WHAT IS A PAYMENT PROCESSOR AND ITS ROLE IN TRANSACTIONS

A payment processor is a company or service that manages transactions between a merchant and a customer’s bank or credit card company. Payment processors act as intermediaries between merchants, customers, and financial institutions, facilitating the smooth flow of funds during transactions.

In today’s digital age, seamless and secure payment transactions are vital for businesses to thrive in the transactional ecosystem. This is where payment processors play a crucial role. In this article, we will delve into the world of payment processors, their functions, and how they contribute to secure and efficient payment transactions.

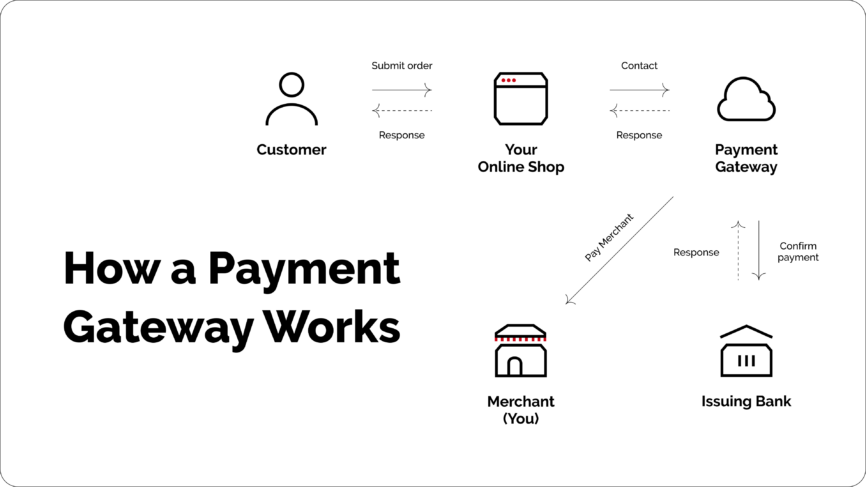

Payment Gateways and Their Functions in the Transactional Ecosystem

Payment gateways are essential components of the traditional banking ecosystem, serving as intermediaries between merchants, customers, and financial institutions. Their primary function is to facilitate the smooth and secure processing of payment transactions. When a customer makes a purchase using a payment card or electronic payment method, the payment processor securely transmits the transaction details to the relevant financial institution for authorization, verification, and settlement.

One of the key functions of payment gateways is payment authorization. They validate the customer’s payment information, such as credit card details, to ensure the availability of funds and the authenticity of the credit card transaction process. This step helps prevent fraud and protects both merchants and customers from unauthorised transactions. Once payment is authorised, payment gateways initiate the settlement process. They facilitate the transfer of funds from the customer’s account to the merchant’s account. The settlement ensures that merchants receive timely payments for their products or services, allowing for smooth cash flow and financial operations.

Payment gateways also play a vital role in transaction security. They implement robust security measures to protect sensitive payment data, such as encryption and tokenization techniques. Compliance with industry regulations and adherence to Payment Card Industry Data Security Standards (PCI DSS) are paramount to safeguarding customer information and maintaining trust in the banking ecosystem. Additionally, payment gateways handle the reconciliation process. This involves matching and balancing the transaction records to ensure accurate accounting and reporting. Reconciliation ensures that financial records are in line with the actual transactions processed, enabling proper financial management and transparency.

In the traditional banking ecosystem, payment gateways work closely with acquiring banks, issuing banks, and card networks to ensure the seamless flow of funds between all parties involved in the transaction. They facilitate the settlement of funds between merchants and the acquiring bank and banks, while also managing the interaction with card networks to process payments and maintain network connectivity.

Types of Payment Processors

There are different types of payment gateways available in the market:

TRADITIONAL PAYMENT PROCESSORS

These include banks and financial institutions that have long been the go-to option for businesses. They offer comprehensive payment processing services and often provide merchant accounts for businesses to accept various payment methods.

ONLINE PAYMENT GATEWAYS

With the rise of e-commerce payment solutions and online transactions, online payment providers have gained significant prominence. These specialised providers offer secure online payment solutions, enabling businesses to accept payments through websites, mobile apps, and other digital channels. Mobile payment processors are also popular.

