BTC→USDT: Are Stablecoins Overtaking The Crypto Market?

Prelude

Throughout my childhood, I observed my father’s penchant for gambling, particularly during our visits to Epsom Downs and Kempton Park. Despite not wagering my own finances, the anticipation of these events would invariably stir a mix of nervousness and apprehension within me. The prospect of victory, albeit slim, was always overshadowed by the potential for loss — a sentiment that has profoundly influenced my financial demeanour towards savings over speculation.

Consequently, when Bitcoin emerged in the early 2010s, my initial reaction was one of scepticism. My reservations were further compounded by the cryptocurrency market’s inherent volatility, reminiscent of the gambling uncertainties I sought to avoid.

My perspective shifted in 2019 following the necessity to open a Binance account to receive payment in USDT. This experience unveiled the efficiency and expediency of stablecoins for financial transactions, especially appealing for someone who frequently travels internationally, seeking reliable and swift monetary exchanges without the exorbitant fees characteristic of traditional banking systems. Embracing stablecoins for their inherent stability and blockchain advantages, sans the volatility, has since become a principal of my financial transactions.

This preference echoes a broader trend among individuals leveraging stablecoins for diverse purposes within the DeFi ecosystem, ranging from lending and borrowing to the secure storage of assets in cold wallets, or as a viable alternative to Bitcoin for its predictability and efficiency.

This article aims to explore the ascendancy of stablecoins within the cryptocurrency market, specifically their gradual encroachment on Bitcoin’s dominance in payment transactions. We will delve into the essence of stablecoins, their trajectory towards overtaking Bitcoin, and the underlying reasons for this shift.

How Do Stablecoins Differ From Legacy Cryptocurrencies Such As Bitcoin?

Stablecoins and legacy cryptocurrencies like Bitcoin differ fundamentally in their approach to value stability.

While Bitcoin’s value is driven by supply and demand, making it highly volatile, stablecoins aim to maintain a stable value. They achieve this by pegging their value to more stable assets such as fiat currencies, commodities, or other cryptocurrencies. This pegging can be direct, through reserves of the asset, or algorithmic, using financial mechanisms to maintain price stability.

There are three main kinds of stablecoin:

- Fiat-collateralized.

- Crypto-collateralized.

- Algorithmic.

Let’s dive a little deeper to understand not only how they differ from legacy currencies such as Bitcoin, but from each other.

Fiat-collateralized stablecoins maintain a reserve of a specific fiat currency as collateral to back each coin in circulation, ensuring stability. An example of a fiat-collateralized stablecoin is Tether (USDT), which claims* to maintain a reserve of U.S. dollars as collateral to back each USDT in circulation, aiming to ensure its stability and maintain a 1:1 value ratio with the USD.

*Indeed, Tether has come under scrutiny regarding the transparency surrounding reserve holdings. USDC, a stablecoin also pegged to the dollar, is arguably even more ‘stable’ than USDT because of its transparent and regulated approach to maintaining reserves (*).

Crypto-collateralized stablecoins are backed by other cryptocurrencies, often requiring over-collateralization to absorb price fluctuations of the backing asset. For example, Dai, issued by the MakerDAO system, is backed by a mix of other cryptocurrencies deposited into smart contracts as collateral (*). While over-collateralisation offers the buffer needed for stability, there is no doubt that it is a less efficient col-lateralisation method than that used by fiat-collateralized stablecoins.

Algorithmic stablecoins do not have collateral but use algorithms to control the supply of the stablecoin, aiming to maintain its price stability. For example, if the price of the stablecoin rises above the USD peg, the algorithm issues more stablecoins to increase the supply, which should help lower the price back to the peg. Conversely, if the price falls below the peg, the algorithm reduces the supply, either by encouraging users to burn their stablecoins in exchange for other incentives or automatically removing coins from circulation, aiming to increase the price back to the peg.

