Crypto as a Forex Payment Gateway: Should You Give it a Thought?

The use of cryptocurrency in the broader financial market is still in its early stages. But foreign exchange, the biggest financial market by daily volume, has taken a bolder stance. It is using cryptocurrencies as a Forex payment gateway to settle faster, run smoother and attract younger, tech-savvy investors.

As the buzz around cryptocurrencies gets louder — over 580 million people own digital assets worldwide — Forex has discovered the potential of this new asset class to improve the mundane but crucial plumbing underpinning the global exchange.

So, what role does cryptocurrency play in the global Forex market? And how eager are Forex businesses to embrace this new asset class? Let’s find out.

The current state of crypto in the Forex market

Cryptocurrency’s influence is starting to be felt, and savvy brokerages are adopting cryptocurrency for Forex payment processing to improve payments and settlements, and attract a new generation of crypto-savvy investors.

Forex is going crypto

Forex is warming up towards crypto. The why’s range. Some onboard crypto to attract new customers. Others — to retain the ones they already have. Notably, more than half of retail investors are willing to switch brokers if they lack a comprehensive digital asset offering. In that sense, onboarding crypto is a proactive move for brokers to stay afloat.

Overall, since the beginning of 2020, more than half of the Fortune 100 companies have undertaken initiatives in crypto, blockchain or web3. Here are some of the worthy mentions:

- Late 2022. Deutsche Bank (10.89% market share), JP Morgan (8.67%) and Bank of America (3.73%) implement crypto transactions.

- September 2023. Deutsche Bank invests in Taurus’ crypto custody and tokenization platform. UBS (9.69% market share) launches tokenization services.

- October 2023. Dukascopy, a Swiss online bank, introduces US dollar cash loans against cryptocurrency investments.

- January 2024. BlackRock, an American multinational investment company, launches the first-ever Spot Bitcoin ETF.

- March 2024. Assets under management in BlackRock’s iShares Bitcoin ETF reach $10 billion within seven weeks after launch, according to Nasdaq.

Forex and crypto: the mutual influence

And while crypto might seem like a competitor to the Forex market, there’s potential for cooperation and innovation. Some crypto platforms are embracing Forex perpetuals and even venturing into Forex trading. The examples include platforms like Bitmex, Pancakeswap and Uniswap.

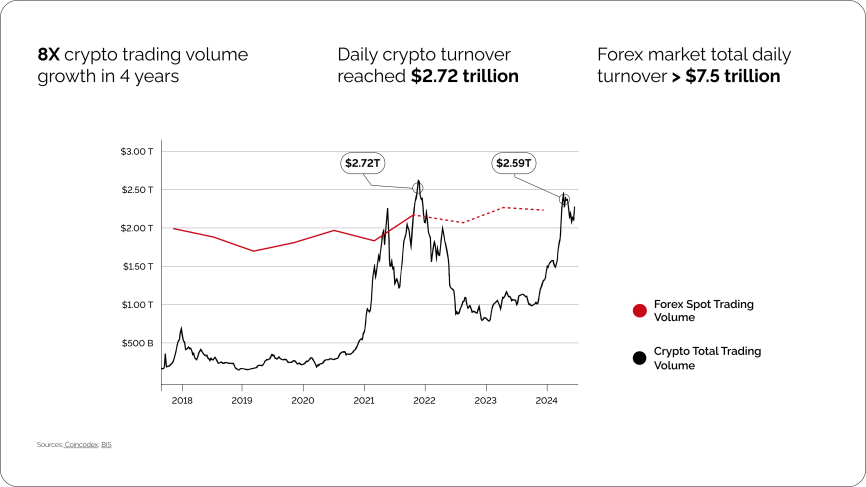

Looking ahead, the cryptocurrency market will likely continue to rise. Data suggests a 140-fold increase in cryptocurrency trading volume over the past five years. In contrast, Forex spot market trading volumes showed a more stable upward trend. Keeping in mind this disparity in growth trajectories, it’s not too bold to assume that Forex brokers may not be able to stay on the sidelines if the crypto market continues its climb.

