A Merchant’s Guide To Onboarding Users To Crypto

If you’ve read some of our previous articles, you’ll know that offering crypto as a payment medium to your customers comes with a variety of benefits: lower fees, new markets, no rolling reserves and chargebacks, borderless payments, and more. Indeed, these benefits increase with the number of users that utilize crypto as a payment method on your platform.

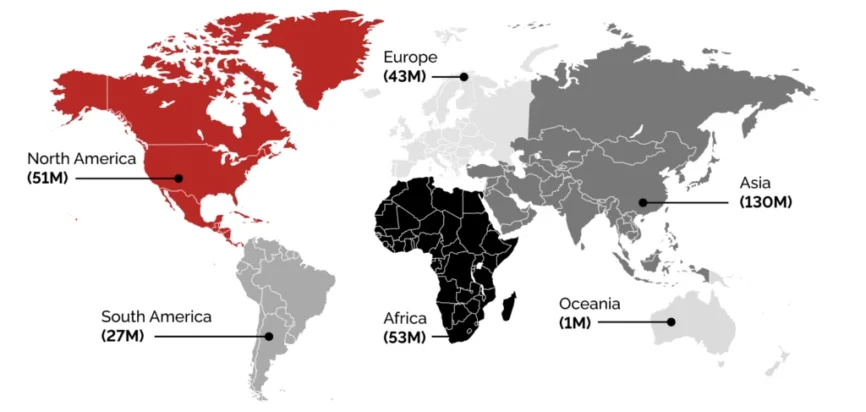

Thus, attracting crypto traffic can have a positive impact on the efficiency of your business. In 2022, the number of digital assets owners surpassed 320 million, which are your company’s potential clients.

Motivating those who are yet unfamiliar with the digital asset market is also paramount, as the mass adoption continues despite the financial crisis and bear cycle. Thus, businesses have to act quickly to gain competitive advantage before it gets “too crowded”.

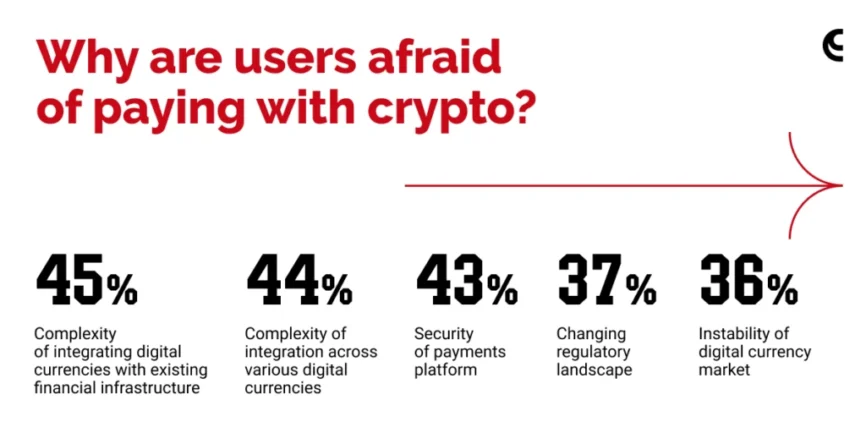

It’s at this point that we arrive at the important question – as a merchant, how can you onboard more of your users to crypto to ensure a magnification of those benefits that we all know and love? In order to answer this question, we’ll be outlining firstly the reasons why users are afraid of paying with crypto, and secondly, the steps you can take to combat these fears.

To The first of the reasons we’ll look at relates to the intimidation factor of the blockchain – especially from a technical point of view. An individual will always gravitate to platforms and mechanisms that they understand. The blockchain, for most first-time crypto shoppers, is a Mariana trench of advanced mathematics and complicated code. As such, it can be incredibly frightening as a medium of payment. Customers might be convinced that with one newbie error, they could lose their funds or fall victim to a hack. Indeed, a warning littered across DeFi is that if an incorrect wallet address is engaged, funds may be lost forever.

