What is Tokenomics?

Tokenomics is the backbone of blockchain technology.

It has attracted the interest of many, leading to discussions about decentralized finance at coffee shops and boardrooms alike.

Understanding tokenomics enables stakeholders to grasp the intrinsic value, incentive structures, and economic models that govern cryptocurrency tokens.

So let’s begin with the basics.

Basics of Tokenomics

Tokenomics blends economics and cryptography, a cornerstone of cryptocurrency ecosystems, determining supply rules.

Through mechanisms like mining, staking, or burning, token issuance and distribution are finely tuned, impacting scarcity and value proposition.

In addition to supply mechanisms, it considers aspects like “token utility” and governance features.

Tokens have a broad range of functions, from facilitating transactions within a network to granting voting rights.

By understanding the various roles tokens can play, one can assess the potential success and longevity of the associated blockchain project.

What is Tokenomics?

Tokenomics: a fusion of “token” and “economics,” refers to the study of the economic systems and models within a cryptocurrency environment.

It encompasses various aspects such as token supply, distribution, and incentive structures.

In essence, tokenomics is crucial as it dictates how a token will function within its ecosystem, impacting its value and utility.

A well-designed tokenomic model can enhance user engagement and project sustainability.

Successful tokenomics can drive token adoption and long-term growth for crypto projects.

A comprehensive understanding of tokenomics allows investors and developers to predict market behavior, ensuring informed decision-making.

Tokenomics is thus indispensable for anyone participating in the cryptocurrency space.

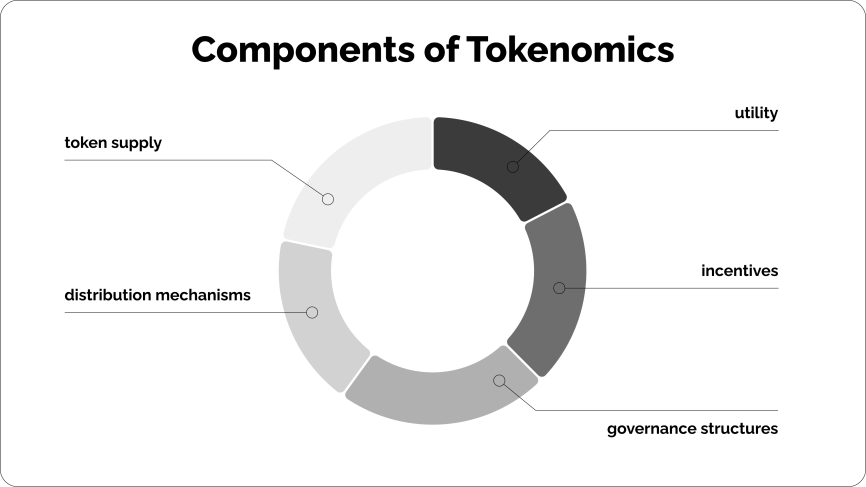

Key Components

Tokenomics is composed of several critical components which determine the overall framework and viability of a cryptocurrency project.

First, token supply refers to the total number of tokens that exist or will exist.

Another essential element is token distribution, which encompasses how tokens are initially allocated, including mechanisms like initial coin offerings (ICOs), airdrops, and mining.

Related: Crypto Token vs Coin – What’s The Difference?

Additionally, incentive structures are central to tokenomics, ensuring user participation and network security through methods such as staking rewards, yield farming, and governance voting rights.

Together, these components work in synergy to foster a robust and sustainable ecosystem, ensuring that tokens are adequately utilized and valued within the market.

Historical Context

Tokenomics finds its roots in the evolution of traditional economics applied within blockchain technology.

In 2009, Bitcoin pioneered the concept, introducing a decentralized digital currency with a fixed supply.

Its success inspired a wave of innovations, leading to the creation of various alternative cryptocurrencies, each with unique economic models.

Ethereum, launched in 2015, marked another milestone, enabling the deployment of smart contracts and diverse token standards.

This evolution laid the groundwork for sophisticated tokenomics frameworks that underpin modern blockchain ecosystems.

Components of Tokenomics

Tokenomics encompasses several critical components, each contributing to a token’s functionality, value, and economic dynamics.

These components include token supply, distribution mechanisms, utility, incentives, and governance structures, ensuring a comprehensive framework for evaluating and deploying tokens within blockchain ecosystems.

Token supply refers to the total number of tokens in circulation, which can be fixed or inflationary. Distribution mechanisms determine how tokens are initially allocated and distributed to users, influencing market dynamics.