Sources: Crypto – CoinCodex; Forex – Bank of International Settlements

Where crypto and Forex markets intersect

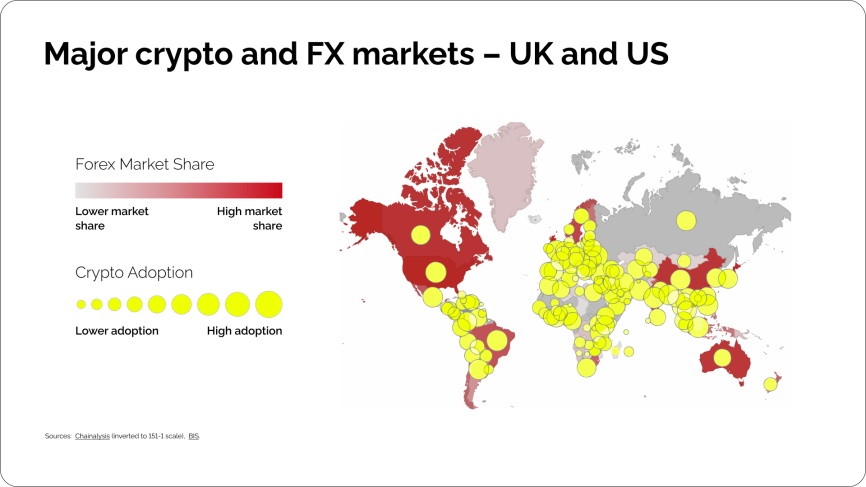

The cooperation between the two markets will likely be stronger in emerging economies, which are experiencing a simultaneous rise in both Forex participation and crypto adoption.

While developed economies like the UK and US still dominate the Forex market, making up 57% of its trading volume (they are big in crypto, too), the world of Forex is changing.

Emerging economies like Kenya, Nigeria and South Africa are seeing a jump in Forex trading as well. Interestingly, the same economies are leading the charge in cryptocurrency adoption. Take Nigeria, for example. The country has become one of the largest cryptocurrency economies in the Sub-Saharan region, and it continues to grow despite two major recessions.

This convergence of trends could be a game-changer for how the Forex and crypto markets work together. Forex brokers traditionally concentrated in established financial centres. But today, they might find fertile ground for expansion by offering crypto-related services to the growing economies.

for Forex:

Why does Forex turn to crypto?

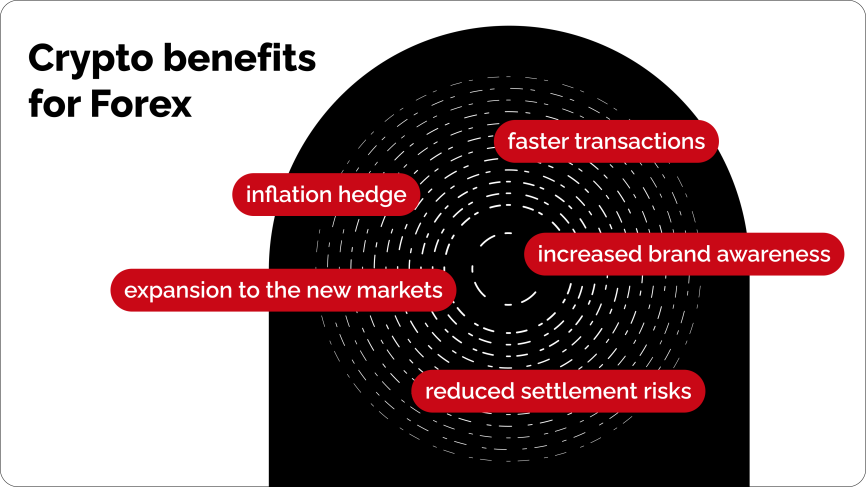

Forex is onboarding crypto payments for a few reasons. First, there are some inherent limitations of the traditional foreign exchange market that a new, decentralised asset class like crypto can solve. Second, certain global trends are shaping the way in which financial markets develop. Being the biggest and most popular one, Forex is susceptible to these trends.

