Business Crypto Wallet vs Crypto Processing

The question of how to integrate crypto payments becomes more relevant for businesses as the mass adoption of digital assets spreads.

The benefits of handling crypto:

- enabling instant, borderless, and low-fee transactions

- opening up a product or service to the global market

- unlocking an audience of tech-savvy crypto owners

There are two ways a business can get started with crypto.

- Cryptocurrency Gateway such as CryptoProcessing by CoinsPaid to accept regular digital assets payments. Note that implementing crypto processing functionality via API will take some time.

- Using a Business Crypto Wallet, which can be set up quickly and easily. This option has limited functionality compared to a processing gateway but does not require any technical integration.

The key to determining which option suits your business lies in defining your goals and understanding your market niche.

Why are businesses looking to accept crypto?

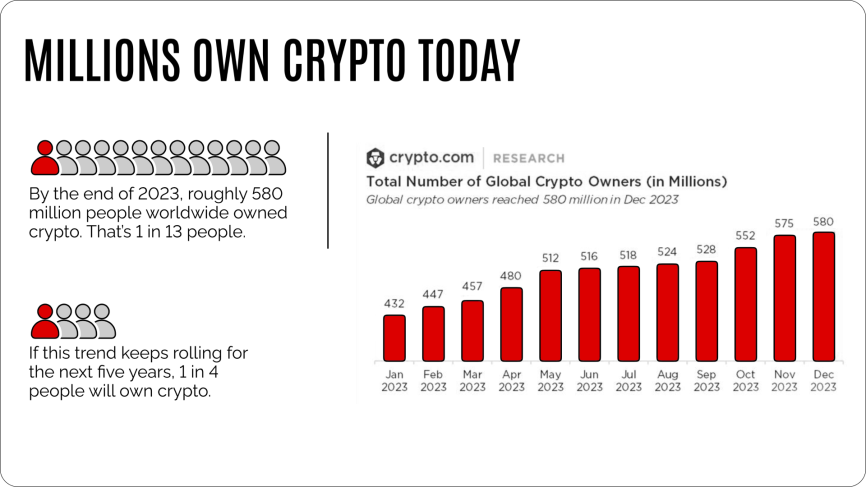

According to a Deloitte survey conducted in 2022, nearly 75% of retailers plan to accept either cryptocurrency or stablecoin payments within the next two years. Moreover, there are currently over 617 million crypto owners worldwide, and further surveys show that up to 93% of them would consider using digital currencies to make purchases.

The rise of blockchain payments is largely influenced by specific challenges of the fiat banking system:

- Cross-border transactions can often take up to 5 working days as they pass through countless layers of intermediaries. In contrast, crypto payments take minutes to settle, regardless of geographical location.

- Merchants have to keep high rolling reserves due to the potential for chargebacks. Because blockchain payments are immutable, chargebacks aren’t an option, and merchants can access more readily available capital.

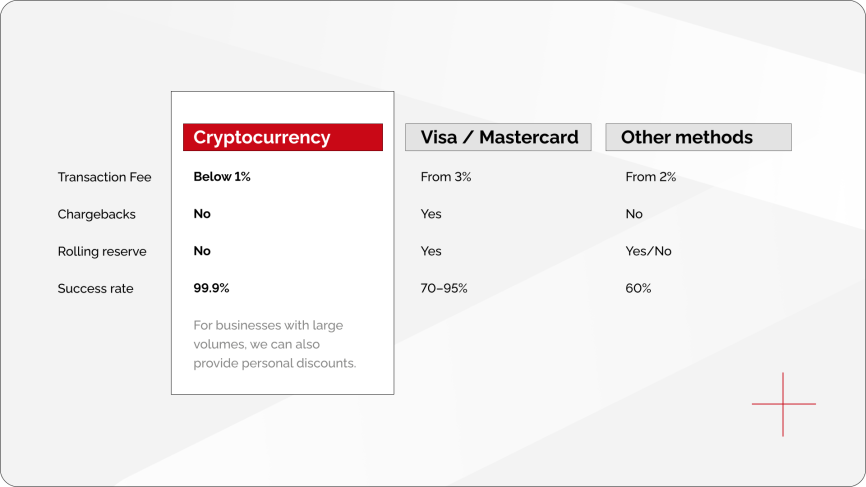

- Commissions are much lower for crypto payments. With traditional processors, merchants often face fees of up to 3.5%. With crypto payments, these fees can fall below 1.5% and, in some cases, even lower due to Loyalty and Ambassador Programs.

Accepting online payments in crypto allows even the smallest businesses to open their doors to the global market. This ability to quickly accept cross-border payments ultimately drives revenue. With an overall higher average transaction acceptance rate, it’s a powerful option for merchants to leverage for growth.

What is Crypto Processing?