The second reason relates to the inherent volatility of cryptocurrencies. In the wake of the crypto crash – with Bitcoin falling over 60% from its November 2021 peak – community faith in crypto has dwindled. Of course, one could straightaway interject with the stablecoin argument, arguing that correctly-collatorised tokens can be more stable than most fiat currencies. However, while transparently backed stablecoins such as USDC are on the rise, their use is still not mainstream when it comes to crypto payments. When one considers the inherent instability of traditional cryptocurrencies, combined with the novelty and lack of transparency and regulation concerning stablecoins, of course, there’s a disincentive to be noted.

The third reason relates to the bad reputation of crypto. For example, did you know that blockchain technologies are already widely used by governments and institutions? Still, more often than not, people tend to focus on the negative and, as a result, associate crypto with money laundering pursuits, terrorist financing, tax evasion, and dark-web dealings.

Still, it’s quite easy to counteract this with the appropriate education. According to Checkout.com’s 2022 ‘demystifying crypto report’, whereas digital assets used to be associated with transactions on the dark web, it’s losing that reputation fast. In developed European economies, we’re seeing fewer than 5% of people using crypto for dark web purchases.

As the world of blockchain becomes more developed, ordinary people are beginning to get hold of crypto through the usual means. Freelance copywriters, developers, and advisors are now being paid in cryptocurrency. Gamers are now engaging with play-to-earn mechanics which let them earn cryptocurrency from simply playing. With ordinary, KYC’d people being gradually introduced to the blockchain, criminal activity is being diluted massively.

El Salvador has adopted Bitcoin as a legal tender, with the CAR following suit – we mustn’t forget the inherent instability of certain home currencies that welcomes a decentralised payments system. Having said that, the chequered past of crypto and an overall lack of education in the market still means that crypto’s reputation as a payment medium is a significant barrier in the way of its widespread adoption.

The final reason usually manifests as an onboarding drop-off rate. The market encounters plenty of would-be-users intending to engage with cryptocurrency that are put off by the difficulties involved in creating a wallet and topping up their balance with crypto. Indeed, if we’re speaking about a non-custodial wallet, the installation of a browser extension, perhaps a number of cross-chain bridges, in addition to saving the mnemonic key might warrant a YouTube tutorial or two. When it comes to the lengthy KYC procedures required by most centralized exchanges such as Binance, users can be put off by the invasiveness or the time required for such a procedure to be completed. Ultimately, many users are simply dropping off from onboarding, left with a bitter taste in the mouth when it comes to crypto.

So, what can be done?

When fear manifests in the ‘fiat’ world, one might argue that inoculation is the best way to go. Removing hindrances to exposure, pressuring exposure, facilitating greater knowledge and less fear. A similar approach may be taken to cryptocurrencies, but it must be done in the right way. With no intrinsic value to digital goods, especially those which are uncollateralized, it’s easy to see how the pressure to adopt crypto as a means of payment could manifest itself as a desire to further one’s own investments by increasing demand for their goods. In other words, it seems like you’re advertising a pyramid scheme to your clients.

How to Tackle the Intimidation Factor

Indeed, the concept that the blockchain is a twisted net of mathematical barbs is simply an illusion – mobile banking is used on a daily basis by everyone from fishermen to day traders; the authentication engines at play are therefore no less familiar to a Binance newcomer, for example.

There are three things that can be done, first and foremost, to tackle crypto intimidation.

- User-friendly interface. Clients should be guided through the onboarding journey with a simple interface, only displaying the necessary features. Perhaps a ‘Paying with Crypto’ FAQ would be a wonderful addition to your website as a merchant.

- Special offers. The user should be attracted to crypto as a payment method – discounts or special benefits might be available for those paying with crypto. You might consider developing Loyalty and Affiliate programs.