Utility defines the token’s purpose, such as facilitating transactions or accessing platform features. Incentives are mechanisms like staking rewards designed to encourage desired behaviors.

Finally, governance structures allow token holders to participate in decision-making processes, ensuring community-driven development and sustainability.

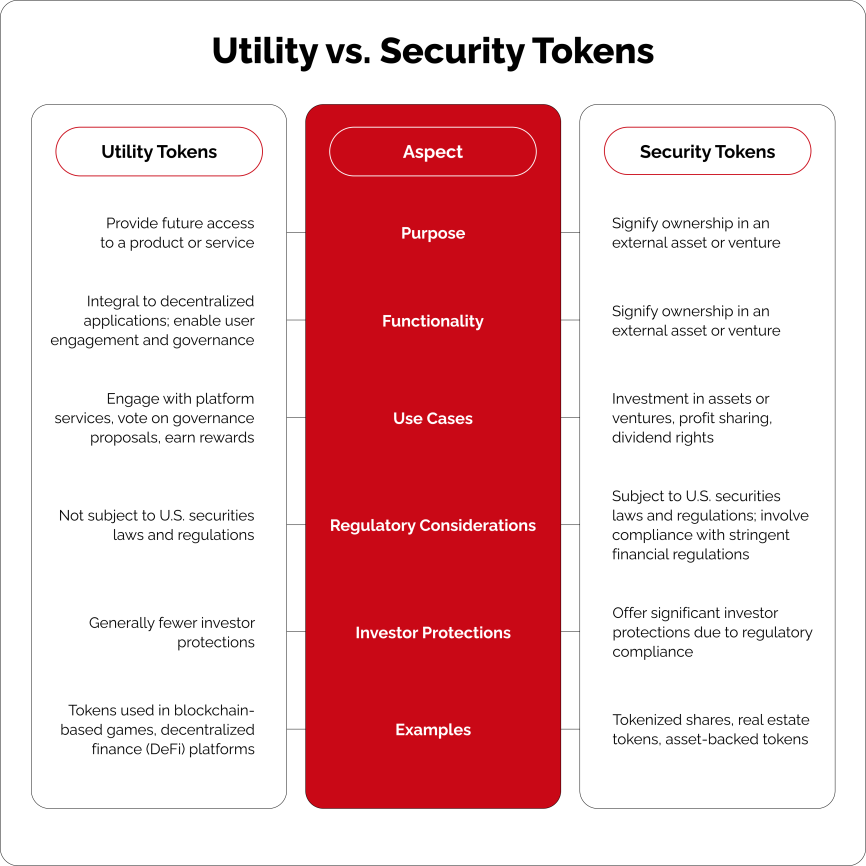

Utility vs. Security Tokens

Utility and security tokens are foundational concepts within the tokenomics framework.

They represent fundamentally different purposes and regulatory considerations, each serving distinct roles in the blockchain ecosystem.

- Utility tokens are designed to provide users with future access to a product or service.

Utility tokens are integral to the functionality of decentralized applications, enabling users to engage with the platform’s services, vote on governance proposals, and earn rewards.

- Security tokens signify ownership in an external asset or venture subject to U.S. securities laws and regulations.

Security tokens, however, are seen more as “digital assets” encompassing shared ownership, profit claims, or even dividend rights in traditional markets.

Their issuance typically involves compliance with stringent financial regulations, offering investor protections.

Token Supply and Allocation

Token supply and allocation are crucial for a project’s sustainability, involving issuance, distribution, and management of native tokens.

Developers determine generation mechanisms and total supply cap. Allocation strategies drive initial distribution and ecosystem growth through various channels.

Tokens are distributed to teams, advisors, supporters, and community incentives. Initial phases like public sales and airdrops shape market perception and value.

These factors contribute to ecosystem success and token economy stability.

Mechanisms and Protocols

The mechanisms and protocols underpinning tokenomics are multifaceted, ensuring robust and secure token ecosystems.

- Consensus Mechanisms: Enables decentralized agreement on the state of the blockchain (e.g., Proof of Work, Proof of Stake).

- Minting and Burning: Controls the supply by creating new tokens or removing them from circulation.

- Governance Models: Facilitates decision-making within the blockchain network (e.g., on-chain voting, DAO frameworks).

- Staking Protocols: Rewards participants for supporting network security and operations.

- Liquidity Pools: Ensures token availability for trading, impacting market stability and value.

- Smart Contracts: Automates contractual agreements, reducing the need for intermediaries.

- Token Vesting: Gradually releases tokens to prevent market flooding and align incentives over time.

