Digital Sovereignty

The Rise Of Digital Sovereignty: The Role Of The CBDC

Digital sovereignty is challenged by legacy systems with their centralization bottlenecks, high transaction costs, slow settlement times, and outdated accessibility. These systems, relics of the past, must evolve or face obsolescence.

Enter the concept of digital sovereignty – a principle that is rapidly becoming a cornerstone of modern economic strategy. At the heart of this transformation is the Central Bank Digital Currency (CBDC), a revolutionary approach that promises to redefine the very architecture of financial transactions.

The benefits of digital sovereignty extend far beyond the pragmatic reduction of transaction times and costs. It represents a reclamation of financial agency, providing states the capability to navigate and influence the digital world according to their own rules and values. For individuals, it’s about control and privacy, ensuring that personal data remains protected under the aegis of local regulations. For economies, it is the promise of innovation, competitiveness, and resilience in an interconnected world that waits for no one.

What’s Digital Sovereignty?

“…Digital sovereignty refers to the ability and right of a state to control and manage their own digital data, infrastructure, and services, without undue influence from foreign entities.

This concept encompasses a wide range of issues including consumer data protection, cybersecurity, technological independence, and governance of the digital economy.

The goal of digital sovereignty is to ensure that digital policies and practices align with a nation’s laws, values, and interests, promoting autonomy, security, and economic competitiveness in the global digital landscape…”

Five Key Categories of Digital Sovereignty

- Consumer data and privacy

The European Union’s General Data Protection Regulation (GDPR) serves as a prime example of this effort. Implemented in 2018, GDPR has set a global standard for data protection, granting individuals significant control over their personal information, limiting data sharing and imposing strict guidelines on how organisations can process that data. The regulation affects not only European entities but also any organisation worldwide that deals with the data of EU citizens, showcasing the EU’s commitment to digital sovereignty in the realm of data protection.

- Technology

This is crucial for reducing reliance on foreign technology providers, especially for critical digital infrastructure and services. This component of digital sovereignty aims to minimise vulnerabilities to foreign surveillance, influence, or disruption. An illustrative example of this pursuit is China’s push for self-reliance in technology. The country has made significant investments in developing its semiconductor industry, aiming to reduce its dependence on foreign chip manufacturers. Through initiatives like “Made in China 2025,” China seeks to achieve technological independence in key areas, thereby enhancing its digital sovereignty.

- Cybersecurity

Such measures are essential for defending against digital threats, attacks, and espionage. Strengthening these defences helps protect national security, critical infrastructure, and sensitive consumer data. The United States’ establishment of the Cybersecurity and Infrastructure Security Agency (CISA) exemplifies a national effort to bolster cybersecurity defences. CISA’s mission is to understand, manage, and reduce risk to the cyber and physical infrastructure Americans rely on, reflecting the country’s commitment to maintaining digital sovereignty through enhanced security measures.

- Regulations

is necessary for governing the digital ecosystem in a manner that reflects national values and interests. This includes regulations covering internet governance, digital services, and emerging technologies such as artificial intelligence (AI). The European Union again provides a notable example with its Digital Services Act and Digital Markets Act proposals. These legislative efforts aim to create a safer digital space that respects users’ fundamental rights while ensuring fair competition among businesses. By setting clear rules for the digital economy, the EU endeavours to safeguard its digital sovereignty while promoting innovation and consumer protection.

- Industry

Finally, promoting the development of local digital industries and technologies is key to ensuring economic competitiveness in the global market. South Korea’s focus on becoming a leading player in the information and communication technology (ICT) sector demonstrates this aspect of digital sovereignty. Through substantial investments in research and development, as well as fostering a robust startup ecosystem, South Korea has established itself as a global technology powerhouse, known for its advancements in electronics, telecommunications, and digital services. This strategic emphasis on the digital economy not only enhances South Korea’s economic competitiveness but also contributes to its digital sovereignty.