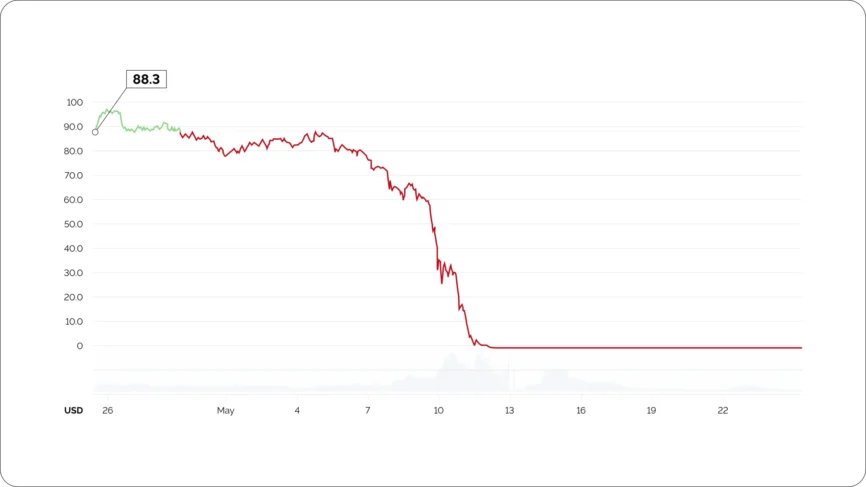

UST’s collapse in 2022 (an algorithmic stablecoin) showcased the risk to such endeavours: if confidence wanes or market conditions change rapidly, the algorithm may fail to maintain the peg, leading to rapid devaluation (*). This can trigger a “death spiral” where attempts to stabilise the coin further erode trust and value, demonstrating the potential fragility and systemic risk algorithmic stablecoins can pose to the wider crypto ecosystem.

However, algorithmic stablecoins eliminate the need for traditional collateral, enabling a more decentralised and scalable approach to maintaining stability. Indeed, centralised stablecoins create a barrier to ‘true web3’. Moreover, they’ve evolved post-UST by incorporating more robust mechanisms, such as improved governance, better capital efficiency, and enhanced algorithms that react more effectively to market dynamics.

Now that we know a bit more about Stablecoins, let’s answer the question posed by this section –how do they differ from big crypto? It’s simple – they offer the advantages of legacy cryptocurrencies, such as speed, security, and borderless transactions, without the price volatility*. This makes them suitable for daily transactions, and remittances, and as a stable store of value in the digital economy.

*This is why, as a professional in the industry with zero interest in speculative investing, I only transact in stablecoins, with the odd exception of an instant fiat conversion.

You might be also wondering on a tangent what the ‘best’ kind of stablecoin is, as we’ve explored a number of different types. This is subjective, but I’d hazard a guess that a system combining the decentralised benefits of algorithmic stablecoins with the inherent stability of fiat-backed currencies will end up reigning king – unless we go down the CBDC route, but that’s a topic for another time. I recently learned about FRAX, which introduces a novel “fractional-algorithmic” stabilisation mechanism (*). FRAX operates as a hybrid, backed by a basket of stablecoins and other assets, utilising both collateral and algorithmic methods to maintain its peg. This approach allows for greater flexibility and scalability in response to market dynamics.

I digress, now that we understand how different kinds of stablecoins work, and ultimately how they differ from legacy currencies such as Bitcoin, let’s move on to understand how they are overtaking the crypto market through some data analytics.

What Does The Data Show?

To logically determine which cryptocurrencies are being transacted by both individuals and companies, one would typically consult a cryptocurrency payment gateway. Fortunately, data from CryptoProcessing.com is readily accessible to me.

