USDC vs USDT: Decoding The Difference Between Stablecoin Giants

Stablecoins promise stability to those seeking refuge from the crypto market volatility.

Indeed, by buying a stablecoin, you are acquiring an asset whose value is tied to a fiat currency. Key players in this arena, USDT and USDC, serve the same goal — provide a reliable, dollar-backed store of value.

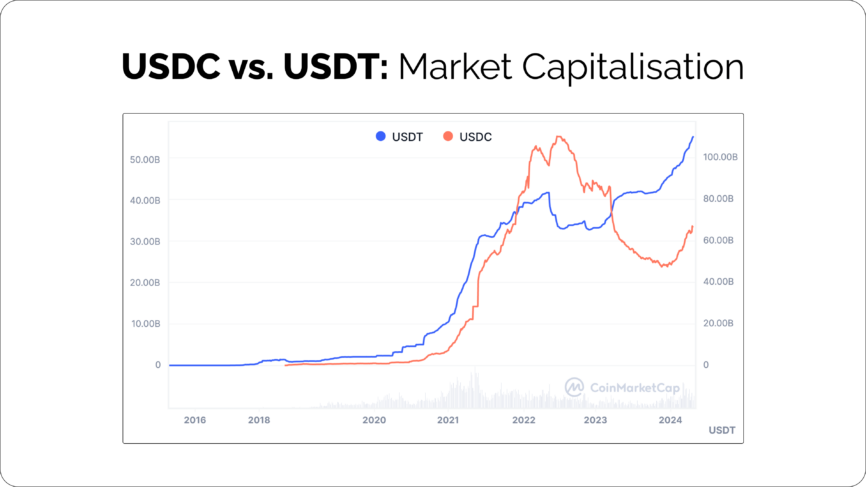

Recently, a new trend emerged in the USDC vs. USDT balance of power. While USDT remains the undisputed leader in terms of market capitalization ($103.36 billion as of March 18, 2024), USDC has been tipping the scale of popularity in its favour. Since December 1, 2023, USDC’s market cap has increased by 14.3%, outpacing USDT, whose market cap expanded by a smaller 8.7%.

This trend raises some questions: What factors are powering the change? Will USDC challenge USDT’s long-help position? And what are the essential differences between the two popular stablecoins? Let’s break down the USDC vs. USDT dynamic and dive into the factors shaping their current trajectories.

But First Things First: What Are Stablecoins?

Before we delve into the specifics of USDC vs. USDT, let’s zoom out and see what stablecoins are and how they differ from other cryptocurrencies.

Unlike traditional cryptocurrencies whose value fluctuates wildly based on supply and demand, stablecoins offer more predictability. After all, the name “stablecoin” reflects their core characteristic — relative stability in price. This is because their value is pegged to another asset, such as fiat currency, a commodity like gold, or even another stablecoin. There are also algorithmic stablecoins, where an algorithm automatically adjusts the supply of coins to maintain their peg.

The pegging mechanism helps stablecoins to avoid the dramatic price swings traditional cryptocurrencies suffer from. This makes them a more attractive and convenient option for investors seeking a less volatile crypto experience.