Crypto Processing is a company that enables businesses to send, receive, and manage digital currencies with innovative software solutions. CryptoProcessing.com by CoinsPaid offers a full spectrum of crypto processing services that can be customized to fit any business model.

The platform offers automatic near-instant fiat conversions to businesses that don’t want to hold digital assets. In other words, you can automatically convert incoming crypto payments into bank payments without worrying about any of the coins and tokens. In addition, CryptoProcessing reduces volatility risks by freezing the exchange rate at the time of purchase, ensuring market fluctuations don’t factor into the transaction.

The service offers multiple payment methods to fit any business model:

- Channel — simple deposits in cryptocurrency tied to your customer’s account. They can top up their balance for any amount in crypto at any time, while we can help credit their account on the fly and convert it into fiat where necessary.

- Invoice — send direct payment requests for any amount due in fiat or crypto, then settle transactions. Highly flexible option, best for payments that involve a timer.

- Payment link — a version of an invoice for crypto deposits, which does not require an immediate settlement. Best for fixed payments that just require a QR code or a link.

Key Elements of Crypto Processing

Crypto Processing allows businesses to work with digital currencies and is often used on websites, applications, or point-of-sale systems. It involves:

- Integration into payment systems. Businesses with higher transaction volumes opt for more complex API integrations to add digital currencies to their payment flow.

- Generating addresses and payment links. Crypto processing requires wallets and keys to settle transactions. Think of this as a behind-the-scenes infrastructure that enables payments.

- Facilitating currency conversions. This includes both manual and automated conversions of cryptocurrencies to other cryptocurrencies, stablecoins, or fiat. We also freeze rates on purchase to protect against volatility.

- Ensuring security & compliance. Crypto processing complies with KYC and AML industry standards and best practices, as well as regional regulations like MiCa in Europe. In addition, advanced security measures help achieve the safety and reliability of transactions.

Examples of Crypto Processing in Businesses

Crypto processing can be somewhat different for various industries, depending on the exact needs of a business.

1. Retail, E-Commerce, Luxury

An online store can integrate crypto processing to accept Bitcoin, Ethereum, or other cryptocurrencies from customers. By integrating a payment gateway into its flow, it aims to attract tech-savvy or international customers who want to pay in crypto.

What this looks like: Customers can choose “Pay with Crypto” at checkout, scan a QR code, or click an e-mail link. They complete transactions within minutes, and the business gets revenue near-instantly.

Examples: Major e-commerce giants like Shopify and Newegg have worked with crypto for years. Luxury brands like Gucci and Balenciaga had success with it as well.

2. High-Risk Industries, Forex Platforms

A business in a high-risk industry, such as a Forex trading platform or an online gambling provider, may use crypto payments to manage risks. They can also take advantage of converting cryptocurrency payments into fiat at the time of the transaction, reducing volatility concerns.

What this looks like: Customers deposit funds into their trading or gambling accounts using cryptocurrency. Crypto processing calculates the real-time exchange rate and converts funds into the platform’s base currency (e.g., USD, EUR, JPY, etc.). This eliminates the need for manual conversions and provides transparency.

Examples: Vera&John was the first licensed casino to accept crypto all the way back in 2014. Giants like Forex.com also have robust cryptocurrency offerings for their traders.

3. Travel and Hospitality

A travel and hospitality business handles large transaction volumes and fees are one of its largest operational expenses. Such a business also receives a large amount of cancellations and refund requests, creating operational challenges. Crypto processing simplifies the process by reducing fees and potentially automating refunds.

What this looks like: The system generates crypto invoices at checkout, with significantly reduced fees and fast settlement times. When a customer cancels a booking, the platform calculates the equivalent refund amount in cryptocurrency at current exchange rates and sends it directly to the customer’s crypto wallet.

Examples: AirBaltic became the first airline to accept crypto payments in 2014. Travala, a crypto-friendly travel agency, has been processing around 77% of its bookings in cryptocurrencies across 2024.

How does cryptoprocessing.com work?

We strive to create a smooth onboarding experience for any business looking to accept payments in digital currencies. If you’re looking for a crypto gateway, here’s what to expect:

Step 1. We create a personalised offer based on your business model and goals.

Step 2. We ensure the legality of the process by stepping you through a KYB check for compliance.

Step 3. We integrate a crypto payment gateway into your systems via API.

Step 4. We provide constant support and regular software updates.

Business Wallet by CoinsPaid

Business Wallet helps companies send, receive, exchange, and manage crypto without the need for API integrations. Like a corporate debit card, it can be used by a range of individuals within the company for actions such as payroll, procurement, marketing, and so on.

Business Wallet by CoinsPaid is designed to help small-to-medium businesses take advantage of digital assets without technical complexities. It can be used for safe storage and transactions, though automation and functionality are limited by design.