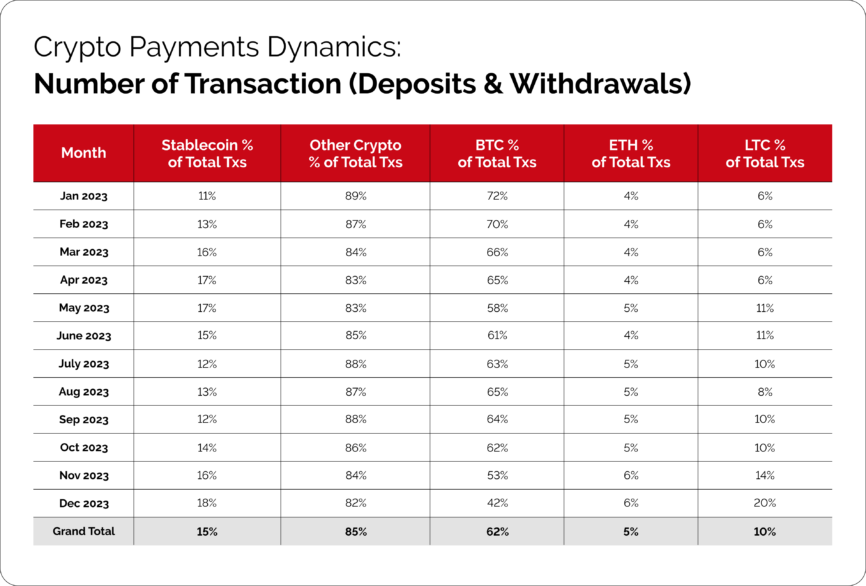

I received four sets of data relating to transactions conducted throughout 2023. The first set shows the changing percentage share of different cryptocurrencies as a part of the total transaction number over the course of a year (from January 2023 to December 2023).

There are two conclusions we can draw from the data above:

- Firstly, we see an increase in stablecoin transactions from 11% in January to 18% in December, demonstrating a growing trend in the use of stablecoins for transactions throughout the year.

- Next, bitcoin starts at 72% in January and decreases each month, with some fluctuation, to 42% in December. This significant drop over the year indicates a decrease in the use of Bitcoin for transactions relative to the total.

Overall, the data indicates that while stablecoin transactions have increased, Bitcoin’s share of total transactions has decreased throughout the year.

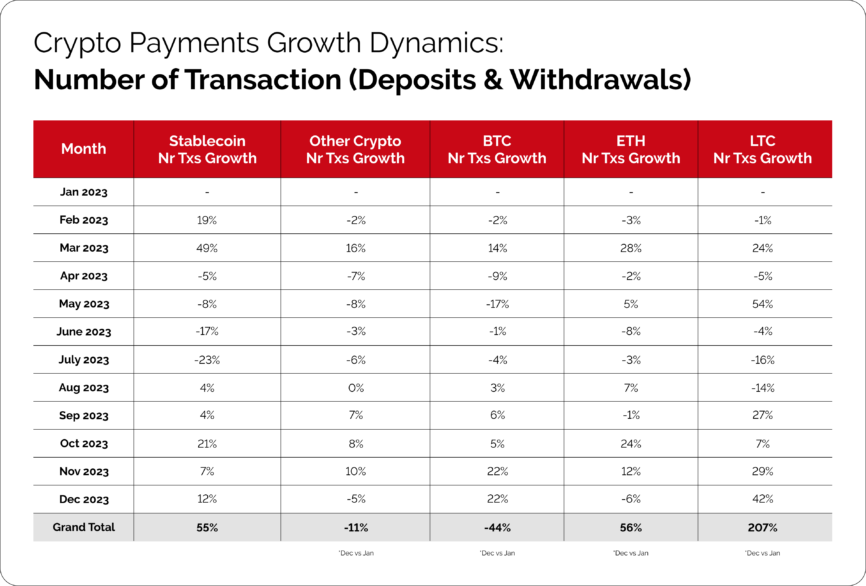

The second set of data relates to the growth in the number of transactions, concerning the same period and currencies.

- As shown above, while there is considerable fluctuation in the monthly growth rates, with significant growth in March (49%) and a notable decline in July (-23%), overall, the grand total indicates a 55% increase in the number of stablecoin transactions over the year.

- Meanwhile, the number of Bitcoin transactions shows a general declining trend throughout the year, with the most substantial decreases in November and December (-22% each). The total annual growth is a decrease of 44%.