- Yield Farming: Provides returns to users who lock up their tokens in liquidity pools, enhancing ecosystem value. Efficient and well-implemented mechanisms and protocols are vital for token stability and user trust.

They create the foundation for scalability, security, and governance within the blockchain ecosystem.

PAYMENTS

with CryptoProcessing

Economic Models

Economic models in tokenomics explore various frameworks, including inflationary and deflationary mechanisms, that dictate token supply and demand dynamics.

These models can affect key elements such as token price stability, user incentives, and overall network health.

By applying specific economic design principles, projects can tailor their token economies to promote sustainable growth, user engagement, and long-term viability.

Inflationary vs. Deflationary

Inflationary and deflationary models diverge fundamentally.

In an inflationary model, new tokens are continuously introduced. This increase in token supply is akin to traditional fiat currencies where central banks print more money.

Consequently, inflationary models can spur spending and usage within the ecosystem but may lead to devaluation if not managed properly.

On the contrary, deflationary models reduce the total supply.

In inflationary settings, tokens can be minted over time – as seen with Ethereum, which periodically increases its supply – to incentivize network participation and infrastructure growth.

Deflationary models aim to control or reduce supply over time, such as Bitcoin’s fixed supply of 21 million coins, driving its scarcity.

These models can potentially stabilize or increase value as demand outstrips supply, provided user adoption and utility remain robust.

Token Burning

Token burning reduces the total supply, potentially increasing the value of existing tokens by creating scarcity.

This practice involves permanently removing tokens from circulation through mechanisms like smart contracts.

Projects use token burns to boost token value and can be part of a strategy to maintain value, as seen in Binance’s quarterly burns.

Burning can address oversupply or underperformance, improving the ecosystem.

This deflationary tactic signals a commitment to scarcity and value preservation, enhancing investor confidence and market stability.

Staking and Yield Farming

Staking and Yield Farming revolutionize how cryptocurrency holders earn passive income through decentralized finance (DeFi) platforms.

Staking involves locking up a certain amount of tokens to support network operations like validating transactions. In return, participants earn rewards.

Yield Farming, often termed as liquidity mining, allows users to provide liquidity to a DeFi platform’s pool. This process rewards them with interest or additional tokens.

The incentives for both practices attract enthusiasts and institutional players alike, enhancing liquidity and network security.

It’s a win-win strategy fostering community engagement and financial returns.

Market Dynamics

Market dynamics refer to the forces that influence market prices and developments within a crypto-asset’s ecosystem.

In the context of tokenomics, these forces encompass supply-demand equilibrium, speculative trends, regulatory influences, and macroeconomic conditions, impacting value propositions and market performance.

Key terms “bullish” and “bearish” are often used to describe the market sentiment.

Liquidity and Trading

Liquidity and trading are essential components in the crypto ecosystem, directly affecting token viability and market dynamics.

High liquidity means that assets can be bought and sold quickly without significant price changes.

This ensures that investors can enter or exit positions efficiently, fostering confidence in the market.

On the trading front, tokens are exchanged on various platforms, from decentralized exchanges (DEXs) to centralized exchanges (CEXs), each with its own set of mechanisms and regulatory frameworks.

Market makers, arbitrageurs, and trading bots also play significant roles in maintaining an orderly trading environment.

Token Valuation

Several factors can influence a token’s valuation, including supply and demand dynamics, utility, and market sentiment.

Fundamental analysis looks at the intrinsic value of the token by assessing project goals, team competency, and strategic partnerships.

Additionally, economic models and real-world use cases significantly impact perceived value.

Key metrics such as total supply, circulating supply, and lock-up periods provide insights into scarcity and potential inflationary pressures.

Furthermore, market trends and macroeconomic factors should not be overlooked.

External factors like regulatory changes, technological advancements, and global economic conditions can also influence token valuation, providing both opportunities and risks for investors and businesses alike.

Regulatory Impacts

Regulatory landscapes are rapidly changing, directly impacting the tokenomics of cryptocurrencies.

New policies can impose compliance requirements or bans, affecting the market environment and increasing compliance costs.

Regulatory shifts can influence investor sentiment, causing market volatility and price fluctuations.

While regulations may initially hinder aspects of the crypto ecosystem, they can also establish a framework for legitimate growth.

Comprehensive regulations enhance security, consumer protection, and trust in the crypto space, encouraging long-term investment.

Use Cases in Tokenomics

Tokenomics, or the economics of cryptocurrency tokens, highlights key aspects like utility, governance, and investment opportunities.