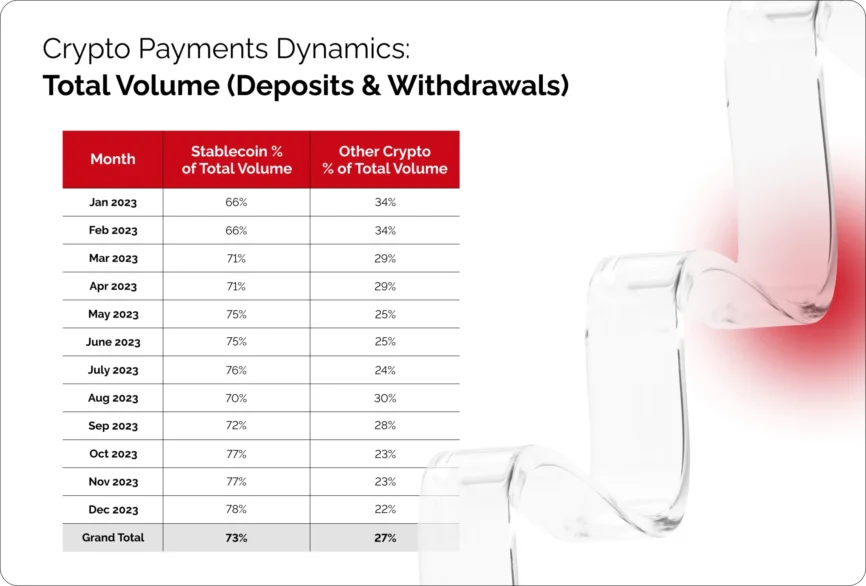

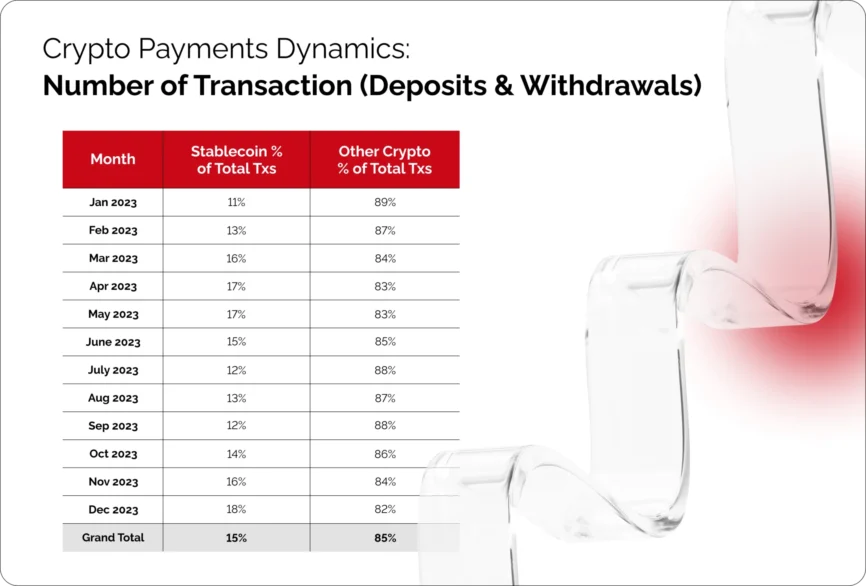

Indeed, stablecoins are gaining significant traction, and our analysis of the data from Cryptoprocessing.com attests to that.

- 66% of the total transaction volume made up by stablecoins in January 2023;

- This number steadily climbed to 78% by December.

- The grand total shows that on average, stablecoins constituted 73% of the total volume throughout the year.

- Conversely, the share of other cryptocurrencies of the total transaction volume decreased from 34% to 22% in the same period.

- While still a smaller portion, the number of transactions settled in stablecoins also increased, rising from 11% in January to 18% in December.

- During the same timeframe, transactions using other cryptocurrencies fell from 89% to 82%.

USDT

Created by a company called Tether Limited, USDT was launched in 2014 as a way to hedge against crypto market volatility. The concept behind USDT stablecoins was quite straightforward: create a digital asset that is more likely to retain value by pegging it to the US dollar.

Although it was not the first stablecoin ever launched, USDT quickly gained popularity. In 2015, it was adopted by Bitfinex, a major digital asset platform, which further fueled its growth. Since then, USDT has been the largest stablecoin by market capitalization.

However, USDT’s path has been riddled with controversy. The transparency of its reserves is a very grey area. Tether claims to fully back every USDT with US dollars held in reserve, allowing users to redeem tokens on a one to one basis. Now, that has been questioned.

Tether’s close association with Bitfinex — they share several executives — raises further concerns. In 2019, both companies were involved in a legal battle with the New York Attorney General’s office. Tether allegedly used funds that were supposed to be backing USDT to cover a $850 million loss suffered by Bitfinex.

The case ended in a settlement with Tether agreeing to publicly disclose their reserve composition. Still, some argue their reports haven’t been entirely transparent.