Faster transaction processing

A typical spot Forex transaction is settled the second business day after a trade (T+2). You agree to buy or sell a currency and initiate a trade. But the actual exchange of currencies takes place two days later. Such delays in Forex payment processing bear the risk of slippage — receiving a less favourable rate than anticipated.

The reason is a network of intermediaries each transaction has to go through. These range from correspondent banks to custodian institutions. Time zones and operating hours extend the settlement time, too. So it’s not a rarity for a Forex transaction to take 5+ business days due to public holidays or weekends.

While the systematic effort of improving transaction speed is under way, some brokerages recognised the advantage of onboarding crypto.

Here’s what happens when cryptocurrency comes into play as a Forex payment gateway.

Conducted directly between two parties, without any intermediaries like banks, cryptocurrency transactions become near-instantaneous. For example, a USDT transaction on the Tron network takes around 1 minute to go through. The specific speed depends on the chosen network but it rarely exceeds 10 minutes. And when popular blockchains get congested, there are several to choose from.

Moreover, some crypto processing services, CryptoProcessing included, freeze the exchange rate until the transaction is completed to prevent losses.

Reduced settlement risk

When one broker delivers the currency they have sold but don’t get the currency they purchased — it’s a settlement risk. Settlement risks occur for many reasons.

- Time discrepancies: one party might deliver their currency while the other party’s bank is still closed. That creates a temporary gap where the delivering party is exposed to a risk.

- Operational errors: mistakes or technical glitches happen at any point in the Forex patent processing chain, from brokers to intermediary banks involved in the trade.

To reduce settlement risk, market participants have set up the Continuous Linked Settlement institution (CLS). Its aim is to settle Forex transactions on a payment-versus-payment basis. While it has drastically improved settlement rates for some players, around 25% of the global Forex turnover is still exposed to settlement risk. Keeping in mind that the average daily volume in the global Forex market is estimated at around $2 trillion, that’s a considerable impact on financial stability.

Crypto payments reduce settlement risk.

- On-chain cryptocurrency transactions are payment-versus-payment by design. They run on blockchain, a distributed ledger where every operation is recorded. It is also publicly verifiable, so both parties can track the status of a transaction.

- Crypto transactions do not need any intermediaries. With fewer parties involved, the chance of a settlement process being disrupted also decreases. Transaction speed plays a role, too. With crypto as a Forex payment gateway, transactions settle in minutes and have a significantly shorter window of vulnerability.

Easier expansion into new markets

Forex brokerages seeking new markets face many logistical challenges. Establishing a local financial presence is one of them.

For brokerages that only accept fiat, navigating this hurdle may take time as setting up a specialised Forex brokerage account may involve additional due diligence from the bank. Realistically, securing a local bank account may take up to two weeks, followed by an additional four to eight weeks needed to integrate a local Forex payment gateway.

Onboarding cryptocurrencies is an alternative for Forex businesses seeking faster expansion. While local payment infrastructure is underway, crypto payments can be accepted immediately. And keeping in mind the geographic overlap between Forex and crypto markets, investors in regions with strong Forex presence likely already own crypto.

Sources: Crypto Market – Chainalysis 2023 Geography of Cryptocurrency Report, the index was inverted to 151-1 scale, a higher number indicates higher crypto adoption, where 151 is the highest adoption; Forex Market – first 52 countries were ranked from 151-100 based on BIS data, other countries were attributed with the base rank of 80 and ranked based on trading taxes.

You will still have to comply with local AML and KYC procedures, of course. But partnering with a reputable crypto payment provider can alleviate some of the compliance burden, as they will likely already have established procedures in place.

Avoiding correlation with traditional financial markets

Studies have found that nearly all assets experienced increased volatility during COVID-19 and the Russian invasion of Ukraine. Except for Bitcoin. Indeed, traditional financial markets bear inherent risk that is accentuated by periods of uncertainty:

- Economic and geographical instability makes investors risk-averse in regards to managing their portfolios, which results in higher market volatility.

- Crises often trigger market shocks that send ripples to different asset classes, resulting in an even higher volatility.

- Disruptions to supply chains and changes in consumer behaviour impact the market dynamics and further contribute to price fluctuations.

