The Greatest Obstacles in Enabling Crypto Payments and How to Overcome Them

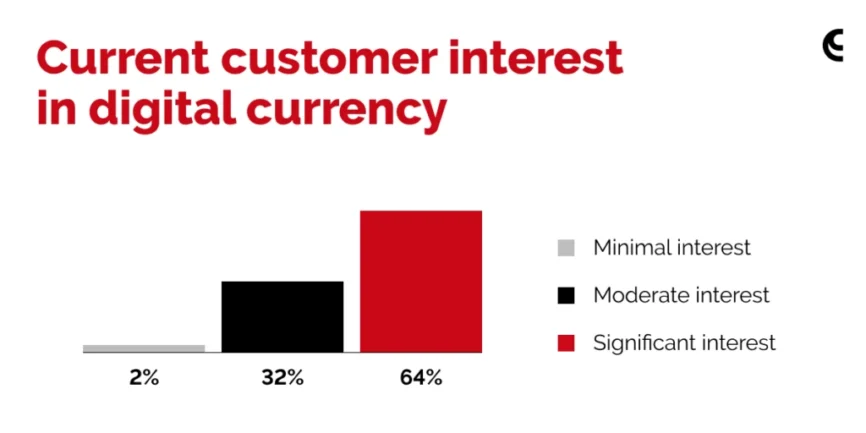

According to Checkout.com’s 2022 ‘demystifying crypto report’, 77% of merchants who support payments in crypto or stablecoins saw an increase in cross border sales. The customer interest, being the main driving force behind mass adoption, also shows significant growth accelerated by COVID pandemic in 2022.

It seems suspicious, therefore, that only a quarter of small businesses in the US are currently accepting crypto as a medium of payment. The truth is that there are still many barriers to adoption on the merchant side that are preventing companies, large and small, from taking the plunge into crypto – which, certainly, has a multitude of benefits, from lower processing fees and faster transaction speeds, to greater brand exposure and new marketing opportunities.

The question that we’ll be tackling today, therefore, relates not only to defining these barriers, but exploring ways that they could be taken down and most importantly – how CryptoProcessing.com is leading such an endeavour today.

What Stops Businesses From Integrating Crypto?

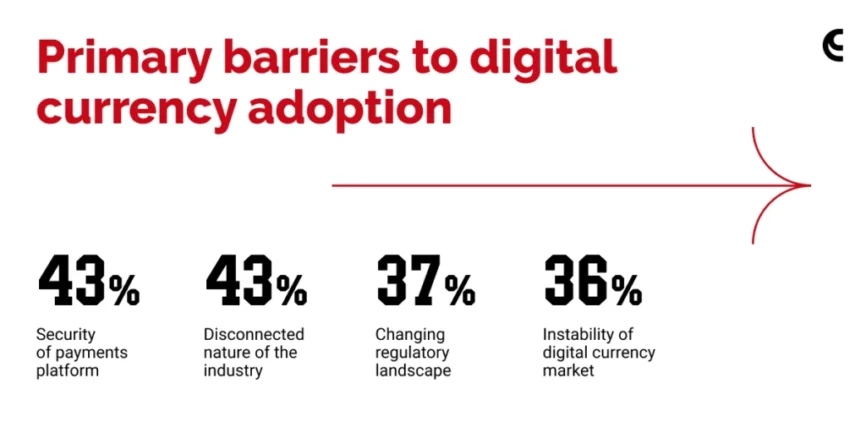

One of the objectives of Deloitte’s survey was to uncover the obstacles to merchant crypto payments adoption. There were a number of interesting statistics exposed from the survey.

The first barrier that became apparent was the perceived complexity of integration. Indeed, 89% of respondents selected at least one of the two options alluding to such a barrier. An implementation into the existing financial infrastructure was perceived to be the biggest concern. This figure of almost ninety percent spans consistently across companies, regardless of their revenue size.