How USDT Works

The way USDT tokens are issued is quite straightforward. A KYC-verified user deposits fiat currency into Tether’s bank account. In response, Tether issues USDT tokens and sends them to the provided wallet address. Users can deposit USD to buy USDT on major exchanges like Binance, Coinbase, and Kraken and then trade it for other crypto assets or hold it as a stable value asset. The amount of tokens issued is equal to the deposited amount, which helps to maintain the 1:1 peg.

Tether claims to back each USDT with an equivalent amount of assets held in reserve. According to the latest report by BDO Italia, 84.58% of Tether’s reserves are held in cash, cash equivalents, and short-term deposits. Additionally, the company holds 0.05% of its assets in corporate bonds, 3.62% in precious metals, 2.91% in bitcoin, 4.95% in secured loans to unaffiliated entities, and 3.89% in other investments.

USDC

Issued by Center, a consortium founded by Circle and the Coinbase, USDT aimed to capitalise on Tether’s lack of transparency. Following its launch in 2018, it quickly became the most successful challenger of USDT among the new wave of stablecoins.

Strategic partnerships with major cryptocurrency exchanges and platforms have been a key driver. For instance, in 2020, Coinbase prioritised USDC trading pairs, giving it a significant boost in visibility and adoption.

How USDC Works

Just like USDT, USDC strives to maintain a 1:1 peg to the US dollar. When a user deposits USD into their Circle Account, Circle issues the equivalent amount of USDC. This process creates new USDC tokens in circulation.

The token is fully backed by low-risk assets. According to the latest report published in January 2024, the value of USDC reserves is greater than the amount of USDC tokens in circulation. The majority of backing assets are held in treasuries, repurchase agreements, and cash at Circle Reserve Fund.

Building on its claim of transparency, Circle has been disclosing their reserve holdings on a weekly basis. They have also partnered with Deloitte that now runs monthly third-party assessments of USDC’s backing assets.

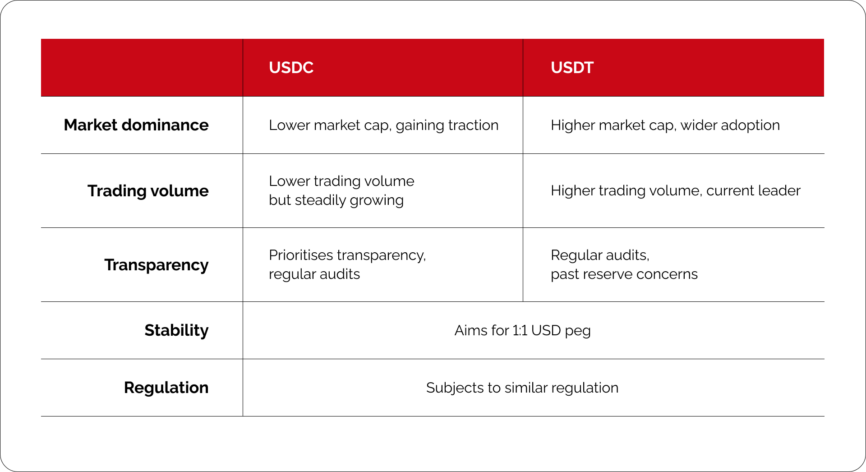

USDC vs. USDT: Key Features and Differences

STABILITY AND TRUST

The stability of both tokens is based on the claim that they are backed by USD reserves. And while Tether has a history of being tight-lipped about its backing assets, Circle has been consistently transparent. As of December 2023, both stablecoins were fully backed.