So, what can be said? Stablecoin transaction numbers have seen a healthy overall increase throughout the year while Bitcoin transaction growth has significantly reduced.

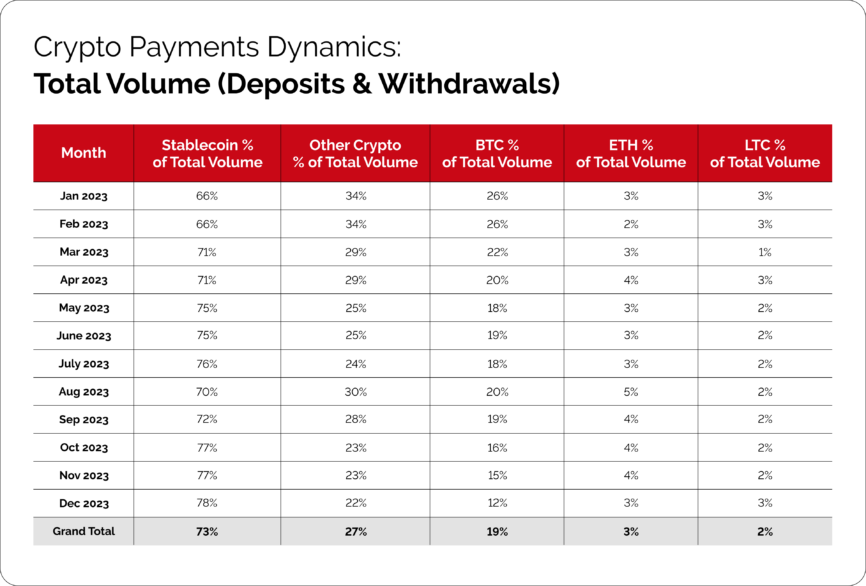

Our third dataset supports our growing conclusion:

- Stablecoins make up a significant and increasing portion of the total transaction volume, starting at 66% in January 2023 and growing to 78% by December 2023. The grand total indicates that on average, stablecoins constituted 73% of the total volume over the year.

- Conversely, Bitcoin’s share of the total volume starts at 26% and decreases throughout the year to 12% by December.

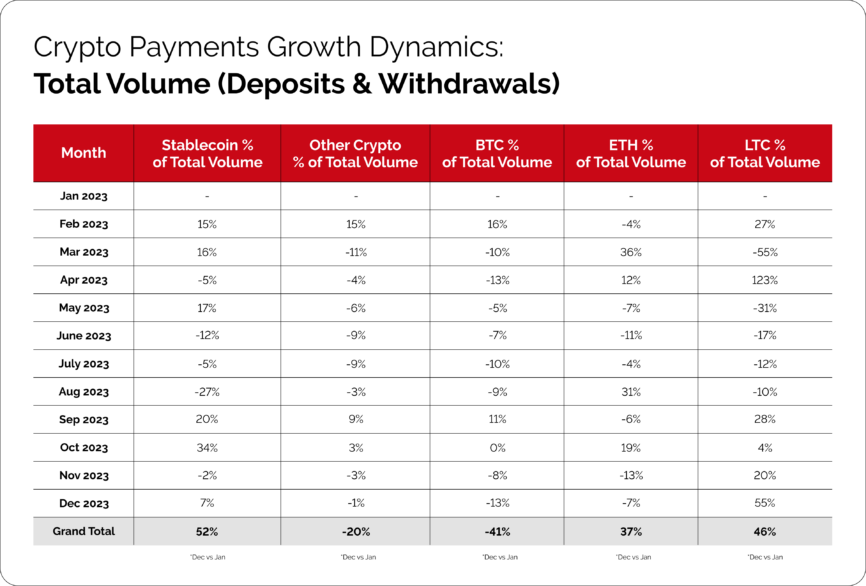

Our last dataset shows the month-over-month growth percentages for transaction volumes of stablecoins, other cryptocurrencies, Bitcoin (BTC), Ethereum (ETH), and Litecoin (LTC) throughout the year 2023. Once again, we are able to observe a favourable trend towards the use of stablecoins over Bitcoin.