While cryptocurrencies are not entirely unsusceptible to fluctuations, they have consistently attracted investors during economic turmoil. There are several reasons for that:

- Crypto assets are not directly controlled by governments — unlike traditional currencies. Some investors may see it as an advantage, especially if they fear excessive governmental intervention in the economy.

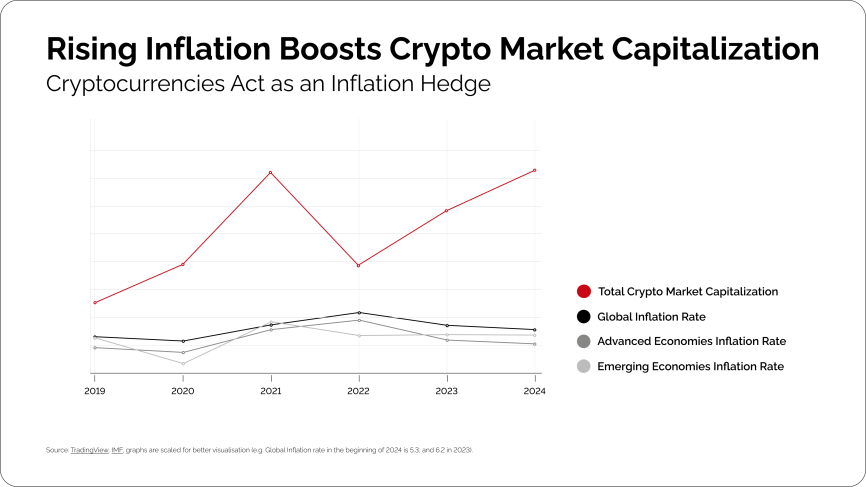

- Many cryptocurrencies have a capped supply. It means that there is a limit to the number of units a specific cryptocurrency may ever come in. This built-in mechanism prevents inflation. For this reason, cryptocurrency is often used as an inflation hedge. Indeed, on the graph below, the crypto market cap is rising alongside inflation rates.

Source: TradingView, IMF, graphs are scaled for better visualisation (e.g. Global Inflation rate in the beginning of 2024 is 5.3, and 6.2 in 2023).

Forex Businesses:

Retaining liquidity

The Forex market is larger and more liquid than the cryptocurrency market. But even though the cryptocurrency industry is smaller, it is growing fast and may compete for liquidity.

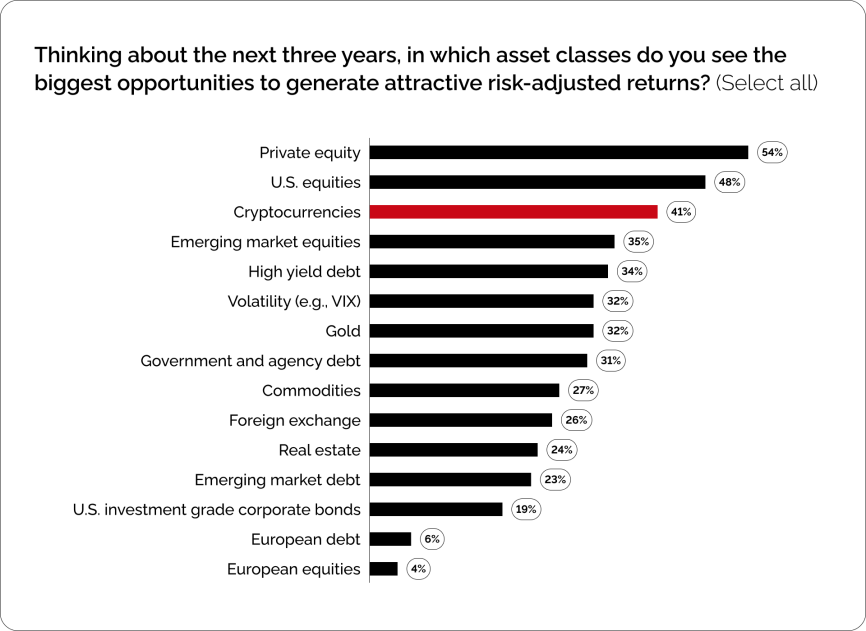

Today, cryptocurrency already ranks third as the best source of risk-adjusted returns. A high-performing asset class, it may encourage investors to diversify their portfolios and pull funds from traditional Forex markets.