CRYPTOCURRENCY PAYMENT GATEWAYS

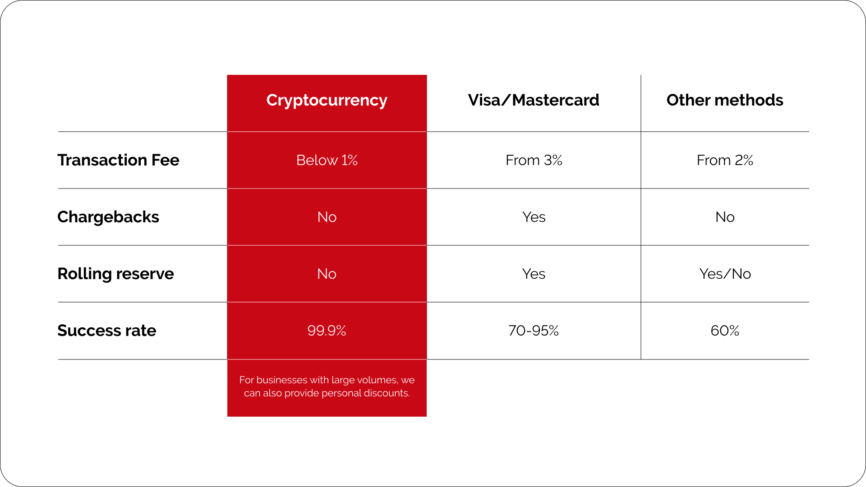

Lastly, there are crypto payment processing solutions that allow businesses to accept payments in cryptocurrencies, such as Bitcoin, Ethereum, or Litecoin. There are plenty of benefits specific to crypto processing such as access to a wider customer base, fast and borderless transactions, enhanced security, and lower transaction fees.

Fast and borderless transactions: Cryptocurrencies operate on decentralized networks, which means that transactions can be processed quickly and without the need for intermediaries like banks. This enables faster payment settlements and facilitates cross-border transactions without the typical delays and fees associated with traditional banking systems. Moreover, embracing cryptocurrency payments demonstrates a serious business owner’s willingness to adapt to new technologies and trends. It positions them as forward-thinking and innovative, which can attract tech-savvy customers and set them apart from competitors.

Enhanced security: Keeping things private and secure is very important. A crypto processing is great for this. Due to the security of blockchain technology the safety of your transactions from fraud and hacking significantly improves. With a crypto payments gateway, businesses can give their customers a secure way to pay, keeping their money matters safe and sound.

Lower transaction fees: Transactions with cryptocurrency usually have smaller fees than regular bank systems, which can save businesses a lot of money.

Security and Efficiency of Payment Processors

The payment authorization and verification process is a crucial step in ensuring the legitimacy of a transaction. Payment processors validate the customer’s payment information, such as credit card details or bank account credentials, to confirm its authenticity. This helps prevent fraudulent transactions and protects both merchants and customers. Additionally, payment gateways comply with payment industry regulations and adhere to payment card industry compliance standards to safeguard sensitive payment data.

Once payment is authorised, payment service providers initiate the settlement and reconciliation processes. Settlement involves transferring the funds from the customer’s account to the merchant’s account. This step ensures that the merchant receives timely payments for their products or services. Reconciliation, on the other hand, involves matching and balancing the transaction records to ensure accurate accounting and reporting.

Payment gateway providers, on the other hand, facilitate secure and efficient transactions by employing encryption and security measures to protect sensitive payment data. They verify the accuracy of wallet addresses, monitor the blockchain network for transaction confirmations, and implement fraud prevention measures to detect and prevent fraudulent transactions.

With near-instantaneous settlement and transparent, immutable records on the blockchain, crypto payment providers offer seamless integration with secure wallets and ensure compliance with regulatory standards. By incorporating these measures, they create a secure environment for payment transactions, fostering trust and confidence in the digital payment ecosystem while enabling efficient and reliable processing of cryptocurrency payments.

Key Considerations for Businesses When Choosing a Payment Processor

When selecting a fiat payment provider, businesses need to consider several key factors.

- First and foremost, they should evaluate the payment processor’s security measures and data protection protocols to ensure the safety of their customers’ payment information. Compliance with industry regulations, such as Payment Card Industry Data Security Standard (PCI DSS) requirements, is also crucial.

- Businesses should assess the processor’s reliability, uptime, and customer support to ensure seamless payment processing operations.