While not as widespread, there are multiple barriers to adoption:

Combined, the aforementioned barriers lead to a high level of concern the businesses experience in regards to cryptocurrencies. Considering the digital asset market is a highly volatile one, 79% of the respondents pointed out greater levels of concern about engaging in business payments with cryptocurrency. Even though the majority of those 79% believe crypto payments will be ubiquitous in their industries in 5 years, the merchants still experience doubts in terms of digital asset payments’ necessity.

On top of that, 2022 has put a lot of pressure on the crypto owners. We witnessed the collapse of several cryptocurrency giants, including FTX and Terra Luna, that were supposed to be “too big to fail’, resulting in multi-billion losses suffered by both institutional and retail investors. Furthermore, the majority of analysts agree that we are yet to see the price bottoms during the current bear cycle.

Indeed, one can see why providing peace-of-mind when it comes to the uncertainty of the regulatory landscape, the instability of the digital market and its disconnected nature. And thus, among easily quash-able tasks, such as providing solutions pertaining to increasing customer security, a greater challenge is afoot.

How to Overcome These Obstacles?

If 77% of merchants who onboard CryptoProcessing.com experience an up-shoot in cross-border sales without an increase in loss of client funds, instances of fraud or run-ins with the regulator, then there must be a solution to these challenges aforementioned. And there sure is.

OPT FOR A TRUSTED CRYPTO PARTNER

Since one of the main user concerns is the security of crypto transactions, it is essential to choose a reliable and legal cryptocurrency partner. Of course, there is an option of creating crypto infrastructure and software from scratch, but it would require considerable funding and time costs.

CryptoProcessing.com, on the other hand, offers the full spectrum of ready-made services for accepting crypto payments with customisation to fit any business model. With more than 8+ years of experience in the market, we manage approximately 8% of global Bitcoin transactions and have already processed 16 billion euros in digital assets since the platform’s inception.

CryptoProcessing by CoinsPaid has made sure to integrate all necessary solutions into its product offering to ensure effective KYB, ongoing transaction monitoring in addition to AML and CFT checks. Being a EU-licenced crypto services provider, we comply with the Money Laundering and Terrorist Financing Prevention Act. This level of regulatory compliance within CryptoProcessing.com’s framework goes lengths to settle merchant concerns when integrating crypto payment processing for the first time.

Moreover, dual independent security audits have been able to increase merchant confidence. 10Guards and Hacken have both asserted zero vulnerabilities within the CryptoProcessing.com system – this explains the impressive lack of client fund loss that we pointed out earlier. The system also makes sure that all necessary accounting documents for bank payouts are provided – tax-related concerns are tackled in this way. We also integrated two risk scoring systems to detect and notify merchants of every suspicious transaction, as well as give the recommendations on further steps to be taken.

On top of that, CryptoProcessing by CoinsPaid keeps the merchants’ funds in a specialised cold storage, protecting it from potential fraud involved with online wallets. Unlike some crypto companies such as FTX, we never use clients’ money for operational or investing activity. Thus, our customers have round-the-clock access to their funds and can withdraw them whenever necessary to a regular fiat bank account.

MITIGATE THE VOLATILITY FACTOR

In the current unstable financial environment, it is vital to protect your end customers from crypto volatility. CryptoProcessing.com guarantees an exchange rate for a set period of time to prevent slippage from the consumer side while taking on all the risks related to rate fluctuations. Furthermore, we use a liquidity aggregator to ensure the best exchange rate.