- Educational content. Lastly, the appropriate materials should be in place to guide the user to a crypto wallet, where they will be able to quickly and easily access all the necessary information regarding the service. You can also provide educational content to help guide users through the crypto world.

How to Tackle the Volatility Concern

There are thousands of cryptocurrencies on the market that could, in theory, be used for payments. However, not all of these currencies are going to be around forever. As a result, it’s important to offer your customers the most stable currencies on the market, in addition to the big names. CryptoProcessing.com supports 40 top digital currencies, including stablecoins such as USDT and USDC to mitigate the volatility concern.

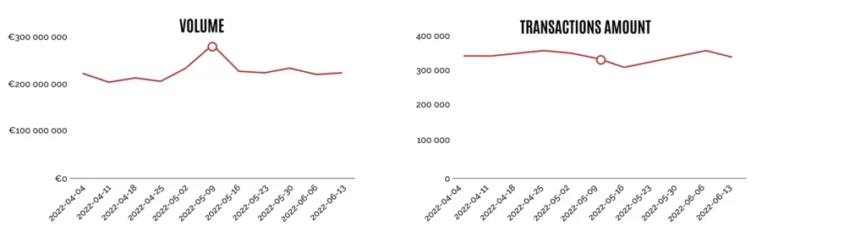

Furthermore, despite the massive price fluctuations and industry losing over 2 trillion in its cap compared to all-time highs, the payment sector remains mostly unaffected. Our internal analytics show that even during Terra Luna collapse in 2022, the number of transactions and volume were not impacted.

You may also wish to inform your customers that crypto processors such as CryptoProcessing.com take on volatility risks, guaranteeing a purchase price to prevent slippage. In addition, it’s important to educate your audience on the real reasons behind the Terra Luna collapse, bolstering the position of ‘stable’ algorithmic stablecoins.

It may be worth drawing attention to the natural volatility inherent to many currencies. Bitcoin may turn out to be a more efficient investment than something such as the Turkish Lira in the long-run, given the current economic climate. Inflation is skyrocketing around and the alternative may be dwindling in its attractiveness. This may all be done via a Medium channel or an on-site blog.

How to Mitigate the Forces of Mistrust

Mistrust is arguably one of the most important fears to dismantle — it involves effectively opening one’s eyes to the benefits of crypto as a payment medium, which, if you’ve read the Allegory of the Cave, can be exceedingly tricky when one has never known any different.

The best way to improve trust is by selecting a reputable crypto processing provider. For example, CryptoProcessing.com is the firm market leader with 0 instances of client fund loss. We’re an EU-licensed crypto services provider with an in-built transaction monitoring system, having been audited by two separate independent bodies.

As soon as you make it clear that you’re entrusting an experienced third party with transactions, you put the client at ease. Effective education is the best way to combat mistrust in the market – tune into the usefulness of blockchain technologies on a global scale, the damaging constraints of centralization, and the freedom of cross-border, low-fee transactions. It’s important to put yourself in your client’s shoes. You might wish to do this through an effective social media outlet such as Twitter, Medium, or Youtube.

How to Combat the Drop-off Rate

A high drop-off rate is an indication that crypto onboarding isn’t very effective. This is largely due to a combination of all those reasons that we’ve looked at so far. An individual may be intimidated by all the glaring red warning signs along the way or the complexity and invasiveness of the KYC process – this is a key metric to tackle as you’re losing would-be crypto customers at the most crucial stage.

The remedy is of course to make the onboarding process as smooth as possible. As the merchant, you aren’t always directly responsible for this, which is why it’s important to integrate a reliable and efficient crypto processing provider.

If you haven’t yet integrated crypto payments for your business, feel free to book a meeting with our sales team to discuss how CryptoProcessing.com could benefit your individual case. We’d be more than happy to assign you a personal manager who will guide you through the entire process. Moreover, we offer a range of different payment options to satisfy every conceivable merchant or client need.

with crypto payments integration