- The cost structure, including payment processor fees, setup fees, and any additional charges, should be carefully examined to ensure compatibility with the business’s budget and revenue model.

- Options such as payment APIs and integrations, as well as compatibility with the business’s existing systems, should also be considered.

- Scalability and the ability to handle growing transaction volumes are vital for businesses with expanding customer bases.

- Lastly, businesses should assess the payment processor’s reputation and track record in the industry to gain confidence in their reliability and track record. By considering these factors, businesses can select a payment gateway that aligns with their specific needs and goals, enabling them to offer convenient and secure payment options to their customers.

CryptoProcessing.com is an example of a comprehensive payment gateway that offers a range of payment processing services, including cryptocurrency payments. Their robust payment gateway and integration capabilities make it easy for businesses to accept payments in various digital currencies. As a payment processor, CoinsPaid prioritises payment data security and implements fraud prevention measures to ensure secure transactions for merchants and customers.

Final Thoughts

In conclusion, payment gateways play a vital role in enabling secure and efficient payment transactions. They handle the complexities of payment processing, offering businesses a seamless and reliable way to accept payments. Whether through traditional or online payment processors, businesses can leverage these services to streamline their payment operations, comply with regulations, and provide a convenient payment experience for their customers.

If a business is looking for a payment processor that will give them an edge on the global stage, implementing crypto payment processing will do the trick – all the while enabling them to benefit from a whole range of benefits unique to Web3. By selecting the right crypto payment processor, and considering key factors, businesses can pave the way for successful and frictionless transactions in today’s dynamic business landscape.

Payment Processor FAQs:

WHAT ARE EXAMPLES OF A PAYMENT PROCESSOR?

- PayPal: A widely-used online payment system that supports online money transfers and serves as an electronic alternative to traditional paper methods like checks and money orders.

- Stripe: A technology company that builds economic infrastructure for the Internet. Businesses of every size use Stripe’s software to accept payments and manage their businesses online.

- CryptoProcessing by CoinsPaid: A solution for businesses to integrate cryptocurrency payments, providing secure transaction processing and a wide range of supported cryptocurrencies.

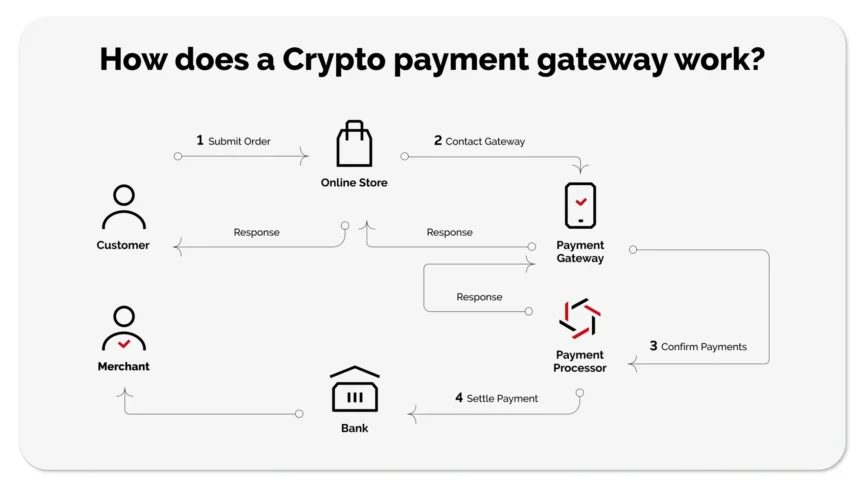

HOW DOES A CRYPTO PAYMENT PROCESSOR WORK?

A crypto payment processor, like CryptoProcessing.com, works by integrating with a business’s system to facilitate cryptocurrency transactions.

The process usually involves these steps:

- Personalized Offer Creation: The processor understands the specific needs of the business and provides a tailored commercial offer and API documentation.

- Legal Compliance: As a licensed provider, the processor ensures compliance with relevant laws and anti-money laundering (AML) policies, requiring clients to pass Know Your Business (KYB) checks.

- API Integration: The business integrates the processor’s system via an API, which is a straightforward process often requiring minimal technical expertise from the business’s side.

- Ongoing Support: The processor provides continuous technical support and updates, ensuring smooth payment processing and often includes marketing assistance to help grow the business.

Crypto payment processors support multiple digital currencies and offer customizable solutions like invoicing, top-ups or payment links.