In practice, these tokens can perform integral functions such as representing ownership stakes (equity tokens) in projects or providing access to decentralized applications, offering various benefits like tokenized incentives for user participation.

This diversity helps align stakeholders’ interests and stimulates network growth.

Additionally, “DeFi” and “NFT” tokens are notable for their transformative role in the broader financial ecosystem.

Decentralized Finance (DeFi)

Decentralized Finance (DeFi) revolutionizes traditional financial systems through blockchain technology, enabling peer-to-peer financial services without intermediaries.

- Lending and Borrowing: Platforms like Aave offer decentralized lending and borrowing services.

- Decentralized Exchanges (DEXs): Uniswap and SushiSwap allow users to trade cryptocurrencies without a central authority.

- Yield Farming: Users can earn rewards by providing liquidity to DeFi platforms, e.g., Compound.

- Staking: Participants lock their tokens to support network operations and earn rewards, as seen with Ethereum 2.0.

- Synthetic Assets: Platforms like Synthetix allow the creation of synthetic assets tracking real-world assets.DeFi leverages smart contracts on blockchain networks, thus reducing counterparty risk and transaction costs.

Despite rapid growth, DeFi faces challenges such as regulatory scrutiny and smart contract vulnerabilities that need addressing for sustainable development.

Non-Fungible Tokens (NFTs)

Non-Fungible Tokens (NFTs) represent unique digital assets verified using blockchain technology.

- Unique Identification: Each NFT has distinct metadata and identification codes, making them non-interchangeable.

- Indivisibility: NFTs cannot be divided into smaller units; they exist as whole entities.

- Ownership Verification: Blockchain ensures transparent proof of ownership and provenance of each NFT.

- Interoperability: NFTs can be used across different blockchain-based platforms and applications.

- Scarceness: NFTs can be programmed for limited issuance, enhancing their rarity and potential value.NFTs are prevalent in sectors like digital art, gaming, and virtual real estate.

They are driving a new wave of digital ownership and economy, challenging traditional asset concepts.

Understanding NFT mechanics is crucial for utilizing their full potential in various applications.

Gaming and Virtual Worlds

iGaming and virtual worlds are embracing tokenomics, revolutionizing in-game economies and user experiences.

Blockchain technology now grants players true ownership of in-game assets, traded through NFTs to create vibrant in-game economies.

These assets can hold value beyond the game, encouraging engagement through play-to-earn models.

Verifiable ownership and scarcity drive enduring asset value, fostering community involvement. Interoperability among gaming platforms streamlines asset transfers, enhancing the virtual goods marketplace.

This player-driven economy, facilitated by tokenomics, is set to blur the lines between virtual and real-world economies.

Future of Tokenomics

Tokenomics’ future is promising, fueled by technological innovation, market demands, and regulatory adjustments.

Let’s see what the future might hold.

Evolving Technologies

In the realm of tokenomics, evolving technologies, especially blockchain, drive a shift towards secure, transparent systems.

Smart contracts and decentralized applications (dApps) enhance functionality in finance and supply chain management.

Advances in consensus algorithms like Proof of Stake (PoS) bolster security, ensuring robust transaction verification and promoting efficiency in token exchanges.

The integration of artificial intelligence (AI) with tokenomics offers predictive analytics for market trends, enabling stakeholders to optimize investment strategies and operational efficiencies in a resilient tokenized ecosystem.

Mainstream Adoption

Tokenomics is gaining traction, connecting niche markets with mass adoption.

Enterprises, investors, and regulations are aligning, making tokenomics vital across industries like finance and entertainment.

This acceptance leads to the integration of mainstream financial instruments through tokenization, improving asset management and liquidity.

Governments exploring Central Bank Digital Currencies (CBDCs) highlight the credibility and potential of tokenomics, driving investments and innovations for a stronger global economy.

Innovative Token Models

Innovative token models like utility tokens, security tokens, and governance tokens cater to specific needs in the tokenized ecosystem.

Utility tokens grant access to products or services, while security tokens represent ownership in assets.

Governance tokens enable participation in decision-making processes. Additionally, hybrid models combine features of different token types for complex use cases.

Non-Fungible Tokens (NFTs) revolutionize digital assets, impacting art, entertainment, and ownership. These models enhance user interaction, bridging digital and real-world integration boundaries.

Conclusion

The realm of tokenomics is vast, dynamic, and ever-evolving, influencing diverse economic sectors and user interactions.

As we advance further into a tokenized world, tokenomics will undoubtedly play a pivotal role in shaping financial landscapes, driving innovation, and fostering inclusive economic growth.

EXPERIENCE

highly secure crypto payment gateway