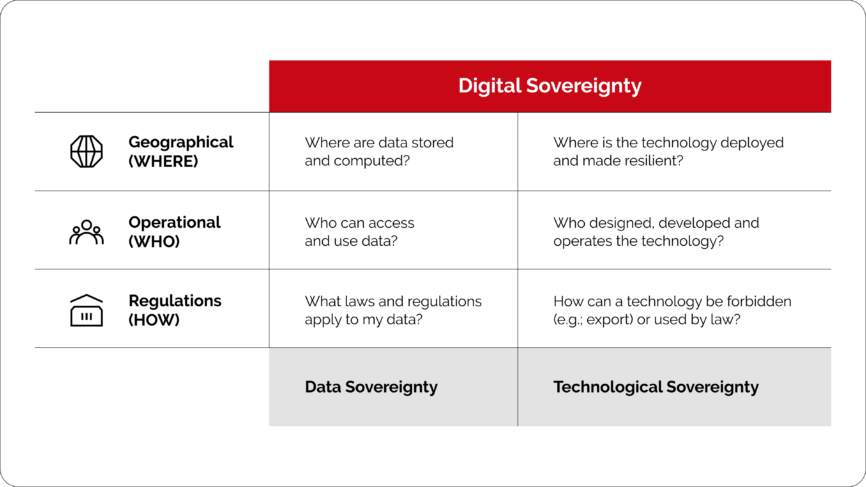

How Digital Sovereignty Shapes Data Governance and Technology

An alternate way of thinking about digital sovereignty is by splitting it into Digital Sovereignty and Data Sovereignty.

The former deals with managing the storage, processing, and governance of data, focusing on the physical location of consumer data, who can access and use the data, and the laws and regulations applying to the data.

The latter, data sovereignty, involves control over the technology’s development, deployment, and legal aspects, covering the resilience of the technology’s infrastructure, the creators and operators of the technology, and how the technology is legally handled, including restrictions and permissible uses.

The concept emphasises that maintaining autonomy in the digital sphere requires a comprehensive approach to both the data and the technology used.

Now that we’ve explored the concept of digital sovereignty, let’s move on to the impacting object of today’s argument.

What is Central Bank Digital Currencies (CBDC)

Before we can address the impact of Central Bank Digital Currencies (CBDCs) on the transition to digital sovereignty, it is important to understand how they work.

…”Central Bank Digital Currencies (CBDCs) are a form of digital money that is issued and regulated by a country’s central bank. They represent a digital form of a nation’s official currency, meaning that just like traditional money, one unit of a CBDC is equivalent to one unit of the physical currency. However, unlike decentralised cryptocurrencies, which operate without a central authority, CBDCs are centralised and are an official legal tender backed by the government…

The concept of CBDCs has been around for a while, but serious discussions and development picked up significantly in the 2010s, with multiple central banks around the world exploring the concept. China has been piloting its Digital Currency Electronic Payment (DCEP), also known as the digital yuan since 2014 and has ramped up its efforts in recent years. Other countries like Sweden with the e-krona and the Eastern Caribbean with DCash have also been actively developing and testing their own digital assets. We’ll study some more contemporary examples of CBDCs later in the article.

How do CBDCs Work?

To understand how CBDCs work, let’s use the metaphor of a public transit card system:

Imagine that the traditional currency is like cash you use to ride a bus. You have physical notes and coins that you hand over to the bus driver in exchange for a ride. A CBDC, on the other hand, is like having a digital transit card issued by the city’s transit authority. You can load money onto the card in digital form, and when you take a bus, you simply tap your card on the reader to pay for your ride. The transit authority maintains a record of all the transactions, ensuring that only valid card taps are counted as rides and preventing fraud.

In this metaphor, the bus is the economy, the transit authority is the central bank, and the transit card is the digital currency. Just as the transit card simplifies and secures transactions while allowing the transit authority to track usage and ensure the system’s integrity, a CBDC simplifies financial transactions, provides security and anti-fraud measures, and allows the central bank to maintain oversight of the monetary system.

This digital transit card can be topped up or managed online, and the balance is a direct claim on the transit authority, making it secure and reliable. Similarly, with CBDCs, the money held in digital form is a direct claim on the central bank, which is why it’s considered a safe and stable form of money.

