has actually been going down over the past year:

Source: TradingView

2. Security

Problem: Because cryptocurrency wallets aren’t like bank accounts, assets in them are perceived to be vulnerable. Anyone with a key can get in and take advantage of that, which means any cryptocurrency funds on a wallet are potentially in danger.

Solution: To address these concerns, numerous improvements have been made by every leading network. The Blockchain remains unhackable due to its infrastructure, and providers of wallets and payment gateways add numerous security measures such as multi-signature functionality, manual reviews for large transactions, and so on. Today’s crypto security is a long way ahead of what it was when Bitcoin first became popular.

At CryptoProcessing, we stay ahead of evolving threats and offer a solution that passes independent cybersecurity audits. In addition, we offer automatic withdrawals to cold storages for a safe and convenient experience.

3. Regulatory Challenges

Problem: Regulators are still catching up with cryptocurrencies, and many countries aren’t quite sure how to deal with them. Moreover, some countries outright ban them, while others restrict access to banking to clients and businesses that handle digital currencies. Crypto payments are commonly seen as grey-area transactions that rouse suspicion.

Solution: The European Union became a regulation pioneer with MiCA that helps create a framework for crypto-assets and sets a standard for most countries. Moreover, most Central Banks of the G20 are currently exploring cryptocurrency elements for their banking systems – a combined 98% of the world’s GDP. While it’s true that some countries, such as China, ban them, it’s likely to be a temporary measure until they make further decisions.

CryptoProcessing is a legal and licensed service provider in Estonia, a country known for one of the strictest and most comprehensive frameworks covering the cryptocurrency industry.

Start Small

2024 is a great time to move ahead of the trend and start accepting crypto transactions. It doesn’t have to be a big process that involves weeks or months, either. Usually this is a matter of a few business days. You can expand your geography and unlock new opportunities without having to significantly change any of your existing processes.

With us, you don’t even have to worry about set-up or monthly fees – simply reach out, open your merchant account, and get in on the future of payments!