So, how does Forex keep investors engaged when there’s this shiny new asset class? Embracing crypto and offering a wider toolbox for investors may be an option. Allowing cryptocurrency deposits, facilitating crypto trading pairs or even integrating custody solutions — all this may help lock in liquidity and cater to a broader customer base.

Demand for transparency

Traditionally, most Forex trades have been conducted over-the-counter. But here’s an interesting twist: CME’s listed Forex futures and options market has seen a noticeable rise in daily trading volume, jumping to an average of $85 billion from $76 billion in 2021. This could mean that investor preferences are changing toward more transparency.

Unlike OTC trades that are negotiated privately between parties, exchange-traded derivatives have a public order book that shows all buy and sell orders for a specific contract. Investors get to see the market depth and liquidity for a particular currency pair.

This shift aligns perfectly with the principles of cryptocurrencies, where every transaction is recorded on a public ledger. As the demand for transparency grows, cryptocurrencies with their inherent transparency could become a more attractive option for investors.

Clearer regulatory landscape

The murky waters of cryptocurrency regulation are beginning to clear. This is yet another reason for Forex businesses to onboard crypto payments.

A while back, the lack of a clear regulatory framework around cryptocurrencies bred hesitation among Forex brokers. Legal risks and uncertainties made crypto a gamble many weren’t willing to take.

However, recent crypto regulations are changing the game. Take MiCA, for instance. It provides clear rules for issuing, trading and storing crypto assets across the EU. It also harmonises regulations within the EU, potentially allowing a crypto-asset service provider licensed in one EU country to operate in others. This might nudge more TradFi institutions to dip their toes in crypto.

How to Accept Crypto Payments as a Forex business?

Say, you have been convinced: crypto payments are a worthy addition to your traditional payment gateways. What do you do next to start accepting crypto?

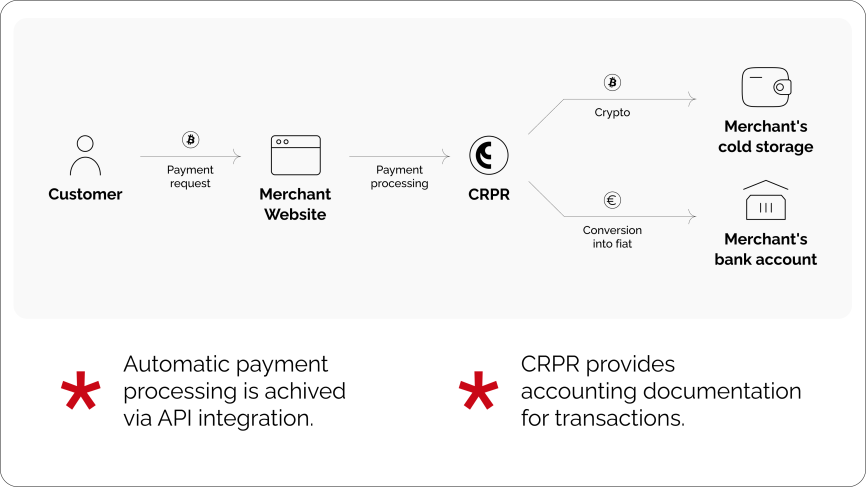

CryptoProcessing – a leading Forex payment gateway

First and foremost, you need to partner with a legal, reputable crypto payments provider. The world of cryptocurrency is ever-evolving, and you need someone who’ll help you safely navigate the difficulties of integrating a new payment option and lend a hand amidst regulatory changes.

That’s where we may introduce ourselves. With over 10 years of experience in the crypto industry, CryptoProcessing has established itself as one of the prominent leaders in crypto payments technologies.