In practice, a CBDC would work by individuals and businesses having digital wallets that could be used to make transactions with the digital currency. These transactions would be instant and would be recorded on a ledger maintained by the central bank, ensuring transparency and security. The CBDC would be designed to be easily transferable, making transactions as quick and straightforward as sending an email.

The benefits of CBDCs are multi-faceted. Of course, they promise enhanced efficiency and lower costs for financial transactions, as they enable faster and more secure payments compared to traditional banking systems. They can improve financial inclusion by providing accessible digital money to those without traditional bank accounts. CBDCs can also enhance the central bank’s ability to implement and track monetary policy in real time. However, most importantly, they accelerate the transition to complete digital sovereignty. Let’s take a closer look.

How CBDCs Are Accelerating the Transition to Complete Digital Sovereignty

Central Bank Digital Currencies (CBDCs) are accelerating the transition to digital sovereignty in a number of ways.

Arguably the most important factor to consider would be their impact on monetary economics. After all, CBDCs provide central banks with a new tool for implementing monetary policy. With real-time data on transactions and money flow, central banks can more accurately gauge the state of the economy and adjust monetary policy accordingly. Moreover, dependence on foreign currencies for international transactions is diminished. This is primarily because CBDCs can facilitate more direct and efficient cross-border transactions, bypassing traditional banking channels that often involve multiple currencies and exchange rates.

This could lead to more effective management of inflation, interest rates, and economic stability. This is a key point, which is why we should dive deeper. Things are about to get rocky.

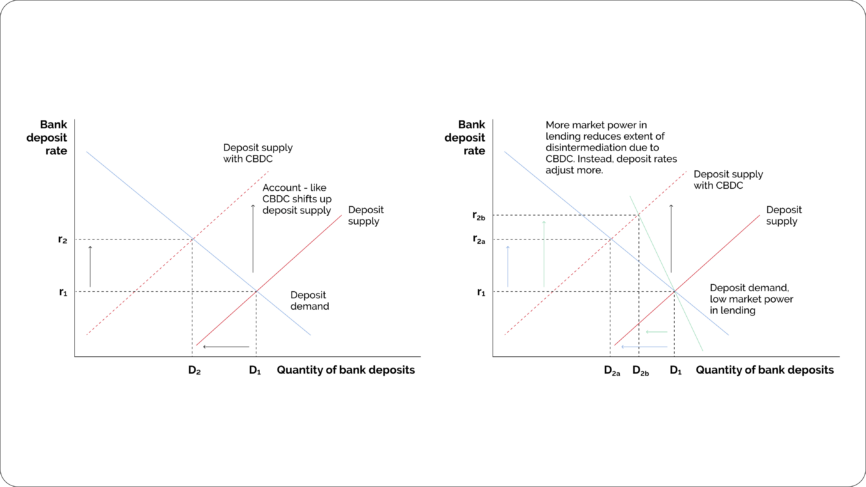

Below, there are two diagrams that, together, illustrate the effect of a CBDC introduction.

The deposit supply curve with CBDC (green line) has shifted to the left, indicating a decrease in the supply of bank deposits because some deposits have moved to the CBDC. This is shown by the new intersection point at DiCBDC, which is to the left of the original intersection point Di.

The market power in lending can affect how much the bank deposit rate adjusts. With more market power, the bank deposit rate can increase to r2b instead of decreasing to r2a in response to the reduction in the supply of deposits due to the CBDC. This illustrates that banks may increase interest rates to retain deposits that might otherwise move to CBDCs.

The gap between r2a and r2b shows the range within which the deposit rate might settle based on the banks’ response to the new competition from CBDCs for deposits.

Ultimately, this analysis can predict how the CBDC acts as a direct monetary tool for the central bank, influencing the supply of money in the economy. By controlling the features of the CBDC (such as interest rates on CBDC accounts), the central bank can influence the deposit rates offered by banks.

In other words, the central bank now holds greater control over the monetary system, accelerating the transition to true digital sovereignty.