To summarise, we find ourselves in a period where stablecoins are, indeed, overtaking the crypto market. But, why is this?

Why The Shift?

The widening gyre of interest in stablecoins over traditional cryptocurrencies and other digital assets, in my opinion, can be attributed to several factors (*).

Blockchain Utility

Crypto is no longer a tool for denizens of the dark web. As more ordinary people onboard crypto, who (much like myself) have no interest in speculative investing, the benefits of the blockchain are all but apparent. Indeed, stablecoins are the go-to medium. Indeed, by being pegged to stable assets such as the US dollar, gold, or even baskets of currencies, stablecoins offer a haven for investors and users seeking predictable value. This stability is particularly attractive to ordinary users and businesses looking for reliable digital payment methods without the price fluctuations inherent to assets like Bitcoin.

Think about cross-border transactions and remittances in 2024. A digital dollar stablecoin, enables users to convert dollars into the same digital equivalent that can be sent almost across the globe in minutes, not days, with minimal fees. This process contrasts sharply with traditional bank transfers that can be costly and slow due to intermediaries and cross-border complications.

Regulatory Clarity

As regulatory bodies around the world begin to better understand and subsequently legislate the cryptocurrency space, stablecoins have emerged as a category with relatively clearer regulatory frameworks.

For example, MiCA (the 2023 European Union’s Markets in Crypto-Assets regulatory framework) specifically addresses stablecoins, categorising them as “asset-referenced tokens” and “e-money tokens” to ensure they adhere to strict operational, governance, and transparency standards (*).

This clarity arises from their attachment to identifiable assets and adherence to existing financial regulations, making them a more secure choice for entities concerned about compliance.

DEFI Vitality

Within the DeFi ecosystem, stablecoins are indispensable. For example, Aave, a decentralised finance (DeFi) platform, enhances the role of stablecoins like DAI, USDC, and USDT, allowing users to lend, borrow, and earn interest in a decentralised and trustless environment. By depositing stablecoins into Aave’s liquidity pool, users receive aTokens that accrue interest over time, signifying their stake and earnings. Borrowers, offering other cryptocurrencies as collateral, prefer borrowing stablecoins to mitigate the inherent volatility of digital currencies, thus maintaining liquidity without asset liquidation. Aave offers both stable and variable interest rates, with stable rates providing financial predictability, thereby making stablecoins an attractive choice for managing risks. Governed by smart contracts, Aave eliminates the need for intermediaries, reducing costs and enhancing transaction efficiency. This system underscores stablecoins’ critical role in providing stability and liquidity essential for the DeFi ecosystem’s functioning and growth, showcasing their significance as a bridge between traditional finance and decentralised applications.

Final Thoughts

Stablecoins are great – they provide access to a lightning-efficient decentralised financial system called the blockchain without the volatility, perfectly tailored not just to my digital nomadism but to a more meta, even Platonic ideal of banking.

What’s even better is that, in analysing current trends such as those shown in the data provided by CryptoProcessing.com, it’s clear that we’re slowly getting the idea. Stablecoins are not only securing a significant portion of the transaction market, but they are also gradually encroaching on the market share traditionally dominated by Bitcoin.

Stablecoins offer seamless integration, facilitating cross-border payments with efficiency and reduced costs compared to conventional banking systems. Regulatory bodies worldwide are beginning to sculpt clearer frameworks for digital assets, with stablecoins often at the forefront of this legislative clarity.

Platforms like Aave illustrate how stablecoins enable lending, borrowing, and interest accrual without the volatility that characterises other cryptocurrencies. This stability, combined with the decentralised, trustless nature of DeFi protocols, fosters a fertile ground for financial innovation and accessibility.

As we move closer into web3, the prominence of stablecoins is likely to grow, fueled by their ability to meet the needs of a diverse range of users and use cases. In other words, growing Stablecoin prominence could be an exponential trend. So, stay tuned.