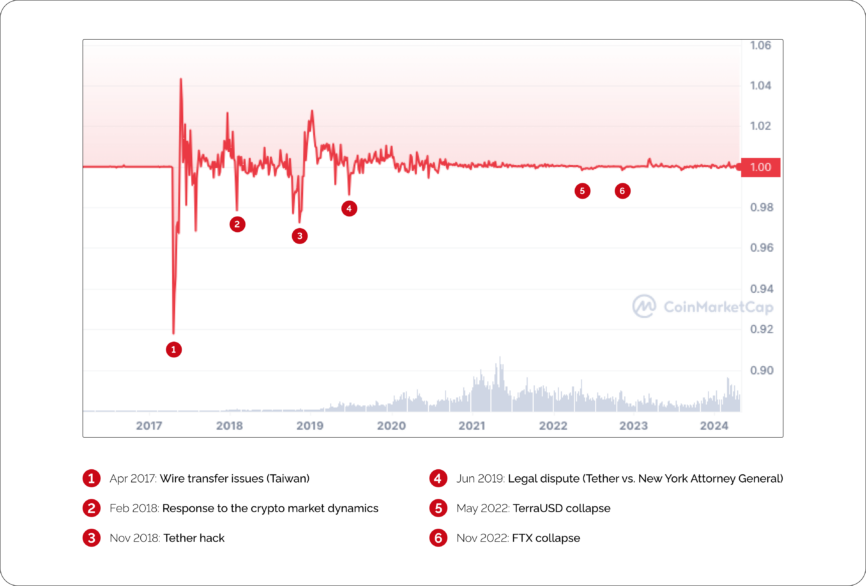

Another factor of stability is the response to incidents and de-pegging. Crypto users saw the price of both coins drop below the $1 target.

For USDT, it happened as an aftermath of a hacking attack back in 2017. After $30,950,000 USDT had been taken from Tether’s treasury wallet and sent to an unauthorised Bitcoin address, the assets were lost and speculative talk swirled regarding Tether’s connection to Bitfinex. The whispers turned into full-blown rumours about Tether not having sufficient reserves in October 2018. That’s when USDT reached the price of $0.92. Luckily, the coin stabilised quickly. However, the incident cast another shadow over USDT’s reliability.

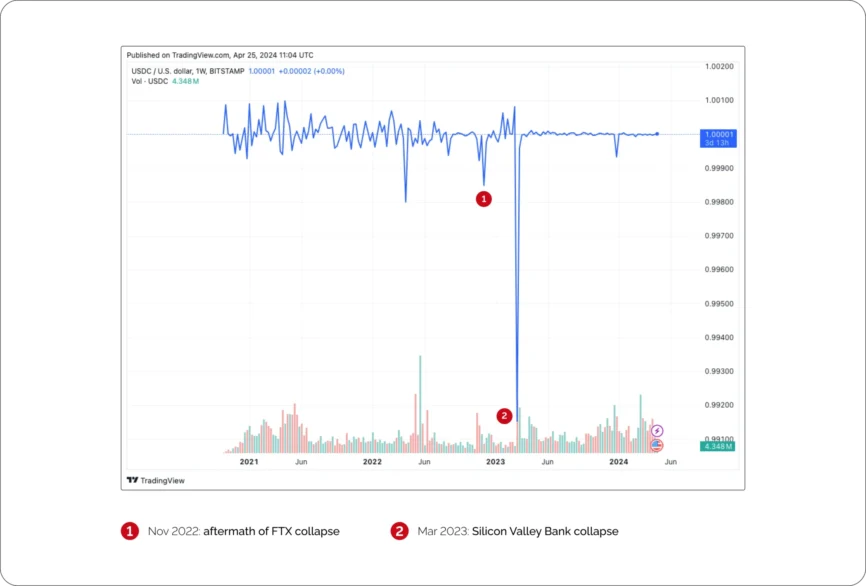

USDC suffered significant de-pegging in 2023 when Silicon Valley Bank, where $3.3 billion of the reserves backing USDC were held, suddenly collapsed due to a bank run. Traders reacted by selling their USDC tokens, and its price dropped to around 90 cents on several crypto exchanges. USDC restored back to its $1 target in just a few days after the incident. Circle was soon able to access the $3.3 billion reserve deposit held at Silicon Valley Bank and transferred it to a new banking partner.

REGULATION AND COMPLIANCE

The regulatory landscape for stablecoins is constantly evolving, especially in the EU, which has taken a proactive approach to regulating the crypto industry.