- We are servicing hundreds of merchant accounts

- We are processing over 900K transactions a month

- We are processing over €700M worth of crypto monthly

- We are registered and licensed in Estonia

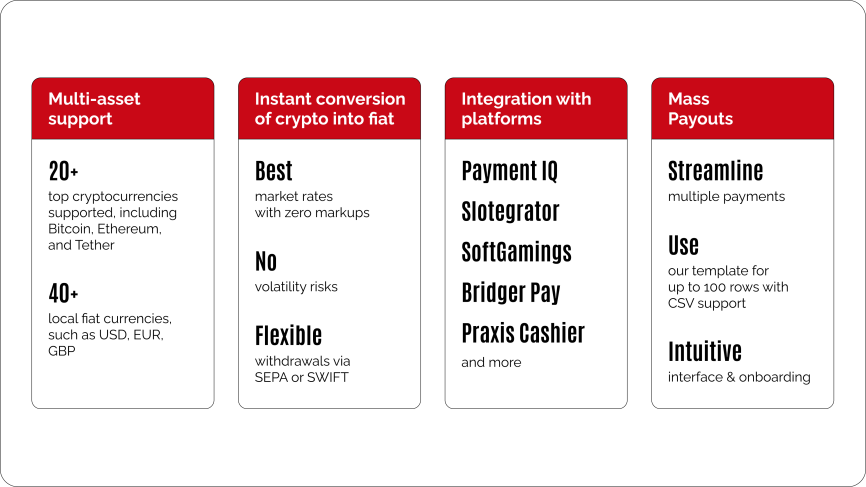

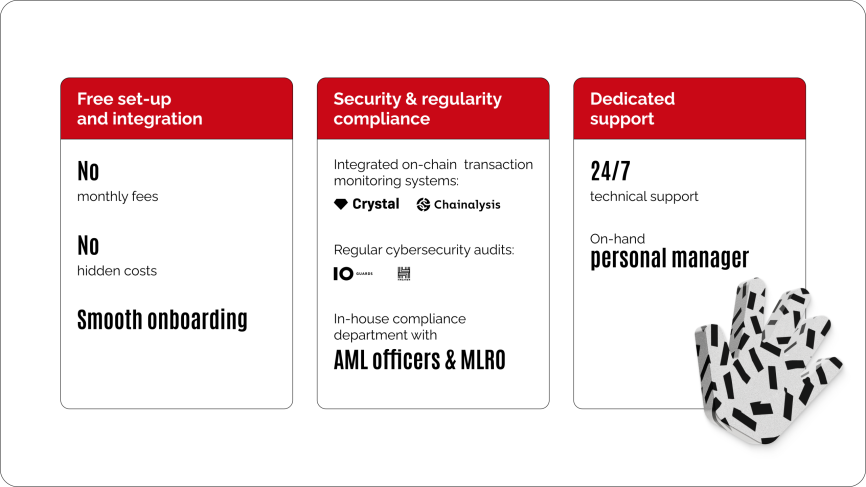

Our core product, the crypto payments processor, is just the right fit for the Forex industry. Here is what we offer:

Business Wallet by CryptoProcessing: storage and management of crypto

In addition to the crypto processing engine, we have a Business Wallet that Forex brokers can use to store crypto as a hedge. Our wallet allows accepting and storing crypto assets without API integration, being a potentially useful addition to your Forex crypto offering. It also offers the same benefits as a Forex payment gateway!

Looking ahead

Cryptocurrencies, once seen as a fringe asset class, are steadily gaining traction in the Forex market. The trend is driven by a unique market dynamic: foreign exchange and cryptocurrencies are competing for liquidity, often targeting a very similar customer base.

At the same time, old challenges of Forex are resurfacing. Higher transaction costs and inherent risks associated with slower processing times may encourage investors to seek profits elsewhere.

In response to these factors, many Forex brokerages have started to embrace cryptocurrency — both as a Forex payment gateway and as trading assets. Interestingly, some crypto services are adopting Forex perpetuals and even venturing in Forex trading.

Looking ahead, we expect even greater convergence of both markets, both developed economies, like the UK and US, and in emerging economies where Forex and crypto are on the rise. So, the bottom line is: if Forex businesses want to stay ahead of the curve, they have to start considering crypto — if not now, then in the nearest future.

business with crypto payments?