However, this isn’t the only theory as to why the CBDCs have the power to accelerate digital sovereignty. For example, CBDCs have the potential to include more people in the financial system, especially those who are currently unbanked. They can be accessible through mobile devices, which are widespread even in regions where traditional banking infrastructure is lacking. This empowers more citizens with direct access to financial services and government support systems. This ties into the idea that CBDCs could allow governments to streamline the distribution of subsidies or other support directly to citizens, bypassing intermediaries. This direct link between the government and citizens is a core aspect of digital sovereignty.

The use of regulated digital currencies can also enhance payment security through finalised and unalterable transactions, which is essential for the integrity of a digital sovereign system. These systems also necessitate meticulous management of consumer data. In a digitally sovereign economy, it is essential to ensure that this information stays within the individual’s control or the issuing country’s boundaries.

Corroborating the enhanced security factor, CBDCs can support strong KYC protocols by using digital identities, helping banks avoid unverified actors. This promotes a cleaner, more regulated financial system, which is necessary for the transition aforementioned.

Of course, there are certainly challenges and risks associated with the adoption of CBDCs, such as the need for significant investment in new technology, technological stability concerns, and the potential resistance from those who favour the anonymity of cash, but we will maintain our focus today on the specific impact of CBDCs on digital sovereignty.

Current Endeavours in CBDC Development

As of 2024, Central Bank Digital Currencies (CBDCs) have made significant strides on the global stage, with nations actively engaging in the development and deployment of their digital currencies. The Bahamas stands at the forefront, having launched the “Sand Dollar” in October 2020, positioning itself as a pioneer in the CBDC arena. Following in these innovative footsteps, Nigeria rolled out the eNaira in October 2021, marking a significant milestone in Africa’s journey towards digital currency implementation.

The trajectory for CBDCs suggests a burgeoning trend, with the Bank for International Settlements (BIS) forecasting the potential for up to 15 retail and nine wholesale CBDCs in circulation globally by 2030. This projection underscores the growing consensus about the transformative potential of CBDCs.

Central banks across the globe are not just contemplating but actively experimenting with CBDCs, with over half engaging in practical trials to test their viability. This surge in CBDC activity demonstrates the robust interest in leveraging digital currencies to revolutionise financial systems.

Major countries are at varying stages of CBDC exploration. Their goals are multifaceted, aiming to broaden financial inclusion, enhance the efficacy of payment systems, and spur economic innovation. Each nation’s journey reflects its unique economic context, with CBDCs offering tailored solutions to address specific monetary and fiscal challenges, thereby reshaping the future of digital finance.

Final Thoughts

The road towards digital sovereignty is a long one, wrought with tribulations. Investments in technology, concerns about stability, and debates over privacy are just some of the hurdles that lie ahead. However, one thing is clear – Central Bank Digital Currencies (CBDCs) lie at the core of this transformation.

These digital assets represent not just technological advancement but a shift in the way monetary systems operate. They offer unprecedented control over money supply and monetary policy, potentially reducing reliance on foreign currencies and enhancing economic stability. Moreover, by fostering financial inclusion and streamlining governmental transactions, CBDCs can strengthen the social contract between states and their citizens.

While the European Union has set the tone with GDPR in consumer data protection, and China with its technological strides, the US has focused on cybersecurity, and the EU again on regulatory frameworks. Meanwhile, South Korea has shown the importance of nurturing local digital industries. It can be said that all these efforts are converging on the digital currency front, with countries like The Bahamas and Nigeria already operationalizing their own CBDCs.

The continued development of CBDCs around the world suggests a clear trajectory towards more robust digital economies. With major economies in various stages of research and implementation, the landscape of digital finance is poised for transformation. As we move forward, the question remains not if, but when and how, these digital currencies will reshape our understanding of sovereignty in the digital age.

The inevitability of this transformation hinges on a global consensus on the role of digital currencies in our future economies. The precise timeline may be uncertain, but our digital destiny is clear: a world where digital sovereignty, underpinned by CBDCs, shall define the new normal in global financial systems.

highly secure crypto payment gateway