In 2020, the EU drafted the Markets in Crypto Assets (MiCA) regulation, a comprehensive framework for cryptocurrencies. Both classified as “electronic money tokens”, USDT and USDC are subject to similar regulations under MiCA.

According to it, companies issuing electronic money tokens not supported by the Euro or any other fiat currency of an EU member state must issue stablecoins at a 1:1 ratio. When it comes to reserve funds, at least 30% of the assets received by the issuers must be held in an independent account at a credit institution. The rest of the funds may be invested in safe, low-risk assets.

Compliance assessment

- 1:1 reserve ratio: both stablecoins are currently fully backed. However, independent audits have not always been available for USDT.

- Reserve management: The USDC reserve is held ~80% in short-dated U.S. Treasuries and ~20% in cash deposits within the U.S. banking system. The USDT reserve is held ~80% in cash, cash equivalents, and short-term deposits at regulated financial institutions.

- Investment limitation: Nearly 4% of USDT’s backing assets are invested in an unspecified entity. USDC’s investments are overall low-risk.

The US, in turn, lacks a unified regulatory framework for crypto assets. Several disparate bodies regulate the use of crypto, including Securities and Exchange Commission (SEC), Commodity Futures Trading Commission (CFTC), and Financial Crimes Enforcement Network (FinCEN).

Since neither USDT nor USDC have been definitely classified as securities or commodities, FinCEN regulations stand out as the most relevant.

FinCEN, under the Department of the Treasury, is responsible for Anti-Money Laundering (AML) and Combating the Financing of Terrorism (CFT) regulations. Under FinCEN, cryptocurrency issuers are required to register with FinCEN, implement customer identification and verification procedures, and report suspicious activity.

Compliance assessment

- FinCEN registration: Both Circle and Tether are registered with FinCEN.

- KYC procedure: Both USDT and USDS have Know Your Customer processes in place.

- Reporting: Circle has been known for transparent reporting, while Tether has not been entirely transparent.

ADOPTION AND USAGE

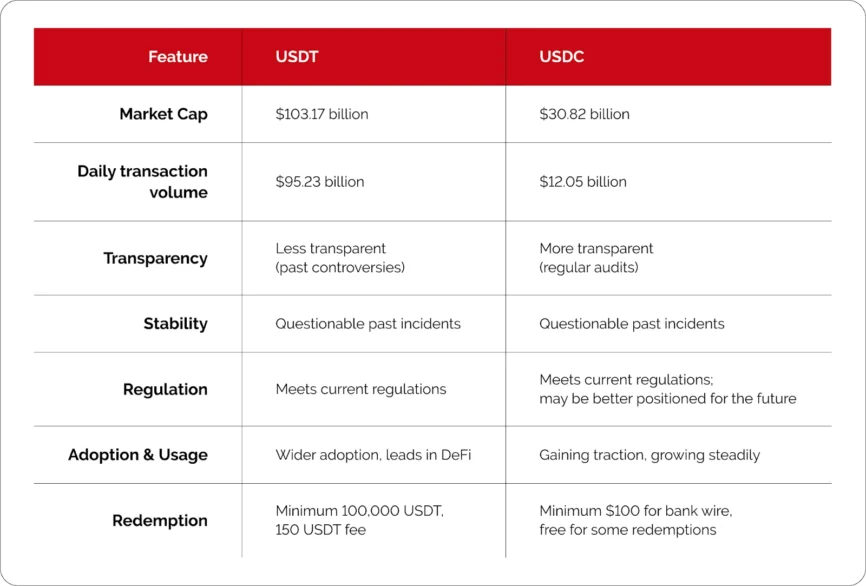

USDT is the leading stablecoin with a market capitalization of $103.17 billion as of March, 2024 and a daily trading volume of $95.23 billion. USDC’s market capitalization is valued at $30.82 billion with a daily transaction volume of around $12.05 billion.

However, USDT’s dominance isn’t built on a completely stable foundation. While it does lead the market, its capitalisation trajectory has been somewhat erratic. In contrast, USDC has experienced steadier growth, potentially reflecting users’ confidence in its transparent approach. The upward trend did hit a pause in March 2023 when the Silicon Valley Bank collapse triggered a market reaction. However, USDC’s market cap has seen steady levelling in the past four months.