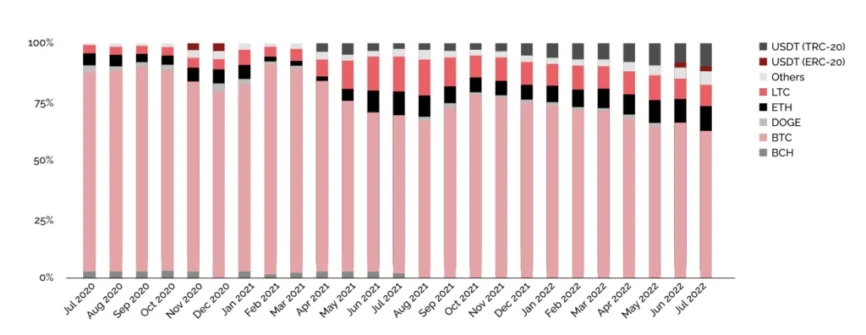

Notably, despite the bear cycle and crypto shedding over $2 trillion in market cap, Bitcoin remains the primary payment option across all coins. Still, the popularity of stablecoins such as USDT and USDC has been increasing due to major price fluctuations of top assets.

Another advantage that you and your business’s customers will benefit from is instant conversion to fiat currencies such as USD and EUR. This allows CryptoProcessing.com clients to run their “business as usual” and not keep crypto on their books.

ENSURE THE SMOOTHEST CHECKOUT EXPERIENCE

Earlier in the article, we asserted that the most pressing barrier for crypto payment adoption in the industry was the perceived complexity of blockchain. This is something that CryptoProcessing.com understands, and provides a smooth onboarding procedure with a dedicated manager and round-the-clock tech support. All a merchant needs to do is to sign up with service, attain an initial consultation to establish requirements and expectations, and acquire a personal manager to guide them through the integration. 24/7 technical support After some initial testing and the addition of a ‘pay with Crypto’ button to the merchant’s website, they are ready to start accepting digital currencies.

Providing an intuitive interface, multiple payment options, and top-notch checkout process is a must in the modern competitive market. CryptoProcessing.com ensures that themerchant’s end customers get to tap into the crypto sea without any background in tech or finance.

TAKE ADVANTAGE OF LOWER FEES AND INCENTIVE PROGRAMS

Last, but not least — choose a crypto processor that offers low fees and has incentive programs in place. Since the competition for customers is high in the current marketing environment, it’s vital to provide the most favourable terms for end customers.

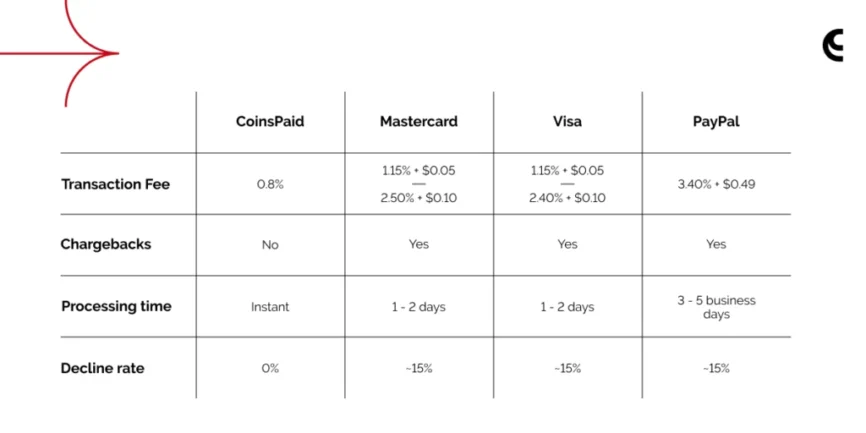

For instance, CryptoProcessing.com only charges 0.8% transaction fee, which is significantly lower to 2-5% in banking. We also don’t have any hidden costs that are usually concealed under setup and monthly fees. On top of that, these 0.8% can be further lowered by taking advantage of our incentive programs. Loyalty program allows CPD native token holders to slash their transaction fees by up to 50%.

Conclusion

Overall, it seems that the greatest barriers to entry facing merchants standing in the doorway, ready to pursue the bountiful benefits of crypto processing, aren’t that great after all. Concerns related to usability, complexity and integration speed can be thoroughly debunked with the right provider. Legal worries can be swept aside with assurance from the strictest regulatory bodies in the world. Security can be bolstered with dual audits – confidence can be established, and CryptoProcessing.com has proved just that.