Key Elements of a Business Wallet

A business wallet is a critical tool for securely managing digital assets, enabling businesses to send, receive, and store cryptocurrencies. It involves:

- Multi-currency support. Smaller companies tend to use business wallets to send and receive payments in Bitcoin, Ethereum, Stablecoins (USDT, USDC, etc.), and other coins and tokens.

- Secure Storage and Access Management. Business wallets prioritize security with features like multi-signature access, cold storage, and two-factor authentication. These protect funds and allow organizations to control account access.

- Transaction Management Tools. Tools like invoicing, reporting, and transaction tracking help businesses maintain clear financial records. These features also support compliance with tax and regulatory requirements, streamlining operations.

- Exchange options. Business wallets offer easy conversion of cryptocurrencies into other currencies as well as access to an OTC desk for large transactions.

Examples of Business Wallets in Practice

Industries across various sectors leverage business wallets uniquely to address their crypto payment needs.

1. Software and Technology

A tech company or consulting provider could use a business wallet to accept payments from global clients or enable cryptocurrency donations for their open-source solutions.

What this looks like: The company or even individual consultant opens a business wallet and puts a QR code to their website for donations. They also share payment links with their customers where necessary.

Examples: Open-source platforms like GitHub sponsors and software companies like Filecoin Foundation accept and send payments via crypto wallets.

2. Real Estate, Luxury Travel, Private Jet Charters

A business that is used to receiving large sums from individual purchases would be able to facilitate cryptocurrency transactions for faster settlements from international buyers.

What this looks like: Buyers send crypto payments directly to the wallet, which the firm can store or convert into fiat at their leisure. Wallets also streamline transaction tracking for large sums, ensuring compliance with legal and tax requirements.

Examples: Luxury travel companies like Taylor Travel and jet charters like SimplyJet leverage cryptocurrency to streamline their payments. Companies like Lodgis in Paris successfully process real estate rentals with crypto.

3. Nonprofits and Charities

A nonprofit, NGO, or charity can sign up for a business wallet to accept cryptocurrency donations. While they don’t exactly use it for business purposes, they still benefit from the added security and management offered by the tool.

What this looks like: The organization sets up a wallet to receive donations in Bitcoin, Ethereum, or other cryptocurrencies and maintains transparency by tracking all incoming and outgoing funds. They can add a QR code and shortlink for easy access, offering donors a way to contribute globally while reducing transaction fees.

Examples: Charities like Save the Children and The Water Project use wallets to accept crypto donations in many currencies. Similarly, the British Red Cross accepts over 70 currencies.

How does a business wallet work?

When opening a business wallet, you are signing up for a service similarly to opening a business account in a bank. In order to remain compliant with global regulatory requirements, KYB is a required standard across the CoinsPaid ecosystem. After your wallet is opened, you can customize roles – certain employees can be granted access to the account on a need-to-know basis, ensuring maximum security.

Risk scoring is applied to every payment with the business wallet to ensure AML and adequate due diligence. We also staff an in-house compliance team with dedicated MLRO and AML officers. In addition, the wallet has been audited by both 10Guards and Hacken, ensuring the highest standard of cybersecurity.

The procedure for opening a crypto business wallet is as follows:

Step 1. Leave a request on our website

Step 2. We determine your business’s needs and suggest the most suitable payment process.

Step 3. We provide the necessary access and instructions for your wallet.

Step 4. You can accept, send, exchange, and manage your crypto all in one place.

Which to Choose: CryptoProcessing or Business Wallet?

Both business wallets and payment gateways allow users to process and manage crypto payments. However, they address different market segments—a gateway can help you process large volumes of transactions and is highly customizable, while a wallet is quick to set up and use but offers less flexibility.

When choosing between the two, determine how many crypto transactions your business would be processing in the first place. Here’s a general guideline:

- Crypto Payment Gateway is best for complex payment flows and large volumes of transactions. It offers a high degree of automation.

- Crypto Business Wallet is best for lower transaction volumes, offers only key functionality, and is easy to use for asset management.

Think of the Crypto Payment Gateway as the more complex evolution of the wallet. With it, you get a complete payment system customized to your specific flow. A business wallet is simply there to let you accept, send, and manage payments in a standard way.

Wrapping Up

The Crypto Processing payment gateway is ideal for businesses with high transaction volumes looking to streamline payment processing. It offers advanced features like automatic fiat conversion, complex reporting, and custom payment flows.

The Crypto Business Wallet is better suited for smaller businesses or those that handle larger irregular payments. For example, if you invoice a single client for a large sum once a month, a business wallet would easily fit into your operations.

Remember that you don’t have to choose right away – starting with a crypto wallet and then integrating a more complex solution is a valid option.