When it comes to transaction activity for USDC and USDT, data from Cryptoprocessing.com reveals interesting insights:

- Among the top 15 cryptocurrencies, USDT (Tron) takes the lead with a 2nd-place ranking, followed by USDT (ERC-20) in 8th place. USDC, in turn, sits at the bottom of the list at 14th place.

- The gap narrows though when looking at transaction volume. Here, USDT (Tron) keeps the top spot, with USDT (ERC-20) close behind in 2nd place. USDC performs well, securing a solid 6th place.

This suggests that USDT might be the choice for more frequent transactions due to lower fees on the Tron network. However, USDC holds its ground when it comes to the total value being transferred, although the volume of its transactions is still significantly smaller than that of USDT (Tron) and USDT (ERC-20) combined.

Beyond that, Decentralised Finance (DeFi) is another battleground for USDC and USDT. DeFi applications often rely on stablecoins for lending, borrowing, and other financial activities. Currently, USDT holds a stronger position in DeFi due to its wider adoption and established liquidity. However, as DeFi matures and regulatory considerations become paramount, USDC’s potential regulatory advantages could stimulate its use within the DeFi space.

TECHNICAL ASPECTS

While both USDT and USDC share the same goal, their technical implementations differ.

USDT is a multi-chain stablecoin, meaning it exists on multiple blockchains. Currently, USDT is most commonly found on Ethereum (ERC-20 standard), Tron (TRC-20 standard), Solana (SPL standard), and Algorand. The multi-chain approach offers flexibility for users. It does come with a share of complexities. For instance, transaction fees and speed may vary depending on the chosen blockchain.

USDC has primarily operated on the Ethereum blockchain using the ERC-20 standard. While this limits immediate interoperability with other blockchains, USDC benefits from Ethereum’s established network effects and security. However, Ethereum’s congestion can lead to higher transaction fees and slower settlement times. To battle those issues, USDC has also expanded to other platforms like Algorand, Solana, and Stellar. Additionally, Layer 2 scaling solutions on Ethereum like Polygon are emerging to improve transaction speed and reduce fees for USDC.

Redemption considerations

Both USDT and USDC allow users to redeem their tokens for USD. However, under varying terms:

- USDT: Redemption requires a minimum of 100,000 USDT and incurs a 150 USDT verification fee.

- USDC: Redemptions to USD via bank wire come with a minimum of $100. Standard redemptions are free for Circle Mint customers redeeming up to $15M USD a day. Redemption amounts above $15 million incur a 0.1% fee.

Choosing Between USDT and USDC

USDT and USDС are the dominant stablecoins with a common idea behind. But their approaches do differ.

USDT has wider adoption and deeper liquidity across crypto exchanges. It’s also present on multiple blockchains, which makes it more flexible. However, Tether has had a fair share of controversy surrounding its backing assets. This is the main reason users look for alternatives.

USDC has prioritised transparency since its launch. It regularly undergoes independent audits to verify its reserves.

When it comes to choosing one over the other, there is no definite answer. For someone who is a frequent trader, USDT might be a better choice due to its wider market presence and deeper liquidity. Someone who prioritises transparency and meeting regulations, USDC might be a better fit, especially for long-term holdings.

When it comes to risks, USDT’s past transparency issues may be a concern, while USDC’s transparency may provide greater assurance. Still, the latter is not immune to incidents and market fluctuations.

Overall, the battle between USDT and USDC highlights the potential of stablecoins to reshape finance. As regulations mature, stablecoins are likely to play a central role in bridging the gap between traditional financial systems and decentralised finance with the basis in crypto. In the long run, the specific winner in the USDC vs. USDT battle might be less important than the overall role of stablecoins in transforming financial systems.

Regardless of the stablecoin you choose, ensuring a smooth and secure flow of crypto funds is essential. Sign up for our demo to navigate the world of stablecoins with ease.